Interest rates are near historic lows, so retirees and other savers who depend on income from their savings and investments are in a fix. The same interest-rate cuts that have fueled the home buying and refinancing boom are a disaster for savings-minded folks. Financial firms only raise their rates so far above the market averages to capture business, but even a fraction of a percent can help. In the past, finding better interest rates was a real chore, so many people simply took what their bank offered. Now, you can use online screening tools to find savings options that fit your timeframe at the highest possible interest rate.

In October of 2000, the average interest rate on money market accounts was running a bit over 4 percent. By early 2004, rates dipped so low that the rate on a typical money market account was below 1 percent. Table 1-1 shows how much this drop costs the typical saver.

Table 1-1. Impact of interest rates on money market returns

|

Initial deposit |

How long |

Contributions |

Interest rate |

Ending balance |

|---|---|---|---|---|

|

$10,000 |

2 years |

$100 per month |

1.25% |

$12,681.02 |

|

$10,000 |

2 years |

$100 per month |

4% |

$13,325.43 |

|

$100,000 |

2 years |

None |

1.25% |

$102,515.62 |

|

$100,000 |

2 years |

None |

4% |

$108,160.00 |

Because compounding is so important to savers, higher interest rates increase the interest paid more dramatically over time than lower interest rates. You can see the difference in interest from a $10,000 nest egg, but the impact is far more dramatic on the $100,000 investment. Many people formulated their retirement budgets based on certain interest-rate expectations, which didn’t come through. These same retirees must now make do with much less. It’s hard enough to save, but the current anemic growth in account balances is enough to put off even the most dedicated saver. Rates will rise eventually, although no one can say when. For now, the predictions are for fairly stable rates in the absence of earth-shaking events on the international or national stage.

Interest rates are set by the Federal Reserve and are closely tied to the economy. During a recession, such as the economic downturn in 2000-01, the Fed is likely to lower—or ease—rates to stimulate economic activity. When times are good, the Fed might raise rates to rein in excessive growth and keep inflation low. Bond traders also influence interest rates as they trade existing federal, corporate, and mortgage bonds. Although you can’t do much about the level of interest rates, one way to increase your savings return is to mine the Internet for the highest savings rates. Many personal finance sites enable you to screen for the best rates for a variety of accounts:

- Checking Accounts

These transaction accounts don’t earn much interest. If you’re lucky, the interest you earn offsets the fees you pay. If you link accounts, a bank might waive your fees.

- Savings Accounts

These accounts pay slightly more than checking accounts, but not by much. Many people use these accounts only for small emergency stashes. However, both savings and checking accounts at banks, savings and loans, and credit unions with balances up to $100,000 are insured.

- Money Market Accounts

Money market deposit accounts, offered by banks, savings and loans, and credit unions, are insured. Money market fund accounts, offered by brokers and mutual fund companies, are not insured, but usually pay slightly higher interest.

- Certificates of Deposit (CDs)

These debt instruments are offered by banks and brokerages and carry differing maturity dates, usually three months to five years. The longer the term, the better the interest rate is. As long as a CD is $100,000 or less and is issued by a bank, savings and loan, or credit union, it’s insured. There are different flavors of CDs—for more information, see the article “Understanding CDs FAQ” at http://www.bankrate.com/brm/news/sav/20020805a.asp?prodtype=dep.

The players in the savings game are banks (both online and bricks-and-mortar), savings and loans, credit unions, brokerages, and mutual fund companies. The Internet has made what used to be a primarily local game into a national one, with online-only, national, and regional financial institutions competing for your savings dollar. Before you begin screening to find the best rates, you must make a couple of decisions:

- Do you want your savings dollars insured?

Federal depository insurance means a lot to people who don’t want to lose their savings in case of a bank failure. Although money market funds aren’t insured, they have never lost money for their customers.

- Do you prefer to deal with a local bank, credit union, or savings and loan?

