Although short-term traders have dozens of technical analysis software programs from which to choose, long-term investors have only a few fundamental analysis applications that help evaluate stock fundamentals.

Fundamental analysis evaluates the underlying performance of companies to find stocks that should do well over the long term. By investing in growing companies that are managed well, compare favorably to the competition, and are selling at a reasonable price, fundamental investors make money as stock price grows along with company earnings. Fundamental analysis programs churn through numbers from company financial statements to present historical performance. Then, it’s up to you to evaluate company history and forecast how the company will do in the future. Some software applications use your estimates and judgment to calculate future prices and potential return. Here’s a review of the contenders.

The National Association of Investors Corp. (NAIC) is a nonprofit investment education organization that teaches a long-term approach to investing in stocks. Their primary analysis tool, the Stock Selection Guide (SSG), was developed in the 1950s but still works well today. Of course, for decades the SSG was purely a pencil and paper tool, but that all changed in the 1980s as personal computers became popular.

Today, NAIC offers four separate fundamental analysis programs for Windows: NAIC Classic, Investor’s Toolkit, NAIC Stock Analyst, and Take Stock. Although the programs share a common approach to stock analysis using the SSG, each offers features and functions geared to investors at different levels of experience. These programs are not black boxes. They depend on input from the user to reach a conclusion about a stock’s suitability as an investment.

No matter which NAIC program you use, the software helps you evaluate a company’s past revenue and EPS growth and the quality of management through pre-tax profit margins and return on equity. After you add your EPS projections for the next five years, you can examine the stock’s past P/E ratio trends and assess the range of P/E ratios at which the company might sell in five years. Multiply these future P/E ratios and your EPS projections to calculate a range of five-year projected prices. By comparing these future high and low prices to the current price, you can determine a good buy price as well as the potential total return if you buy the stock at the current price and the potential downside if the company doesn’t perform to your expectations.

Each of the programs integrates NAIC’s Online Premium Services (OPS) data [Hacks Section 3.4 and Section 3.9]. OPS includes more than 400 data fields—nearly all the data necessary for completing a stock study using the software, including up to ten years of annual data and five years of monthly prices and quarterly results. Using the software programs, you can easily download data as long as you’re connected to the Internet, making it one of the easiest ways to collect data for fundamental analysis. In addition, you can use data files from the American Association of Individual Investors [Hacks Section 3.4 and Section 3.9].

NAIC Classic is primarily a teaching tool. The program features the Stock Wiz, an animated figure who guides you step-by-step through a stock study. After you’ve mastered the techniques used in the program, you can change from Beginner to Experienced mode and bypass the Wiz’s escort. NAIC Classic Plus adds portfolio management tools; the Plus module is available as an add-on to the original software, or you can purchase the enhanced version all at once.

NAIC Take Stock is another tool that teaches beginners how to analyze stocks. The program guides investors through the steps of investment analysis. A beginner can tackle one concept at a time until he is comfortable with the entire process.

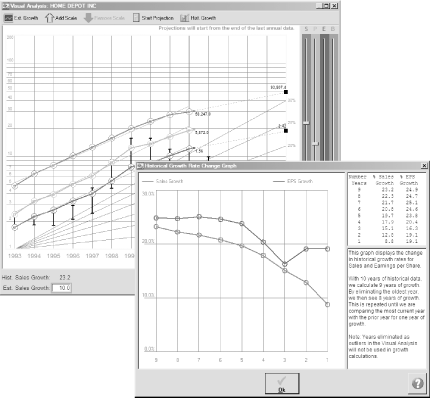

Investor’s Toolkit, NAIC’s most widely used program, also uses the Stock Selection Guide as the backbone of its stock analysis. Toolkit incorporates several more features than Classic. For example, additional graphs plot a company’s past pre-tax profits and P/E ratios, as illustrated in Figure 4-32, and the Judgment Audit function points out potential problems in your analysis. Investor’s Toolkit Pro includes portfolio management features, such as the Stock Comparison Guide, the Portfolio Management Guide, the Portfolio Evaluation and Review Technique charts and graphs, and portfolio reports. As with NAIC Classic Plus, the Pro version is available as an upgrade, or you can purchase the complete edition right away.

The program ships with a directory of stock research sites already configured in the software so that you can find more information at Yahoo! Finance or Quicken with just one click as you study a stock. You can add your own favorite sites to the list, as well.

