Figuring the Deduction

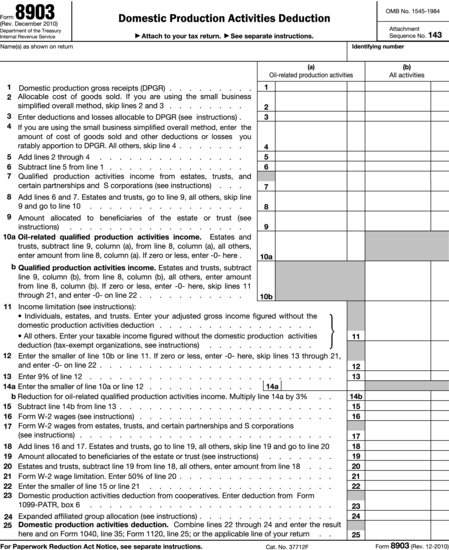

The deduction is 9% of income from domestic production activities and is figured on Form 8903, Domestic Production Activities Deduction (Figure 21.1). This results in an effective top tax rate on corporations of 32% (instead of the maximum 35% rate). “Income” means gross receipts reduced by certain expenses.

Allocable Gross Receipts

Start with gross receipts from qualified domestic production activities, called domestic production gross receipts (DPGR). If your business is entirely domestic, then all gross receipts are taken into account. If you have both domestic and foreign activities, use any reasonable method to allocate gross receipts to qualified domestic activities.

FIGURE 21.1 Form 8903, Domestic Production Activities Deduction

Under a de minimis rule, if less than 5% of total gross receipts are derived from nonqualified domestic production activities, you do not have to make any allocation; all gross receipts are treated as attributable to qualified domestic production activities.

If there is a service element in the activity, allocate gross receipts between the qualified activity and the services. However, no allocation is required if the gross receipts relate to a qualified warranty and other gross receipts from these services are 5% or less of the gross receipts from the property.

Qualified production activity income (QPAI) is determined on an ...

Get J.K. Lasser's Small Business Taxes 2013: Your Complete Guide to a Better Bottom Line now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.