3

The Benefits and Risks of Investing in Hedge Funds

3.1 OVERVIEW

In this chapter I present the standard arguments for investing with hedge funds and both question and develop those arguments. Given that many reasons are based on the nature of past returns, I take an in-depth look at the economic rationale for the existence of such returns going forward and also take a deeper look at the nature of the drivers of returns in the hedge fund space. Investing with hedge funds also presents specific risks that are peculiar to this area and towards the end of this chapter I take a look at the risks that should be considered before investing.

3.2 THE BENEFITS OF INVESTING WITH HEDGE FUNDS

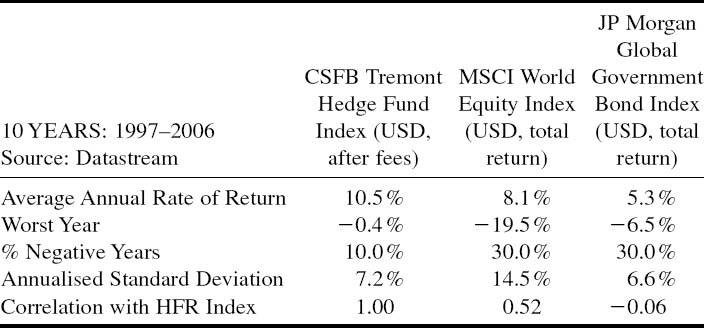

As we can see from Table 3.1, hedge funds have historically outperformed equities and bonds with volatility not too much above bonds. As a result, if this performance was anything to go by, it would make sense to add hedge funds to a traditional portfolio of equities and bonds just because they seem to have better risk adjusted returns than the traditional asset classes; that is, for every percentage point of risk that is taken, greater returns are generated.

Table 3.1 Comparison of Hedge Fund Returns with Major Asset Classes.

However, past outperformance is not a reason in itself to invest as there is no guarantee that these returns will continue to look so good. It isn't the magnitude of hedge fund returns ...

Get Hedge Funds of Funds: A Guide for Investors now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.