Chapter 23

Performance Fees

INTRODUCTION

This chapter explores three aspects of investment management fees, which are not commonly understood. First, performance fees for a group of funds are higher than the average of the funds’ expected fees. Second, the standard deviation of returns net of performance fees understates a fund's exposure to risk. Third, typical mutual fund fees are as high as, or higher than, typical hedge fund fees. Allow me to explain.

PERFORMANCE FEES

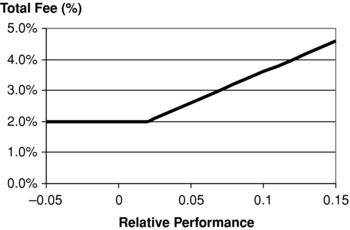

Hedge funds typically charge a performance fee that is a percentage of profits—but not losses—relative to a benchmark along with a base fee that is a fixed percentage of assets under management. Often the base fee is deducted from the profits before the performance fee is applied. If, for example, the base fee equals 2 percent and the performance fee equals 20 percent, a hedge fund manager who produces a 7 percent return in excess of the benchmark on a $100 million portfolio will collect a $2 million base fee (2 percent × $100,000,000) and a $1 million performance fee [20% × ($7,000,000 − $2,000,000)], for a total fee of $3 million. The investor's return net of fees, therefore, is 4 percent in excess of the benchmark. Exhibit 23.1 shows fees as a function of relative performance given this particular fee arrangement.

Exhibit 23.1 Performance Fee Payoff Diagram