REVIEW PROBLEM

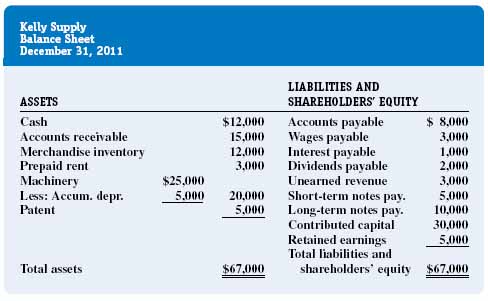

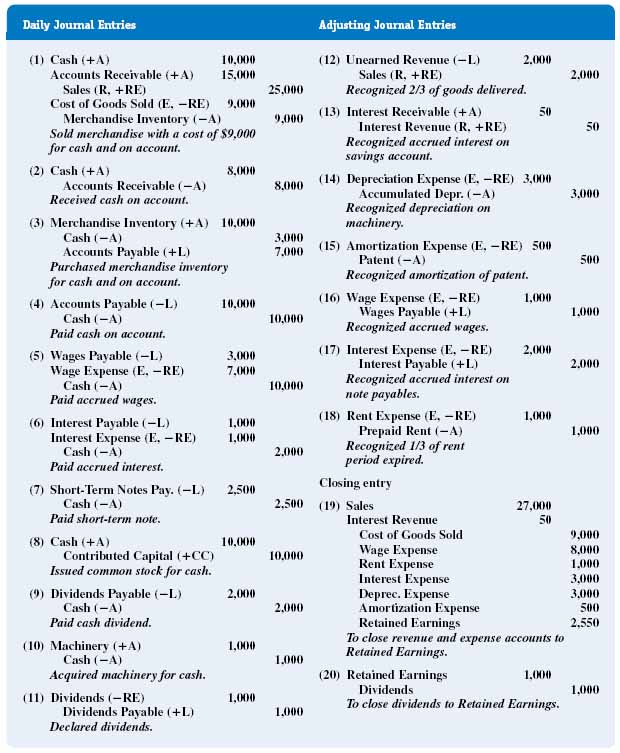

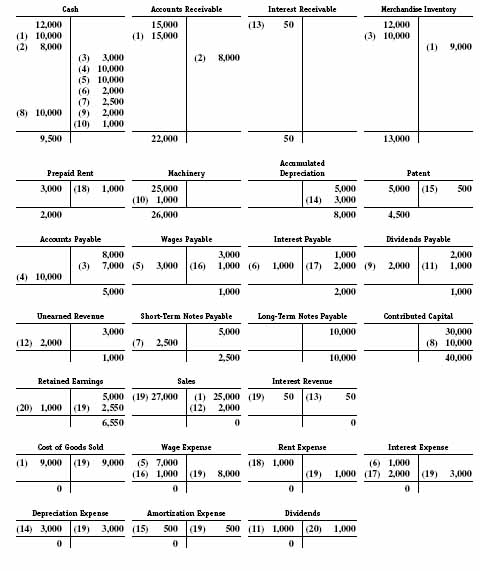

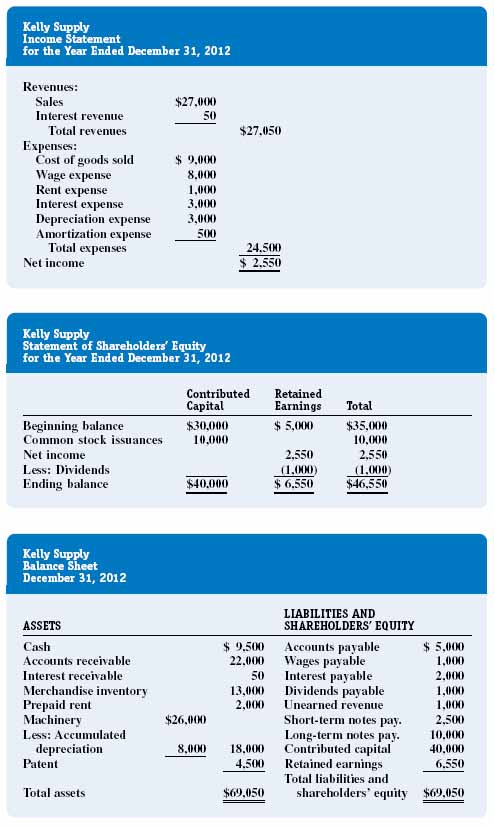

Consider the balance sheet of a small retail company, Kelly Supply, as of December 31, 2011 (Figure 4–20). Exchange transactions that occurred during 2012 are recorded in Figure 4–21 and posted to T-accounts in Figure 4–22. The financial statements are contained in Figures 4–23 and 4–24.

The December 31, 2011, balance sheet accounts are reflected in the T-accounts as beginning balances. The exchange transactions are numbered (1)-(11), and each is described and has been posted in the T-accounts.

At year-end, the adjusting journal entries are recorded and posted to the T-accounts. Adjusting entries are numbered (12)–(18). Entries (13), (16), and (17) are accruals, and entries (12), (14), (15), and (18) are cost expirations. Entries (19) and (20) close revenues, expenses, and dividends to retained earnings.

FIGURE 4-20 Balance sheet for Kelly Supply

FIGURE 4-21 General journal for Kelly Supply

FIGURE 4-22T-accounts for Kelly Supply

FIGURE 4-23 Financial statements for Kelly Supply

FIGURE 4-24 Statement of cash flows for Kelly Supply

The income statement contains revenues ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.