ACCOUNTS RECEIVABLE

Accounts receivable arise from selling goods or services to customers who do not immediately pay cash. Often backed by oral rather than written commitments, accounts receivable represent short-term extensions of credit that are normally collectible within thirty to sixty days. These credit trade agreements are often referred to as open accounts. Often many such transactions are enacted between a company and its customers, and it is impractical to create a formal contract for each one. Open accounts typically reflect running balances, because at the same time customers are paying off previous purchases, new purchases are being made. If an account receivable is paid in full within the specified thirty- or sixty-day period, no interest is charged. Payment after this period, however, is usually subject to a significant financial charge. Credit card arrangements with department stores, like Macy's and JCPenney, and oil companies, like Exxon Mobil and Chevron, are common examples of open accounts.

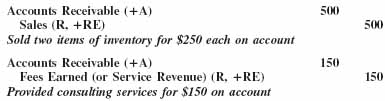

The following journal entries illustrate the recognition of accounts receivable from (1) the sale of merchandise5 and (2) the sale of a service.

Note that the recognition of the account receivable in each case is accompanied by the recognition of a revenue: sales or fees earned (service revenue). Both the balance sheet and the income statement are therefore affected when ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.