10

Final Words of Caution

This book deals in highly leveraged derivatives strategies and as such it is wise to dedicate the final chapter to the risks and problems that may arise.

DIMINISHING RETURNS OF FUTURES FUNDS

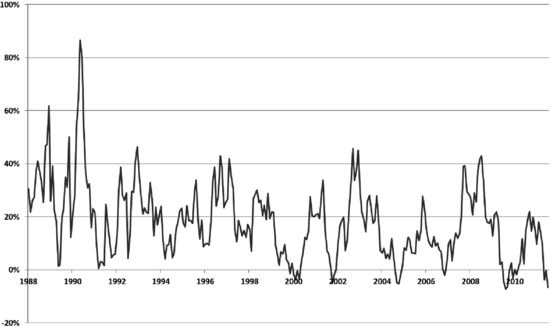

The trend-following business used to be much easier and it is getting tougher and tougher to achieve the big number returns. In the 1980s and 1990s most managers in this business had stellar compound returns with hardly any lasting drawdowns, but those days seem to have been replaced with higher volatility and more uncertain results. The core trend-following strategies are still profitable given enough time, but the return profiles have clearly changed in the past decade. To demonstrate the effect, I have made a composite out of a large number of trend-following futures funds where each fund has an equal weight. Figure 10.1 demonstrates how the returns have changed over the years by showing the 12 months rolling returns for the composite over time. The volatility was certainly larger in the good old days but so was the profitability. Even the superb year of 2008 did not make the composite go flying off the chart as happened back in 1990.

Figure 10.1 Rolling 12-month compounded return for CTA composite

There are two main factors driving the diminishing returns in our sector. The first factor was touched upon in Chapter 5, and that is the effect of the free contribution ...

Get Following the Trend: Diversified Managed Futures Trading now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.