Chapter 1. Why Should You Invest?

Buying this week’s groceries might set you back $50 or more. As long as you live within your means, you can pay not only for your groceries, but also for your rent, utilities, and other expenses out of your paycheck. But how do you pay for living expenses when you aren’t getting a paycheck—when you retire, in other words? (If you think you can live on Social Security, think again.) And what about your dream of seeing the lights of your life, Pooter and Scooter, graduate from top-notch universities? And don’t forget that 20th-anniversary around-the-world cruise you and your partner fantasize about. All this is gonna take some moola—and probably a lot more than you expect.

For example, say you spend $40,000 a year on living expenses and you expect to enjoy 30 years of retirement spending at that same level. You do the math and reel in horror when you realize that you need $1,200,000 for your retirement. If you earn $50,000 a year, spend $40,000 on expenses, and save the remaining $10,000 in your mattress for 30 years, you’ll have, er, $300,000. You’re a whopping $900,000 short.

But it turns out that you’re a lot further from your goal than that. You’ve probably heard of inflation, that nasty tendency of prices to go up a little bit each year—on average about 3.4%. That doesn’t sound like much, but it adds up over time, as you’ll learn in this chapter. For example, by the end of your 30-year retirement, with 3.4% inflation, your $40,000 in living expenses will actually cost about $105,476, and the price tag for your 30 years of retirement is more like $2,030,000.

Lottery tickets don’t cut it. The returns from savings accounts, certificates of deposit, and other savings options rarely beat inflation, so you simply can’t save enough to pay for everything you need or want. What can you do? Fight back by investing your money instead of stashing it in your mattress.

When you invest your money, your savings work harder. The return on a diversified portfolio of stocks and bonds averages about 7%. That not only beats inflation, it shoots growth hormones (all organic) into your nest egg. Invest that $10,000 savings per year and earn 7%, and you’ll have almost a million dollars after 30 years, instead of $300,000. Still not as much as you need, but you’ll learn how to make ends meet by the time you finish reading this book.

Tip

As you’ll learn in this chapter, investing isn’t necessary to meet the demands of short-term goals—say those within the next 5 years (a vacation, sprucing up the bathroom, or buying a new sofa). That’s because inflation doesn’t have a chance to bloat the prices you pay. For these goals, savings options are fine. Just find a money market account, savings account, or certificate of deposit that pays a generous rate of interest. You can see a list of online resources on the web page for this book at www.missingmanuals.com/cds.

How Inflation Hurts

Forty years ago, mailing a letter cost 6 cents and a loaf of bread ran about 25 cents. Today that stamp costs 44 cents, and a loaf of whole wheat bread fetches almost $3. Big deal, that’s only 38 cents extra for the stamp and a couple of bucks more for the bread. But that steady and seemingly trivial increase in prices, called inflation (as if price tags slowly inflate like balloons), is a big deal. Here’s why.

Tip

You can find links to all the websites mentioned in this book on the book’s Missing CD page. To get there, go to the Missing Manuals home page (www.missingmanuals.com), click the Missing CD link, scroll down to Personal Investing: The Missing Manual, and then click the link labeled “Missing CD.”

Inflation in the United States runs, on long-term average, 3.41% a year (http://tinyurl.com/5m2snb). That means that the prices you pay go up about 3.41% each year. This year’s weekly $100 grocery bill will cost you $103.41 next year.

Note

It’s good for a laugh with the bean-counter crowd, but economists go on a shopping spree to figure out the inflation rate. Their shopping list, aka the Consumer Price Index (CPI), includes everything the average person spends money on—housing, transportation, groceries, clothes, medical care, education, utilities, fun, and so on. They gather prices from 50,000 households and 23,000 stores around the country. They tweak the list based on the importance of the items. (People can’t cut back much on housing and heat, even if the prices go up, but they might rein in their spending on entertainment.) Finally, the economists compare each price to what they paid the year before, average all the price changes, and calculate the percentage that the total bill went up or down. (It almost always goes up.)

But inflation’s small increases recur year after year. And each year’s increase expands the previous year’s increase (a process known as compounding, explained in detail on Why Scary Numbers Aren’t That Scary), so the increases get bigger and bigger over time. Those groceries that went up $3.41 the first year, increase by $3.53 the second year, $3.65 the third year, and so on. After several decades, inflation adds up to serious money, especially for big-ticket items like annual living expenses in retirement, as you’ll soon see.

With each year of inflation, a dollar’s buying power (what one dollar can buy) decreases, so you need more dollars to pay your bills. But the salary increases you get might not keep up with inflation, in which case your buying power falls further behind year after year. If you struggle to make ends meet now, it just gets harder as time passes.

Note

The average wage increase from 1998 to 2008 was 4%, according to the Social Security Administration. Their Wage Index web page (http://tiny.cc/gaqx0) shows historical wage increases by year. But lots of people receive wage increases that are lower than the inflation rate.

What’s really scary is that many things you save for go up even faster than inflation, like the ones shown below. Even big-ticket items that increase at the same rate as inflation, like your retirement living expenses, can expand to really scary numbers, like $184,192 for 1 year’s expenses in the year 2050 (see the table below).