Some people like to know that they can enter a bank branch and talk to someone when necessary. With all the mergers-and-acquisitions activity in the banking industry these days, more and more cities have branches of large national banks, as well as regional, state, and local players.

- Are you willing to deal with an online-only bank, or do you feel more comfortable with a bricks-and-mortar institution?

Internet-only banks frequently offer higher teaser savings rates to attract business, so if you have enough savings and don’t mind banking online, this could be a solid option for you.

Most personal finance sites offer savings screening tools that enable you to screen by rates and locale. Bankrate.com (http://www.bankrate.com/brm/rate/dep_home.asp) is one of the best, although MSN Money (http://money.msn.com/banking/home.asp) and Interest.com (http://www.interest.com/investing) also offer helpful screening tools. You’ll find a comparison of their good and bad points in Table 1-2.

Tip

Not all cities are included in the screens. I was disappointed to find out that my hometown, Erie, PA.—the fourth largest city in Pennsylvania—wasn’t included while other, smaller cities were. So if your hometown isn’t included you may miss out on some better local rates. Check out savings rate boxes that run usually once a week in local newspapers to make sure you’re not missing out on a great local deal.

Table 1-2. The best sites that screen for savings products

|

Bankrate.com |

MSN Money |

Interest.com | |

|---|---|---|---|

|

Savings products screened |

Money market, CDs, credit union savings |

Interest checking, savings accounts, CDs, and money market |

Interest checking, savings accounts, CDs, and money market |

|

Best feature |

Initially screens by best rate or by state |

Prominently displays national averages for each type of account above the screen results |

Screen is easy to use with all options centralized on one page |

|

Worst feature |

Must dig to find screen for money market accounts and credit unions |

Must view MSN Partners’ promotional slant (to skip this ad, screen by highest yield or lowest minimum balance) |

Must search by city, and if the screen doesn’t include your city, you must pick the closest one to you |

|

Additional features |

Extensive article archive for explanations of the ABCs of savings; weekly CD rate newsletter; and weekly analysis of interest rates |

Four savings calculators (including “How long will it take me to reach my savings goals?”) and a Savings & Debt Decision Center with practical tips for increasing your savings |

A no-frills site that focuses on the basics |

To find the best rates for a one-year CD using the Bankrate.com web site, follow these steps:

Select CDs/Savings in the product list and click Go.

Select the Select Best Rate option and click Go.

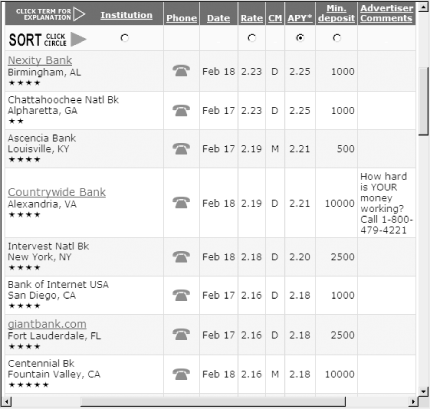

Select 1 Yr CD in the account list and click Go. Bankrate.com displays the 100 highest rates for the CD you chose, as illustrated in Figure 1-1.

To sort by a field, such as the minimum deposit required, select the option button underneath the column heading.

If you want to receive an email alert when rates reach your target, click Rate Alert near the top of the page.

Figure 1-1. Bankrate.com provides the best interest rates nationwide or within the state you specify

Bauer Financial (http://www.bauerfinancial.com/cdrates.html) provides a weekly list of top CD rates from the national banks in the best financial condition.

Amazing Rates (http://www.amazingrates.com/startsearch.asp) enables you to search what they say is the largest database for CD rates.

NAIC’s Mutual Fund Education and Resource Center (http://www.better-investing.org/funds) enables subscribers to screen for mutual fund money market accounts and compare them based on three-, five-, and ten-year total return and cost [Hack #67] .

—Amy Crane

Get Online Investing Hacks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.