REVIEW PROBLEM

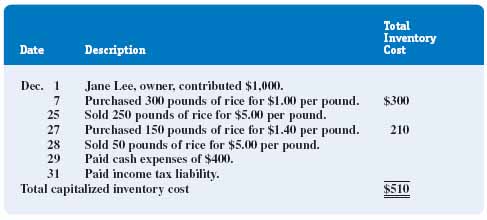

On December 1, Jane Lee contributed $1,000 of her own funds to begin an Oriental grocery store that sells white rice. The rice is kept in a large bin, and customers help themselves by filling plastic bags with a large scoop. The transactions described in Figure 7-10 took place during December. Assume that Jane incurred cash expenses (excluding the cost of goods sold and inventory shortages) of $400 during December, and she pays income taxes at a rate of 30 percent of net income before taxes on December 31.

Jane purchased rice on two occasions at two different prices. By multiplying the number of pounds purchased by the cost per pound, the total capitalized inventory cost for January can be computed ($510). Three hundred pounds of rice were sold for a price of $5/lb., creating total sales of $1,500 (300 lb. × $5).

FIGURE 7-10 December transactions for JL Oriental Foods

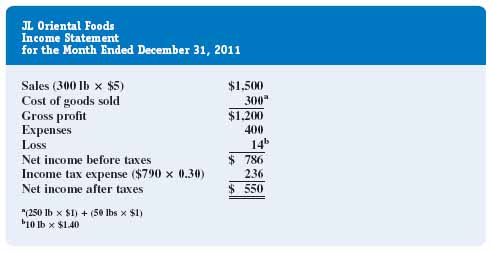

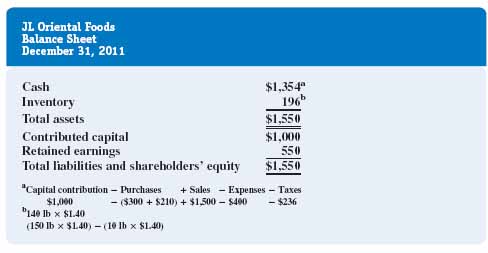

FIGURE 7-11 FIFO assumption

Assume that Jane took inventory (i.e., weighed the rice) on December 31 and noted that there were 140 pounds of rice on hand. Figures 7-11 and 7-12 contain the income statements and balance sheets prepared by JL Oriental Foods under the FIFO and LIFO cost flow assumptions. In ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.