Goal | Average cost in 2009 | Cost in 20 years | Cost in 40 years | |

Stamp | $0.44 | 4.85% | $1.13 | $2.93 |

Assisted living facility for a year | $33,900 | 4.72% | $85,269 | $214,479 |

Private room in a nursing home for a year | $74,000 | 4.27% | $170,772 | $394,100 |

Public college | $30,500 | 6% | $97,817 | $313,714 |

One year’s retirement living expenses | $50,000 | 3.41% (average inflation rate) | $94,376 |

Why Scary Numbers Aren’t That Scary

There’s no question that more than $300,000 for a college education and almost $400,000 for a year at a geriatric resort are scary numbers. It turns out that time and compounding, your enemies when it comes to inflation, are your best friends when you invest to achieve long-term goals. With timeframes like 18 years until your newborn heads to college or 40 years until you retire, investing your money to take advantage of compounding returns can cut scary numbers down to size. You don’t have to save a bazillion dollars. You squirrel away a much smaller amount and let your investment returns do the heavy lifting over the decades.

How Investing Makes Your Money Work Harder

With inflation’s 3.41% price increases compounding year after year, figuring your expenses produces some galactic numbers. Sadly, you can’t choose whether to accept the compounding of inflation. But what if you could use compounding to inflate the money you save? It turns out that you can, by investing your money and reinvesting all your earnings. You can choose the compounding of the returns you earn on your money, so it’s important to understand just how powerful this strategy is.

True, investment returns aren’t as steady as the inflation rate. (The Red Zone tells you how to reduce the risk of varying investment returns.) Some years are better than others, and some years are downright dogs. But for now, assume that your investments increase 7% each year (that’s the return most financial planners tell their clients they can expect on a diversified investment portfolio). Say you seed a retirement account with $10,000, as the table below shows. If you earn 7% the first year, you’ll have $10,700 at the end of the year.

The second year, you earn $749 (7% on $10,700) and end up with $11,449. If you earn 7% each year for 40 years (from the time you start working until you retire), you’d have almost $150,000! That’s $140,000 of earnings on a single $10,000 investment.

Year | Ending balance | Annual return | Cumulative return |

1 | $10,000 | $700 | $700 |

2 | $10,700 | $749 | $1,449 |

3 | $11,449 | $801 | $2,250 |

4 | $12,250 | $858 | $3,108 |

5 | $13,108 | $918 | $4,026 |

39 | $139,948 | $9,796 | $139,745 |

40 | $149,745 | $10,482 | $150,227 |

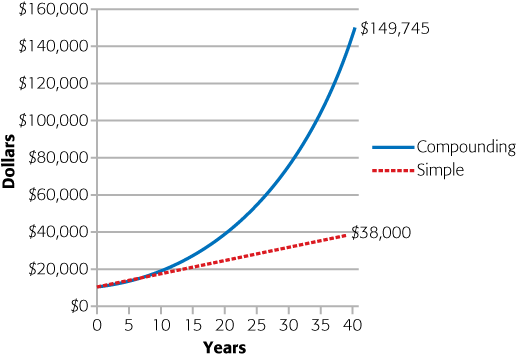

On the other hand, what if you invested $10,000 and earned 7%, but withdrew each year’s earnings? (That return is called simple interest, because you earn the same amount on your original investment each year.) You’d earn $700 each year for 40 years, for total earnings of $28,000 on your original $10,000 investment. By letting your investment returns compound, your total earnings are five times what you’d earn with simple interest. The graph below shows how your nest egg grows like wildfire when you compound your earnings.

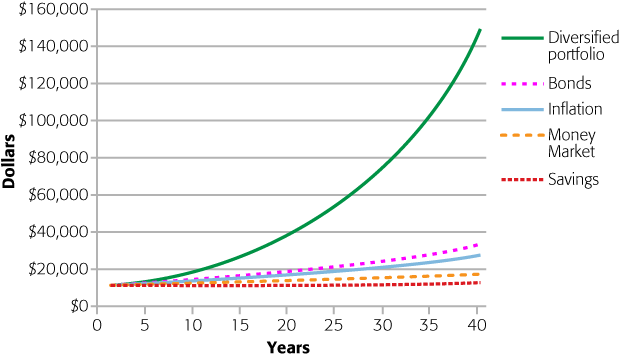

As you’ve seen with inflation, compounding is a powerful force, even when the rate is small. But this technique really shines when you earn higher returns, like the 7% from a diversified portfolio, and give your portfolio time to mature. The graph below shows how a $10,000 nest egg grows when you put your money in diversified investments, bonds, money market funds, and savings accounts. Compare the line for inflation to see how investing can help you beat the steady rise in prices.

You can see below how investments start to take off after 15 years. That’s compounding at work, and that’s why it’s important to start investing for long-term goals as early as you can.

Investing for the Long Term

Although well-diversified investing works like magic when you give it time, it doesn’t make sense for short-term goals. That’s because you have to accept some risk to earn higher returns. Investments in the stock market can decrease during a single year—and do so every several years. The good news is that the risk of losing money decreases the longer you keep your money invested (think decades).

During recessions, the stock market can really tank, like the almost 50% drop it suffered in 2001. You wouldn’t want to see half your nest egg go away the year before you retire. However, since 1929, the average annual return on stocks is more than 10% despite battering from the Great Depression and several recessions.

Besides, a diversified portfolio isn’t invested solely in the stock market, as you’ll learn in Chapter 9. By investing in stocks, bonds, and real estate, you won’t see drops as big as the ones for stocks alone. Chapters Chapter 9, Chapter 10, and Chapter 11 also tell you how to move money that you need in the next few years into ultra-safe savings so it’s around when you need it.

Lots of folks would rather be certain of having a small amount of money than worry about whether a large nest egg might falter right when they need it. You might think that putting money into a guaranteed money market account means you won’t lose money. Think again. If your money doesn’t keep up with inflation, you lose buying power, which is the same as losing money.

Get Personal Investing: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.