OPERATING ITEMS

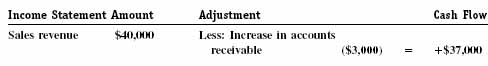

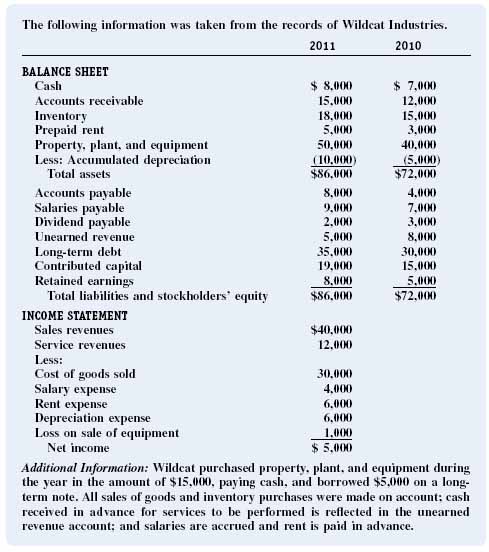

CASH FROM SALES (($37,000). The income statement includes sales revenue of $40,000. Sales were made on account (see Additional Information on Figure 4A–1), which increased the accounts receivable T-account by 40,000 (1). Because the ending balance in accounts receivable was $15,000, accounts receivable must have been reduced during 2011 by $37,000, producing a cash increase of $37,000 (2). Customers must have made $37,000 in payments on account. The adjustment to convert the accrual-based sales revenue to cash inflow is illustrated below.

CASH FROM SERVICES (($9,000). Service revenue of $12,000 on the income statement means that unearned revenue was reduced by $12,000 during 2011 (3). Cash is received in advance for services to be performed and the revenue is only recognized after the service is performed. Because the ending balance in unearned revenue is $5,000, cash received in advance for services to be performed during 2011 must have been $9,000 (4). During 2011, $9,000 was received from customers in advance, and services valued at $12,000 were performed. The adjustment to convert the accrualbased service revenue to cash inflow is illustrated below.

FIGURE 4A-1 Two balance sheets and an income statement for Wildcat Industries

CASH PAID TO INVENTORY SUPPLIERS ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.