Management effectiveness ratios tell you whether company management uses shareholders’ equity and company assets to produce an acceptable rate of return.

Even with the best products or services, companies have trouble delivering strong long-term growth unless their management makes sure that everything operates effectively and efficiently. Management effectiveness ratios compare financial measures from company financial statements to evaluate management performance. Of all the fundamental criteria that long-term investors consider, one of the most important is return on equity (ROE), which is a basic test of how well a company’s management uses its money—are they increasing the overall value of the business at an acceptable rate? Return on assets (ROA) takes another view of management’s effectiveness by illustrating how much profit the company earns for every dollar of its assets, such as money in the bank, accounts receivable, property, equipment, inventory, and furniture. One reason to consider ROA as well as ROE is that the latter can make high-debt companies look more effective than low-debt firms with the same earnings and assets.

Calculate ROE with the formula in Example 4-30.

Example 4-30. Formula for ROE

% Return on Equity = (Annual Net Income / Average Shareholders' Equity) * 100

You can find net income, also known as net earnings, on a company’s income statement, which is a financial statement required in an annual 10-K SEC filing. Shareholders’ equity appears at the bottom of a company’s balance sheet, which is also in the 10-K report.

Table 4-3 shows a simplified example of Home Depot’s 2003 financial statements, created with data obtained from the Home Depot web site (http://www.homedepot.com). First, identify net income near the bottom of the income statement (listed as Net Earnings in this case).

Table 4-3. Home Depot financial statements

|

Income statement (in millions) |

Balance sheet (in millions) |

|---|---|

|

NET SALES 58,247 Cost of Merchandise Sold 40,139 GROSS PROFIT 18,108 Total Operating Expenses 12,278 OPERATING INCOME 5,830 Interest Income (Expense): Interest and Investment Income 79 Interest Expense (37) Interest, net 42 EARNINGS BEFORE PROVISION FOR INCOME TAXES 5,872 Provision for Income Taxes 2,208 NET EARNINGS 3,664 |

ASSETS Total Current Assets 11,917 Property and Equipment, at cost 20,733 Less Accumulated Depreciation & Amortization 3,565 Net Property and Equipment 17,168 Notes Receivable 107 Other Assets 244 TOTAL ASSETS 30,011 LIABILITIES AND STOCKHOLDERS’ EQUITY Total Current Liabilities 8,035 Long-Term Debt, excluding current installments 1,321 Other Long-Term Liabilities 491 Deferred Income Taxes 362 STOCKHOLDERS’ EQUITY Common Stock, par value $0.05; authorized: 10,000 shares, issued and outstanding 2,362 Shares at 2/ 2, 2003 118 Paid-in Capital 5,858 Retained Earnings 15,971 Accumulated Other Comprehensive Loss (82) Unearned Compensation (63) Treasury Stock, at cost, 69 shares at 2/ 2, 2003 (2,000) Total Stockholders’ Equity 19,802 |

Then, look at the balance sheet and find shareholders’ equity at the very bottom. Home Depot calls it Total Stockholders’ Equity.

Using the formula in Example 4-31, you can calculate Home Depot’s ROE.

Example 4-31. Calculating Home Depot’s ROE

Home Depot's ROE = $3,664 / $19,802

= 0.185 or 18.5 percentHome Depot’s ROE is 18.5 percent, and you might be thinking “So what?” Think about the value of your home, your portfolio, or your business. If you were to increase its value by 18.5 percent in a year, you would be doing quite well. That’s a much better return than you would receive from a bank savings account, for instance.

Some professional investors invest only in companies with a ROE higher than 15 percent. This guideline assures that company management has so far been effective in building up the value of their company. Home Depot exceeds this by a comfortable margin.

As with many other financial ratios, you can learn more about a company by comparing its ROE to its historical trends, as well as to other companies in the same industry. First, take a look at how Home Depot’s recent results compare to its past.

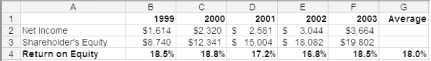

In a spreadsheet, it’s easy enough to calculate ROE for the past five years, as shown in Figure 4-11. EdgarScan (http://edgarscan.pwcglobal.com) is a good source of historical SEC filings already formatted in Excel spreadsheets. Simply isolate net income and shareholders’ equity from each annual 10-K filing and add the ROE calculations, as shown in Examples Example 4-32 and Example 4-33.

Example 4-33. Excel function for the five-year average ROE

5-year Average ROE (cell G4) = AVERAGE(B4:F4)

Tip

In Figure 4-11, the formula in cell B4 was copied to cells C4 through F4. The cells are formatted as a percentage to one decimal point.

With these calculations, you can evaluate Home Depot’s past performance in detail. The company’s ROE has been fairly stable over the past five years. The company recovered from a downward trend in 2001 and 2002, which is a good sign. It’s not unusual to see some fluctuation in ROE from year to year, but well-managed companies produce fairly stable results over the long term. Steadily rising ROEs are desirable, but that can’t go on forever. Eventually a company’s ROE will stabilize or start to fall slightly, which might not be negative if a company is maturing or receding from extraordinary performance levels.

