6

Mezzanine and Project Finance

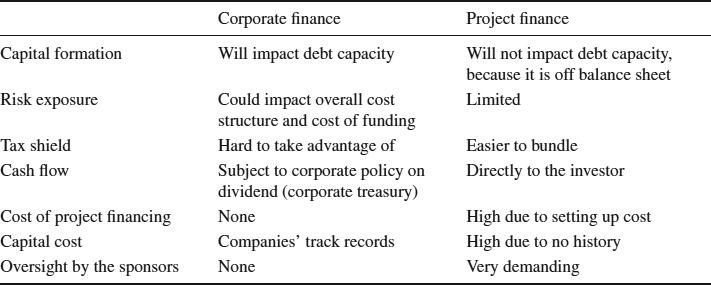

Very often I have been asked to define or demarcate project finance, and very often I have done so by defining it in contrast to corporate finance.1 However, ultimately one could argue that corporate finance is a bundling of many project finances put together and run through one balance sheet. I don't object to that approach. It is not possible, nor is it my intention, to be fully comprehensive when it comes to the fundamentals and techniques of project finance in this chapter. That would not be in line with the objectives of this chapter, nor the book in general for that matter. What I'll try to do is provide the components of the framework within which project finance is active, in order to better understand the role mezzanine products can play (or not). As a starter, let's (try to) agree on the following features for each of the techniques (see Table 6.1):

Table 6.1 Corporate versus project finance

The essence of project finance is that all the parties involved basically judge the financial viability of the project based on the projected cash flows which relate to the project, rather than looking at the balance sheet of the parties involved in the deal. Since pretty much all project finance deals are long term, the use of projected cash flows can mean you will end up being terribly wrong. Nevertheless, the use of project finance has only increased ...

Get Mezzanine Financing: Tools, Applications and Total Performance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.