12

Valuation

CASH FLOWS

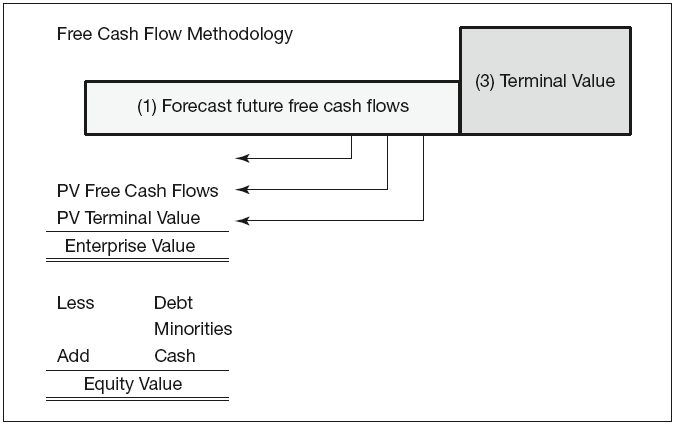

This chapter brings together all the workings from the previous sheets, such as the cash flows and cost of capital. Since the model is valuing the company as the present value of future cash flows, this schedule needs to set out the cash flows to show the source and the stages of the valuation. The valuation conforms to Figure 12.1 with the forecast cash flows, discount rate and terminal value.

Copy a further template sheet and call it Valuation to uphold the consistent structure of the worksheets.

Figure 12.1 Framework

The valuation cash flow ...

Get Mastering Cash Flow and Valuation Modelling now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.