Supermart Interest Rate Swap Trade

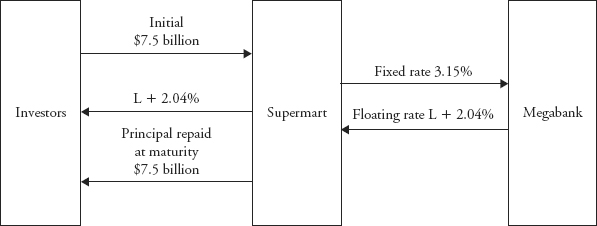

To simplify the hedging discussion for the Supermart interest rate swap trade from Chapter 4, we will change the example slightly. Instead of Supermart doing a cross-currency swap from floating US dollars to fixed UK pounds, Supermart will simply do a US interest rate swap from floating to fixed (Figure 6.3).

FIGURE 6.3 Supermart interest rate swap trade overview.

A standard US dollar interest rate swap is an exchange of a fixed rate for a floating rate. The floating rate is often Libor, which resets quarterly. For the purposes of this book we will use a 12-month Libor to make the examples easier to discuss ...

Get How the Trading Floor Really Works now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.