4

Fundamental Market Models

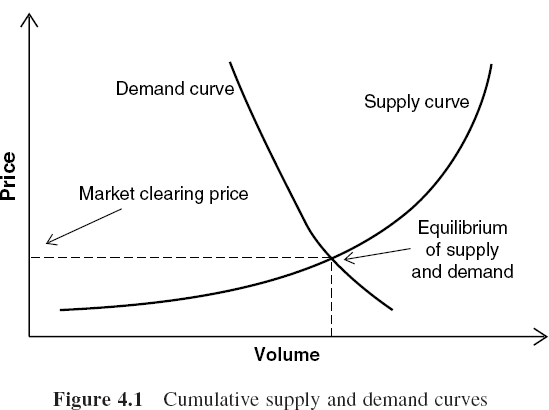

Market prices can be understood as clearing (or equilibrium) prices at the intersection of cumulative bid (demand) and offer (supply) curves (see Figure 4.1). Fundamental market models use cost-based bid and offer curves to derive estimations (or indications) of market prices. They do not necessarily allow forecasting of market prices. These models give insight into fundamental price drivers and market mechanisms. Therefore, fundamental market models can be used for the development of trading strategies as well as for decision support for investments or acquisitions.

Figure 4.1 Cumulative supply and demand curves

This chapter concentrates on fundamental market models for electricity markets. We first describe the most important fundamental price drivers for electricity prices in section 4.1. The principles of economic power plant dispatch discussed in section 4.2 are crucial for describing and understanding the supply side of electricity markets. Different methodological modelling approaches are discussed in section 4.3.

Data quality is critical for high quality description of electricity markets. A general overview on data required for modelling as well as on information sources can be found in section 4.4. Finally, we present examples for the application of fundamental electricity market models in section 4.5 and shortly describe in sections 4.6 and ...

Get Managing Energy Risk: An Integrated View on Power and Other Energy Markets now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.