Finding good companies is only half the battle; buying them at the right price is the other. A number of valuation ratios help you figure out if the price is right.

Although the P/E ratio can help you determine a stock’s value, it can sometimes be misleading, particularly for companies that have recently issued a warning about their future earnings. Investors might have bid down the price of the stock based on those lowered expectations, resulting in an abnormally low P/E ratio for that company. In such a case, a low P/E ratio doesn’t reflect the true value of the company based on its future growth. On the other hand, companies that grow very quickly often have extraordinarily high P/E ratios. However, if those companies can continue to grow at the same pace, the rapid increase in earnings over time brings those P/E ratios back to more common values. Other valuation ratios can confirm or challenge the value shown by the P/E ratio.

The P/E to growth ratio (PEG) is an indication of whether a company’s growth can support the high P/E ratio that the stock price carries. The PEG ratio, shown in Example 4-15, compares a stock’s current P/E ratio to its expected future EPS growth rate.

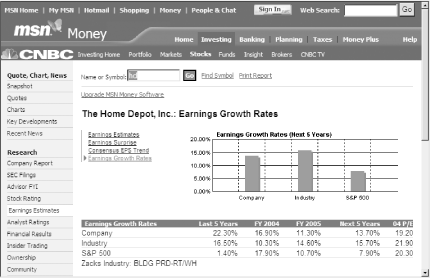

For long-term investors, it’s best to look at EPS growth rate estimates as far in the future as possible. For example, you can find five-year analyst EPS estimates at Yahoo! Finance (http://finance.yahoo.com), Quicken.com (http://www.quicken.com), NAIC’s Online Premium Services datafiles (http://www.better-investing.org), and MSN Money (http://www.money.msn.com), which is shown in Figure 4-7.

The rule of thumb for PEG ratios is that a stock with a PEG of 1.0 is reasonably valued—its P/E ratio is the same as its EPS growth rate. A company with a PEG of 0.5 is potentially a real bargain, while a PEG of more than 1.5 is getting into nosebleed territory on the valuation map.

Tip

Screening for stocks with low PEG ratios is a common technique for turning up potentially undervalued stocks. To learn more about screening and online screening tools, see Chapter 1.

As with most financial measures, there are a few caveats when applying the PEG ratio. It doesn’t work well when you’re evaluating industries valued on their assets and not their operations; these include financial institutions, real estate operations, airlines, and oil drillers. For companies in industries such as these, the price/book value ratio is helpful.

The price/book value ratio, also know as the price/book ratio, is one of the oldest analysis ratios used by investors and analysts. Popularized by Benjamin Graham in the years following the 1929 stock market crash, and later championed by his disciple Warren Buffett, the price/book ratio is the keystone of the value approach to the stock market.

The logic behind evaluating the price/book ratio is straightforward. Accounting practices are conservative when it comes to depreciating assets such as real estate on a company’s ledgers. As a result, an established company might own property worth millions on the market but include that same property on its books on a fully depreciated basis with a value of $0. This hidden value means that a company with a low price/book ratio might be purchased for less than the total net worth of the company’s assets.

Book value is also known as shareholders’ equity, which is found at the bottom of a company’s balance sheet. For an explanation of a balance sheet, read the introduction to Chapter 3. However, when investors speak of book value, they usually mean book value per share, which is nothing more than shareholders’ equity divided by the number of shares outstanding. Historical book value/share is often included in analyst reports such as S&P Reports and on sites such as MSN Money.

Before you apply the price/book ratio, you must calculate book value, which in simple terms is the net worth of a company. Example 4-16 shows the formula to calculate book value.

In its 2002 10 K filing to the SEC, Amgen reported total shareholders’ equity of $18,286 million and 1289.1 million shares outstanding, so its book value per share at the end of 2002 was $14.18.

After you isolate book value per share, you can calculate the price/book ratio using the formula in Example 4-17.

Example 4-17. Formula for price/book ratio

Price/Book Ratio = $ Current Price / $ Book Value per Share

At year-end 2002, Amgen’s stock closed at $48.34, so its price/book ratio was 3.4, close to the average price/book ratio of the S&P 500 of around 3.0.

