9.4 Reporting Rents From a Multi-Unit Residence

If you rent out an apartment or room in a multi-unit residence in which you also live, you report rent receipts and deduct expenses allocated to the rented part of the property on Schedule E of Form 1040 whether or not you itemize deductions. You deduct interest and taxes on your personal share of the property as itemized deductions on Schedule A of Form 1040 if you itemize deductions. If you or close relatives personally use the rented portion during the year and expenses exceed income, loss deductions may be barred under the personal-use rules (9.7).

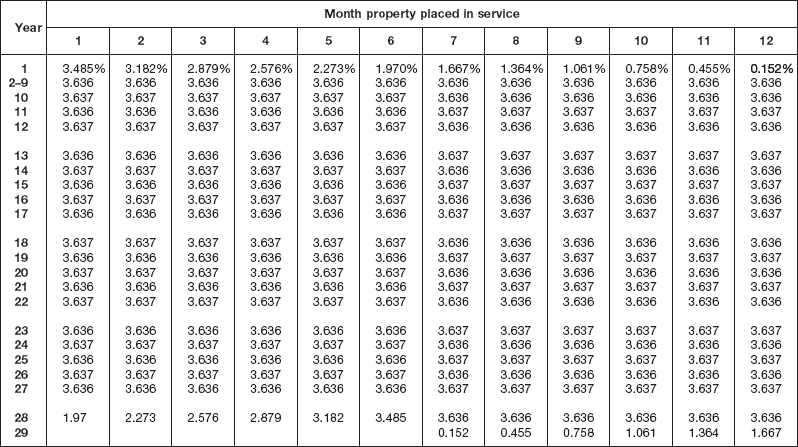

Table 9-1 Depreciation: Use the Row for the Month the Residence Is Ready for Rental in the First Rental Year

Get J.K. Lasser's Your Income Tax 2013: For Preparing Your 2012 Tax Return now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.