Calculating a company’s long-term average ROE can help smooth out short-term fluctuations and help you evaluate the stability of the ROE. Home Depot’s most recent results exceeded its five-year average, which is what you want to see. If ROE declines for three or more consecutive years, you should research the company to understand the reasons for the fall. For example, cyclical companies by their nature see lower earnings as they reach the bottom of their cycle, so their ROEs trend up and down with the economic cycle.

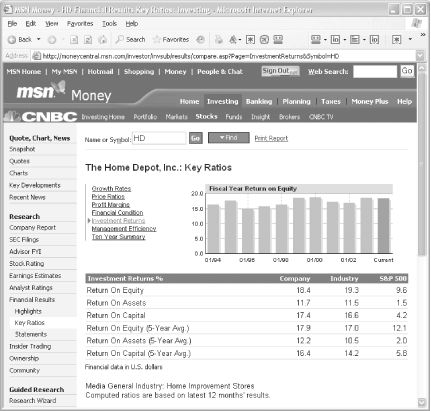

ROE is another measure that you should compare within a company’s peer group. The MSN Money web site (http://money.msn.com) calculates return on equity for you, and shows average ROE for the company’s industry and the overall market. Enter the ticker symbol of the stock that you’re studying and click Go. On the stock page, click Financial Results, then Key Ratios in the navigation bar, and then click the Investment Returns link, as shown in Figure 4-12.

In Figure 4-12, you’ll notice a ten-year chart of a company’s ROE where it’s easy to see that the company’s management has been doing its job well. In the table below the graph, you can also see that MSN Money calculates Home Depot’s 2003 ROE as 18.4 percent. Small differences between this figure and the number calculated from SEC filings is likely due to rounding. Home Depot’s ROE is somewhat below the industry average of 19.3 percent, but it’s well above the S&P 500 average of 9.6 percent and the ROE guideline of 15 percent.

The Return On Equity (5-Year Avg.) a few lines down in the table is more telling. Here, Home Depot’s performance is even better with an average ROE of 17.9 percent compared to the industry’s 17.0 percent, and 12.1 percent for the S&P 500.

Because ROE only compares net income to shareholders’ equity, a company that has raised working capital from bonds and borrowing might show a higher return on equity than a competitor without being any more effective at putting the shareholders’ equity to work growing the company. Return on assets can help you understand how well a company uses debt as well as shareholders’ equity.

You’ll find a company’s total assets on its balance sheet and can calculate ROA, as shown in Example 4-34.

Using the data from Home Depot’s financial statements in Table 4-3, you can calculate its ROA, as shown in Example 4-35.

Example 4-35. Calculating Home Depot’s ROA

Home Depot's ROA = $3,664 / $30,011

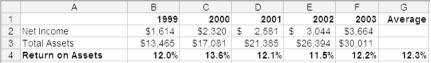

= 0.122 or 12.2 percentProfessional investors won’t often consider stocks with ROA lower than 5 to 8 percent, so Home Depot’s management has exceeded that standard. As with ROE, you should evaluate trends in ROA, and compare a company’s ROA to its competitors and the market in general. A stable ROA over the years indicates that management is effectively managing its total resources to generate profits for the company. Looking at Home Depot’s history in a spreadsheet (see Figure 4-13), you can see that the company’s ROA has been consistent over the past few years.

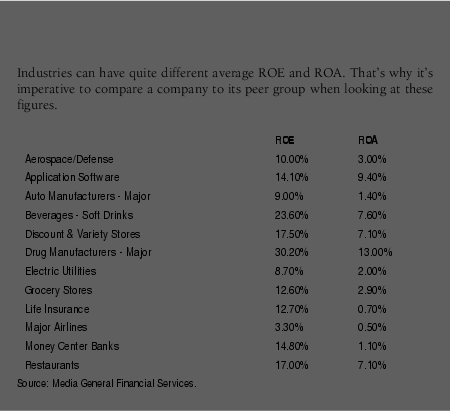

ROA varies significantly by industry, as shown in the sidebar on industry average ROE and ROA. An automobile manufacturer requires a huge amount of assets—factories, materials, and parts—to build those SUVs that are so popular. Software companies, on the other hand, don’t need big manufacturing plants to turn out their products—after they develop a program, they just stamp out software CD-ROMs, package them, and ship them to customers. They might even outsource those tasks to reduce the employees and buildings they need.

To compare Home Depot’s 12.3 percent average ROA to the industry, refer to MSN Money. Figure 4-12 shows that the company’s ROA is better than the industry average of 10.5 percent and worlds better than the 2.0 percent average of the S&P 500.

—Douglas Gerlach

Get Online Investing Hacks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.