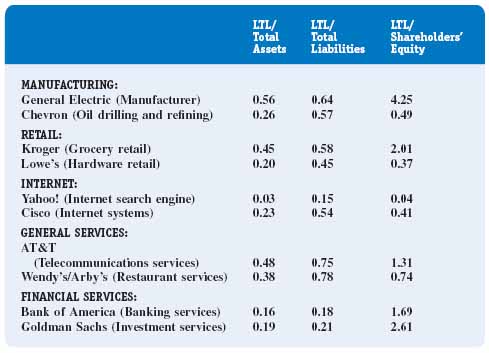

THE RELATIVE SIZE OF LONG-TERM LIABILITIES

In Figure 11-1, we see that Internet firms carry a limited amount of long-term debt. It is also clear that while financial institutions rely very heavily on current liabilities (see Figure 10-2), their long-term debt is still greater than shareholders' equity. Recall from Figure 10-1 that the capital structure of financial institutions tends to be over 90 percent liabilities. GE has relied heavily on long-term debt primarily to finance its strategy to grow by acquiring other companies; note that its long-term debt is more than four times shareholders' equity. Over the years GE has reduced the size of its shareholders' equity by repurchasing its outstanding stock, which we discuss in Chapter 12. Lowe's, AT&T, and Chevron use long-term liabilities to finance large investments in property, plant, and equipment.

FIGURE 11-1 Long-term liabilities (LTL) as a percentage of total assets, total liabilities, and shareholders' equity1

1. Long-term liabilities in Figure 11-1 include deferred income taxes, but many accountants believe that deferred income taxes do not represent a liability in an economic sense. See Appendix 10B for further discussion on deferred income taxes.

![]() Information from the 2008 balance sheets of the Bank of New York, Google, and ...

Information from the 2008 balance sheets of the Bank of New York, Google, and ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.