CHAPTER 3

DIVERSIFIED FINANCIALS

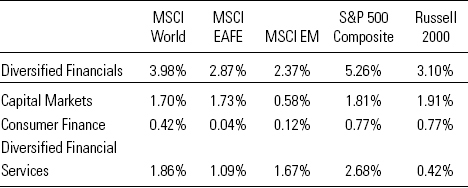

The Diversified Financials industry group is the “catchall” of the Financials sector. If it doesn’t fit neatly in the Banking, Insurance or Real Estate groups, it’s labeled a diversified. Although the group is diverse enough to capture pawn shops and nationally recognized statistical rating organizations (NRSRO), the vast majority of the group is made up of capital markets-related and multi-faith conglomerates. Using GICS classifications, the group consists of Capital Markets, Consumer Finance and Diversified Financial Services industries (see Table 3.1).

Table 3.1 Diversified Financials Composition

Source: Thomson Reuters; MSCI, Inc.;1 Russell 2000 and S&P 500 Indexes. As of 12/31/2011.

The group is very top-heavy: The largest 10 Diversified Financials firms account for nearly 60% of the industry group’s weight in the MSCI ACWI. And of this, over half is attributed to the US banks that are not categorized as banks—Citigroup, Bank of America and JP Morgan Chase & Co.

This chapter covers the following sub-industries, delving into the characteristics of each:

- Capital Markets

- Asset Managers & Custody Banks

- Investment Banking & Brokers

- Diversified Investment Banking

- Consumer Finance

- Diversified Financial Services

CAPITAL MARKETS

The Capital Markets industry is home to Asset Managers & Custody Banks, Investment Banking (IB) & Brokers and Diversified ...

Get Fisher Investments on Financials now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.