Chapter 13

Claiming the Standard Deduction or Itemized Deductions

13.1 Claiming the Standard Deduction

13.3 Husbands and Wives Filing Separate Returns

13.4 Standard Deduction If 65 or Older or Blind

13.5 Standard Deduction for Dependents

13.6 Prepaying or Postponing Itemized Expenses

13.7 Itemized Deductions Reduced for Higher-Income Taxpayers

Claim the standard deduction only if it exceeds your allowable itemized deductions for mortgage interest, property taxes, medical costs, charitable donations, casualty losses, and miscellaneous deductions for job costs and investment expenses. Generally, a single person and a married person filing separately, may claim a 2013 standard deduction of $6,100; a head of household, $8,950; and a married couple filing jointly or a qualifying widow/widower, $12,200. Larger standard deductions are allowed to individuals who are age 65 or older or blind, and lower standard deductions are allowed to dependents with only investment income.

Before deciding whether to itemize or claim the standard deduction, read Chapters 14 through 20 to see that you have not overlooked any itemized deductions. To itemize, you must file Form 1040 and report your deductions on Schedule A. High-income taxpayers may have a portion of their itemized deductions disallowed (13.7).

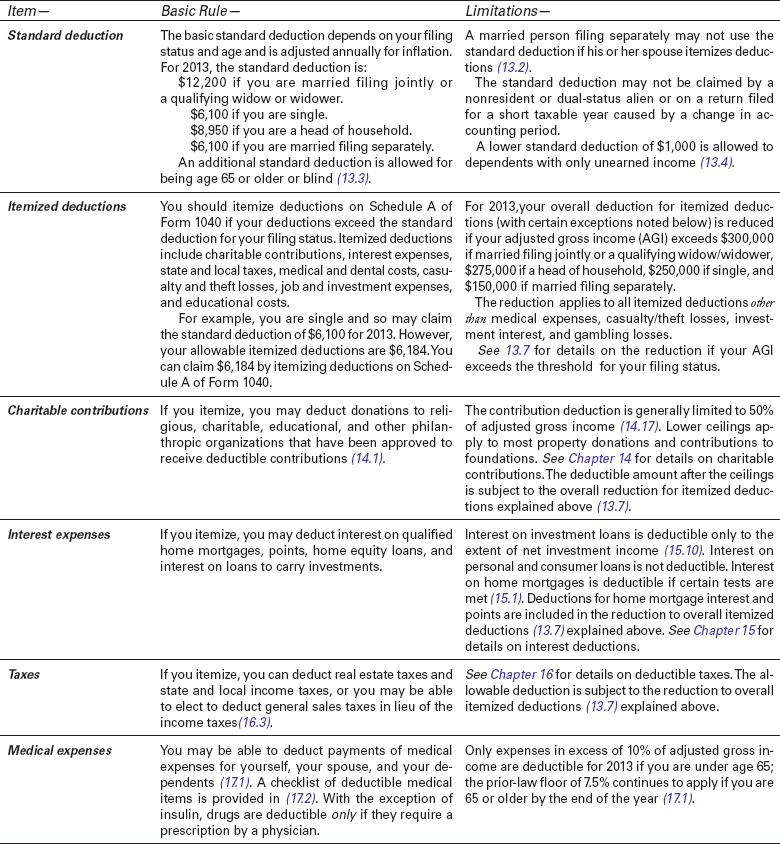

Table 13-1 Itemized Deductions and the Standard Deduction for 2013

13.1 ...

Get J.K. Lasser's Your Income Tax 2014: For Preparing Your 2013 Tax Return now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.