Chapter 8. Evaluating Investments with Net Present Value Criteria

What is net present value (NPV)?

How do I use NPV to compare the merits of investments for which cash flows are received at several points in time?

How do I use the Excel NPV function?

How can I compute NPV when cash flows are received at the beginning of a year or in the middle of the year?

How can I compute NPV when cash flows are received at irregular intervals?

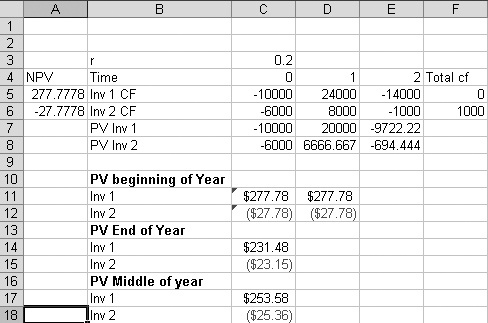

Consider the following two investments, whose cash flows are listed in the file NPVExample.xls and shown in Figure 8-1.

Figure 8-1. To determine which investment is better, we need to calculate net present value.

Investment 1 ...

Get Microsoft® Excel Data Analysis and Business Modeling now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.