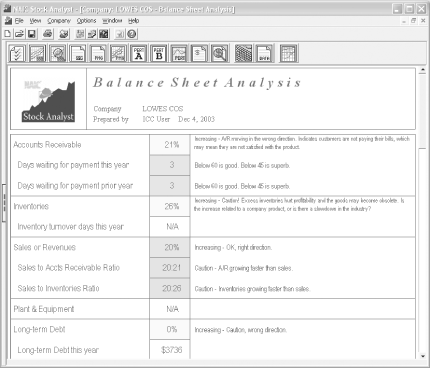

NAIC Stock Analyst adds even more advanced features to those included in NAIC Classic and Investor’s Toolkit. The program includes analytical functions, such as a review of historical debt-to-equity ratios. The balance sheet report, shown in Figure 4-33 [Hack #44] , [Hack #43] , or other industries that report financial results in a slightly different format.

Figure 4-33. NAIC Stock Analyst features a balance sheet report that lets you dig deeper into a company’s fundamentals

Downloadable demo versions of all NAIC programs, as well as purchase information, are available at http://www.better-investing.org. In the left navigation bar, click NAIC Store and then click NAIC Software. An Adobe Acrobat file comparing the three programs is also available at the developer’s web site, ICLUBcentral (http://www.iclub.com/downloads/compare.pdf). In addition to the differences in the functions available in each program, the user interfaces are also quite different. The best way to choose is to evaluate each program and then decide which software best fits your way of working. Prices for the three programs range from $49 to $149, depending on the version you select.

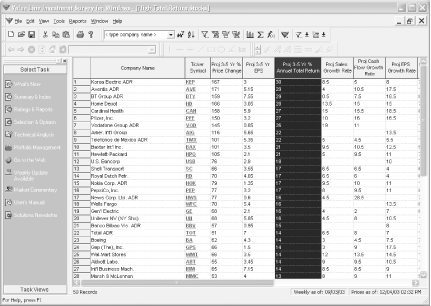

Although the Value Line Investment Survey is known primarily for its printed advisory service, the company also offers the Value Line Investment Analyzer, as shown in Figure 4-34, which provides an electronic version of data and analysis for Windows for all 1,700 stocks covered by the standard version of the Value Line Investment Survey. With this software, users can screen and sort stocks and industry groups, as well as access all the text for Value Line analyst reports and recommendations. An optional Small and Mid-Cap edition adds another 1,800 companies, albeit in less detail.

Figure 4-34. The Value Line Investment Analyzer is a warehouse of data with a variety of analysis checkpoints

The Investment Analyzer provides 350 search fields for each stock, 60 charting and graphing variables, and 10 years of historical financial data. The portfolio management module enables you to create and track stock portfolios and update prices via the Internet. If you use any technical indicators in your stock analysis, the software can also create 60 different technical indicators and 20 different charts.

One drawback to Value Line’s product is its cost; it ranges from $595 to $995 for a yearly subscription, which includes regular online data updates. A three-month trial is available at http://www.valueline.com.

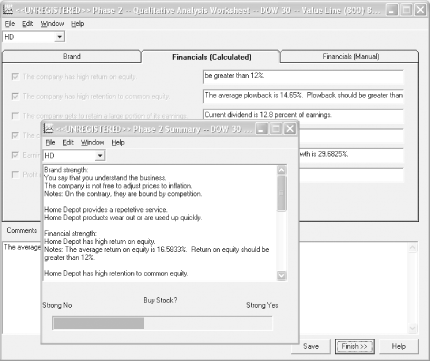

If you believe that successful investing is largely based on knowing the right questions to ask, then Expert Investor might be worth a look. This low-cost ($25) Windows application looks at qualitative and quantitative factors to determine a fair value for a stock. The program starts by prompting you to enter up to 18 years of historical financial data for a company. Based on the growth of earnings or equity, it ascertains a fair value for the stock and suggests whether the stock is a weak or strong candidate for investment. Then, it prompts you to consider the company’s products and brand value, along with your level of understanding of the business, as demonstrated in Figure 4-35. It calculates several financial ratios and makes a final assessment of the company’s potential. You can download a demo or buy a copy of Expert Investor at http://www.fullertonsoftware.com.

AAII’s Stock Investor Pro for Windows (http://www.aaii.com) is primarily a screening tool and data service with monthly updates provided on CD-ROM, but it also incorporates analytical functions.

SharePricer (http://www.sharepricer.com) is another low-cost fundamental stock analysis program. Although it is developed in Finland, it is compatible with U.S. stocks and can retrieve data from Yahoo! Finance.

—Douglas Gerlach

Get Online Investing Hacks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.