LEGAL DEFINITION OF SECURITY

A security, unlike goods or land, has no utilitarian value. A security is simply a manifestation of a promise by an issuer to pay interest and return capital in the case of bonds, or share in the ownership of a company in the case of stock. In truth, a security is hard to define. It is not a check; but it can be a note.1 In many cases, the law resorts to a list in order to define what a security actually is.

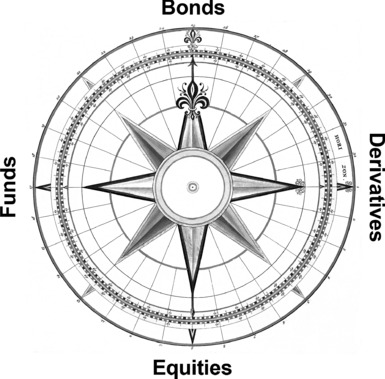

Conceptually, a security can be defined as an investment pooled with others and managed by third parties with whom the investors participate in the economic fate of a common enterprise (whether it be a sovereign nation or a corporation). Securities include equities, options on securities, warrants, preferred shares, depository receipts, bonds, debentures, collateralized debt and mortgage obligations, and mutual funds. A hallmark feature of a security is transferability in a readily available market. In order to further orient ourselves, a comparison to a compass may prove helpful as shown in Figure 1.2.

FIGURE 1.2 The Securities Compass

Imagine the four points of a compass. North are bonds and South are equities. East are derivatives (such as listed options or credit default swaps) and West are investment funds. Anywhere on the compass, depending on the characteristics of the security, one can array a financial investment because they all tend ...

Get Global Securities Markets: Navigating the World's Exchanges and OTC Markets now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.