3

Some Recent Results on High Frequency Correlation

3.1 INTRODUCTION

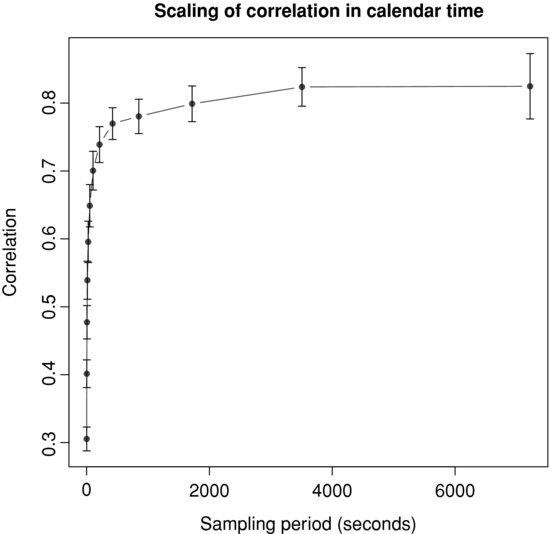

In spite of its significant practical interest, high frequency correlation has not been widely studied in the literature. The main stylized fact known about it is the Epps effect [1979], which states that “correlations among price changes [...] are found to decrease with the length of the interval for which the price changes are measured”. Indeed, Figure 3.1 plots the correlation coefficient between the returns of the midquote of BNPP.PA and SOGN.PA, two major French financial stocks, as a function of the sampling period.

Figure 3.1 Correlation coefficient between the returns of the midquote of BNPP.PA and SOGN.PA as a function of the sampling period.

The correlation starts from a moderate value, 0.3, for a time scale of a few seconds, and then quickly reaches its asymptotic value, 0.8, after about 15 minutes of trading. Note that the increase in correlation between these two time scales is quite impressive since it is multiplied by more than 2.5. Note, however, that the correlation measured with daily closing prices during the same period is 0.94, still above the seemingly asymptotic value of the previous curve.

In this paper, we consider some empirical issues about high frequency correlation. First, we focus on how to extend the stochastic subordination framework introduced ...

Get Market Microstructure: Confronting Many Viewpoints now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.