CHAPTER TWO

The Federal Reserve and Its Powers

CHAPTER 2 IS ABOUT THE FEDERAL Reserve System (the Fed) and its impact on interest rates and the economy. It is often said that the chair of the Federal Reserve Board is the second most powerful person in the United States. Only the president, who is commander in chief of our armed forces, is more powerful. Where does all this power come from? It comes from the Fed's role as the nation's central bank and its responsibilities and powers to conduct monetary policy. The Fed's monetary policy actions have a direct effect on the level of interest rates, the availability of credit, and the supply of money, all of which have a direct impact on financial markets and institutions and, more important, on the level of economic activity and the rate of inflation.

To make the story even more interesting, with all of this awesome power, the Fed is “privately” owned by the banks that are members of the Federal Reserve System. As a result, the Fed is not a government agency and is remarkably free from presidential and congressional pressure. As you can tell, we have a lot of important issues to work through and explain in this chapter, so let's get down to the Fed's business—the business of money. That's what the Fed is all about!

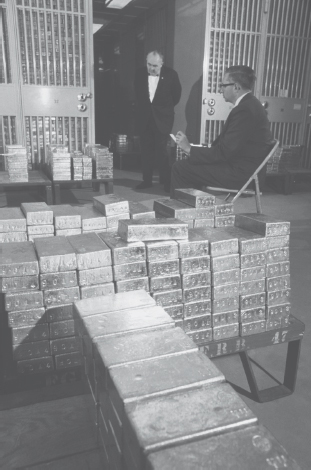

This is foreign gold being counted by sitters in the bottom-most vault (80 feet below the busy financial district) of ...

Get Financial Institutions, Markets, and Money, Eleventh Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.