14

Alternative methods

METHOD

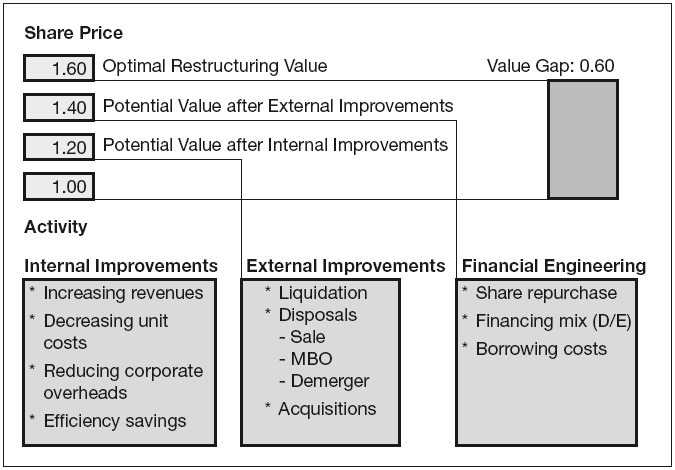

Traditional analysis using discounted cash flows finds a single value but does not provide detailed information on the constituents of value or the breakdown of constituents. Figure 14.1 shows the sources of potential value in terms of:

- current market value;

- internal improvements such as cost cutting and savings;

- external improvements such as liquidations, acquisitions, disposals and strategic improvements;

- financial engineering, which includes borrowing costs, changing leverage and lowering the cost of capital.

Figure 14.1 Value gap

Since you have all the ...

Get Mastering Cash Flow and Valuation Modelling now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.