CHAPTER 13 DX Analytics – Square-Root Diffusion

13.1 Introduction

This chapter uses DX Analytics to model the VSTOXX volatility index by a square-root diffusion process as proposed in Grünbichler and Longstaff (1996) and discussed in chapter 6 Valuing Volatility Derivatives. It implements a study over a time period of three months to analyze how well the model performs in replicating market quotes for VSTOXX options.

13.2 Data Import and Selection

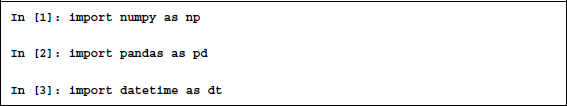

The data we are working with is for the first quarter of 2014. The complete data set is contained in the online resources accompanying this book. As usual, some imports first.

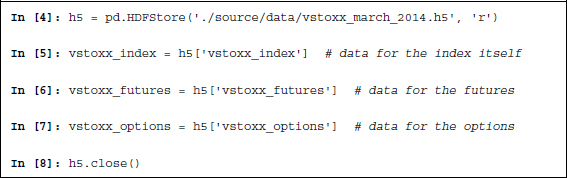

Next, we read the data from the source into pandas DataFrame objects.

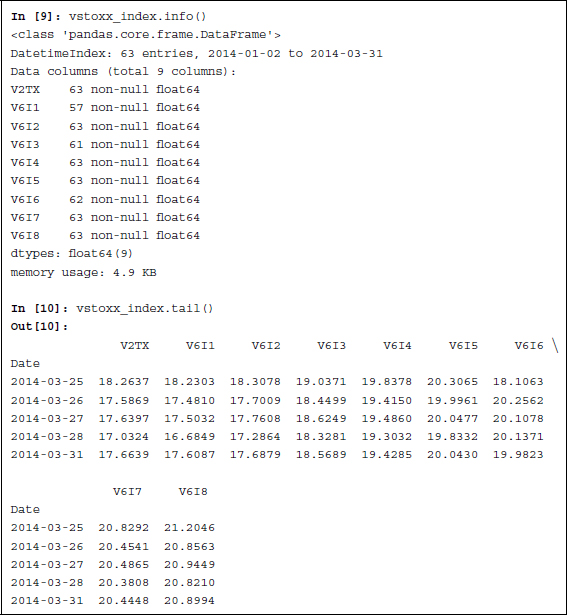

Inspecting the data sub-set for the VSTOXX index itself, we see that we are dealing with 63 trading days.

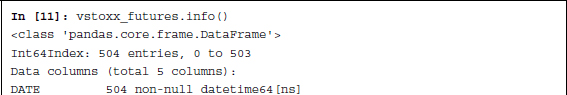

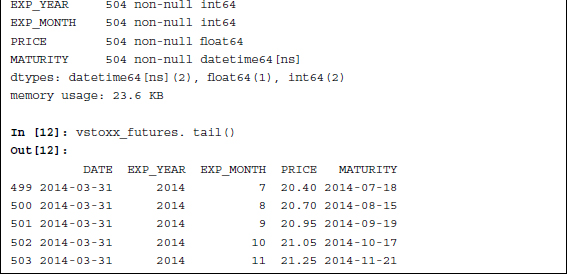

Per trading day, there are eight futures quotes for the eight different maturities of the VSTOXX futures contract. This makes for a total of 504 futures quotes.

By far the biggest data ...

Get Listed Volatility and Variance Derivatives now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.