Find the perfect individual bond for the income-producing portion of your portfolio with online bond screening tools.

Investing in individual bonds [Hack #80] provides you with another safety net to preserve your principal while providing income. When you build your own bond portfolio you can customize it so the bonds mature exactly when you need the money. For example, if you want to create a bond portfolio that matures when your kids’ college bills are due or when you retire—and you don’t want the fees and additional risks of bond funds [Hack #64] —do some research and buy individual bonds. Online screening tools for individual bonds can help, but free tools that locate individual bonds are rare. The Yahoo! Finance’s bond screener (http://bonds.yahoo.com/search.html) and BondsOnline’s Fixed-Income Research Center (http://www.bondsonline.com/asp/research/intro.asp) enable you to search for bonds that meet your needs without paying for the privilege.

Bonds generally have a predictable payment stream and repay the principal, so people often invest in bonds to collect consistent interest income, or to preserve and increase their capital. Whether you are saving for a new home, your child’s college education, or you want to increase your retirement income, investing in bonds can help you achieve your objectives.

To fund financial objectives with a deadline, such as college tuition, select bond maturity dates to match. If you want the tax advantage, investigate bonds that are exempt from both Federal and State taxes. To preserve your principal and avoid bonds that default, use Treasury bonds or AAA-rated corporate bonds. Moody’s indicates that only 18 of the 45,000 municipal bonds that they rated have defaulted since 1970 (1 in every 2,500). Although the chances of a bond defaulting are slim, you lose your entire investment when it happens, so evaluating bonds for their default potential is worth your time.

Bond characteristics determine bond investment value and whether a bond meets your financial objectives. Before you build a bond screen, identify the characteristics you want in a bond. Typical factors to consider when screening bonds for investment include:

The bond’s maturity and redemption features

Credit quality (rating by Moody’s or Standard and Poor’s)

Interest rate

Price/yield ratio

Tax status

Two web sites offer bond screening tools that allow you to screen by bond types, safety level, and maturity dates. BondsOnline.com (http://www.bondsonline.com) offers the most options, although Yahoo! Finance (http://bonds.yahoo.com/search.html) offers basic features that do most if not all of what you want. Table 1-3 summarizes the feature-sets of each.

Table 1-3. The best sites for bond screening

|

Features |

BondsOnline.com |

Yahoo! Finance |

|---|---|---|

|

Bond products screened |

CDs, Corporate, Municipal, Savings, Treasury, Zero Coupon |

Corporate, Municipal, Treasury, Zero Coupon |

|

Best feature |

Screens by best rate or by state |

Provides a simple search to find basic bond issues |

|

Worst features |

You have to sign up for 30 days to screen any bonds The font is small You might have to scroll to click the Search button |

You can’t enter a minimum interest rate or yield The bond screener displays only a limited amount of corporate bonds |

|

Additional features |

Provides extensive information in the Educated Investor Center and Fixed Income Research Center and Investor Tools |

Provides context-sensitive help that includes basic information on the search fields and related topics |

Yahoo! offers plenty of educational material and an easy-to-use, basic bond screening tool accessible from the Yahoo! Finance Bond Center at http://bonds.yahoo.com, as illustrated in Figure 1-2. Yahoo! Finance’s simple screening tool allows you to find bonds based on type, dollar amount, maturity dates, and safety. Yahoo! Finance’s bond calculators answer questions like “How will rate changes affect my bond’s current value?” or “What is my return if I sell today?” The Composite Bond Rates link displays a chart comparing current and historical yields for Treasury, Municipal, and Corporate bonds.

For more robust bond screening using more criteria, navigate to http://www.bondsonline.com. Click the Research Bonds checkmark icon at the top of the home page to navigate to the Fixed Income Research Center. You can sign up for a free month by providing a username, your name, email address, and phone number. BondsOnline.com automatically emails you a password that is good for 30 days. With this username and password, you can research Treasury, Municipal, Corporate, Zero Coupon, CDs, and Savings Bonds.

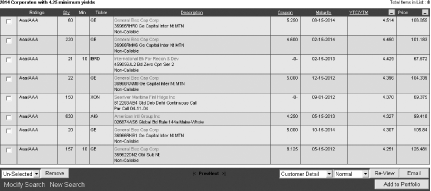

Let’s use the BondsOnline.com web site to find the best $10,000 AAA-rated corporate bond with a minimum yield of 4.25 percent and a maximum maturity date of 2014. Follow these steps to create a bond screen:

Select Corporate Bonds from Prices/Quotes/Yields in the Fixed Income Research Center.

Enter the user ID and password you received from BondsOnline.com.

Type the name for your search in the Title field.

Type

2014in the Maximum Maturity field.From both the Moody’s and Standard and Poor’s (S&P) ratings dropdown lists under the Minimum heading, select AAA.

Type

10under the Minimum heading in the Qty 000’s field.Type

4.25in the Yield field.Select Yield from the Sort By drop-down list.

Scroll down and click Search. BondsOnline.com displays the results from the highest to lowest yields, as shown in Figure 1-3.

But wait, there’s more! You can also specify call dates or non-callable bonds, and select the industry groups (industrial, financial, utility, government) that you want to include or exclude (or select all to include them all). You can choose how you want the information sorted and displayed, including whether you want a printable version or an HTML attachment emailed to you. You can choose to update your search anytime or in set hourly increments, and you can also choose whether to include new offers, price changes, or quantity changes. To check on specific bond issues, select specific CUSIP or Issuer numbers. These features make it easy to search for bonds that meet detailed criteria.

The Bond Market Association’s web site InvestinginBonds.com (http://www.investinginbonds.com) provides extensive bond information. The web site’s Tax-Free versus Taxable Yield Comparison Calculator computes your tax consequence based on your income and state of residence, and then displays a chart showing the taxable yields you need to match the return from a tax-free municipal bond. It also displays your Federal and State tax rates.

The Motley Fool has good basic information on bonds located at http://www.fool.com/school/basics/basics05.htm.

Visit http://www.publicdebt.treas.gov/sav/savprice.htm to find out what your U.S. Savings bonds are worth.

—Martha Sippel

Get Online Investing Hacks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.