A BRIEF COMPARISON OF U.S. LAWS AND EU DIRECTIVES

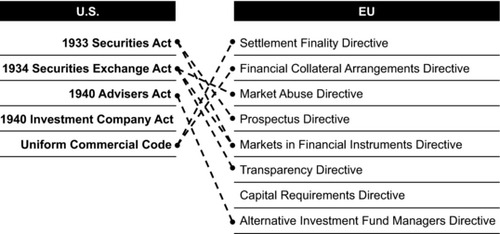

Many of the important EU Directives have direct analogues to the U.S. laws and regulations. In the Prospectus Directive one can see the disclosure requirements of the 1933 Act. In the Transparency Directive are the periodic reporting requirements of the 1934 Act. The Market Abuse Directive encompasses the insider trading and fraud provisions of the 1934 Act. Other Directives not specifically mentioned above, like the Capital Risk Directive, find their analogue in the Net Capital Rule (77 U.S.C. § 15c3-1). A major piece of legislation, the Take Over Directive, which demands that shareholders of a corporation holding more than an established percentage of shares (for example, 30 percent) must acquire the remaining shares at a fair price, has no analogue in U.S. federal law, although there are some equivalents under state law. In the United States, minority shareholders are left to sue in state courts if they are oppressed by controlling shareholders. Figure 6.2 lists important U.S. laws and EU Directives and visually connects the analogous provisions. Happily, from an investor protection perspective, the same themes are covered in each jurisdiction.

FIGURE 6.2 Significant European and U.S. Laws.

1. The existence of government-sponsored insurance protection programs for the customers of banks and securities firms (such as FDIC and ...

Get Global Securities Markets: Navigating the World's Exchanges and OTC Markets now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.