When the price/book ratio is less than one, the share price for the stock is less than the book value for one share, which means you can purchase the company for less than its net worth. Some value investors consider a price/book ratio less than two as an undervalued opportunity.

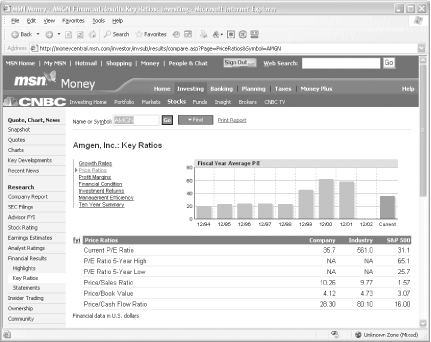

Price/book ratios vary by industry. Today, many high-tech companies can generate hefty profit margins without lots of hard assets and factories (think Microsoft), and thus their book values are comparatively low. Although price/book ratios for manufacturing firms and utilities are higher than those of some high-tech companies, this doesn’t mean that these companies are overvalued. You can compare a company’s price/book ratio and other ratios to industry averages and market indexes at MSN Money (http://money.msn.com), as shown in Figure 4-8.

You can use the price/sales ratio (PSR) as another way to look at a stock’s value. PSR is particularly useful for companies that don’t have any earnings (though you must always be extra careful when considering these emerging, speculative investments). The recent spate of accounting irregularities and write-offs has raised investors’ awareness of how companies manipulate their reported earnings to present them in the most favorable light. The price/sales ratio provides a baseline for comparing companies with volatile or cyclical earnings, or whose management has made significant adjustments to reported earnings.

Calculate the PSR using the formula in Example 4-18.

Example 4-18. Formula for price/sales ratio using per share values

Price/Sales Ratio = $ Current Price / $ Sales per Share

Tip

It’s unusual to find sales per share in data sources, so you’ll probably have to calculate it yourself by dividing the company’s sales from the last four quarters by the number of outstanding shares at the end of the last quarter.

Because it’s usually easier to find a stock’s market capitalization, which is equal to the share price multiplied by the number of shares outstanding, you can also calculate the PSR, as shown in Example 4-19.

Example 4-19. Formula for price/sales ratio using market capitalization

Price/Sales Ratio = Market Cap / Sales in Last 4 Quarters

Now that you know a company’s price/sales ratio, what do you do with it? For companies without earnings, the P/E ratio is useless, so you can use the PSR as a substitute when comparing a stock to its peers or to an industry average. During economic down cycles, you can look for companies with comparatively low PSRs in cyclical industries, such as heavy equipment manufacturers or automobile makers, hoping that those companies can increase sales when the economy kicks back into gear.

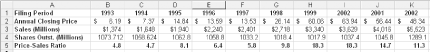

You can also compare a company’s current PSR to its historical trends. Using data that EdgarScan (http://edgarscan.pwcglobal.com) extracts from a company’s financial statements [Hack #18] , along with closing prices from Yahoo! Finance (http://finance.yahoo.com), you can calculate the PSR for several years. A typical formula for PSR in cell E5 of Figure 4-9 is straightforward, as shown in Example 4-20.

The spreadsheet in Figure 4-9 includes data for Amgen for the past ten years and the calculated price/sales ratio based on closing prices for each year. With this history, you can evaluate the company’s current PSR and see where it falls in terms of past trends. Keep in mind that the PSR of a company fluctuates during the year just like the P/E ratio does, so you might want to calculate the PSR based on annual high and low prices, or using trailing four quarter revenues to get a more complete picture of changes throughout the year.

In reviewing Amgen’s PSR trends over the past decade, you can see that the PSR rose from 4.8 at the end of 1993 to a peak of 18.3 in 1999 and 2000, and then began to decline to 11.3 at year-end 2002. Is this a significant downward trend?

To examine the company’s PSR more closely, surf over to MSN Money (http://money.msn.com) and check Amgen’s Key Ratios. Type the ticker (AMGN) in the Symbol box and click Go. In the left margin, click Financial Results, click Key Ratios, and then click Price Ratios. As shown in Figure 4-8, the average PSR for the S&P 500 is 1.5, while Amgen and the biotech industry values are 10. That makes sense, because investors are expecting great things in the future from this relatively new business of biotechnology, even though many of these firms aren’t yet producing much in the way of sales or profits. Amgen’s decline in PSR actually brings it closer to the average PSR of its peers, so it might not be a warning sign, but merely the result of a maturing company and industry.

Tip

The price/sales ratio can help in screening for undervalued opportunities. Although PSRs do vary by industry, searching for stocks with PSRs below 1.0 might tip you off to companies that have been overlooked by the market. You can also create stock screens that look for ratios that compare favorably to industry average ratios. To learn more about stock screening, see Chapter 1.

In the wake of accounting scandals that have toppled companies such as Enron and WorldCom [Hack #39] , cash flow analysis has become much more popular among investors. Like the price/sales ratio, the price/cash flow ratio helps you to examine companies without worrying about how they might have manipulated net earnings.

Cash flow is tricky to understand, so let’s start with one common definition. Cash flow is the money that’s left from revenues after the company has paid the direct costs of manufacturing its goods or providing its services. It’s often referred to as its operating profit or EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. On income statements, described in Chapter 3, companies subtract their expenses from their revenue to calculate their net income. The net income number at the bottom of the income statement appears as the first entry in the cash flow statement, labeled as “Cash flows from operating activities.”

You’ll need to calculate cash flow per share before you can determine the price/cash flow ratio. Divide the cash flow at the end of a period by the number of outstanding shares, and then calculate the price/cash flow ratio, as shown in Example 4-21.

Example 4-21. Formula for price/cash flow ratio

Price/Cash Flow Ratio = Price per Share / Cash Flow per Share

The price/cash flow ratio is most often used to compare a stock to its industry or to the market in general. Because depreciation is a noncash expense that lowers earnings, the price/cash flow ratio can be particularly useful in examining industries with huge depreciation expenses, such as the cable television industry, as well as cyclical industries, such as paper mills, steel manufacturers, and automakers. If a stock’s price/cash flow ratio is lower than the industry average, the stock might be selling at a discount to its competition.

MSN Money provides the current price/cash flow ratio for a company along with averages for industries and the S&P 500 index, as illustrated in Figure 4-8.

Some companies carry a large amount of intangible assets on their books. These intangible assets include goodwill (the premium paid by a purchaser when acquiring another company) and the value of patents and trademarks. Because it’s often difficult to determine the true value of that kind of property, despite what the company reports in its financials, some investors prefer to consider price/tangible book value in place of price/book value when analyzing stocks. Tangible book value excludes assets, such as patents, trademarks, and goodwill.

The value of intangible assets at some companies is obviously quite significant, as in the case of the brand name of Coca-Cola, but for other companies, it can be difficult to put numbers on those assets. In its July 2002 bankruptcy filing, WorldCom claimed that it had assets of $104 billion, nearly half of which was goodwill, and the value of its intangible assets, such as brand names and customers. Many financial experts disputed those figures: there was no way that WorldCom’s goodwill could possibly be worth $45 billion. By March of the following year, the company finally agreed, and its revised financial statements eliminated goodwill altogether—a whopping $45 billion of so-called assets down the drain. Those analysts who focused on the book value of tangible assets weren’t surprised to see the write-down, which makes a good case for using tangible book value.

Some data sources, such as Standard & Poor’s Stock Reports, provide tangible book value/share. Others, such as Media General Financial Services, who provide data to Quicken.com and other sites, remove intangibles from their calculation of book value but don’t explicitly label it as such.

Morningstar, “Using the Price/Sales Ratio” (http://news.morningstar.com/news/Ms/Stocks101/991202s101.html)

Morningstar, “Going by the Book” (http://news.morningstar.com/news/MS/Stocks101/bookvalue.html)

Motley Fool, “Introduction to Valuation” (http://www.fool.com/School/IntroductionToValuation.htm)

Smart Money, “Digging into the Numbers” (http://university.smartmoney.com/departments/strategicinvesting/stockpicking/index.cfm?story=digging)

—Douglas Gerlach

Get Online Investing Hacks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.