Time Horizon—What Is It?

Understanding what an appropriate time horizon is ties into my Chapter 1 point that people often think about their investing future in chopped up phases. Investors often believe they have one time horizon that ends when they retire or start taking cash flow or hit some other milestone, then they enter a new phase. Many investors think this way: “I’m 55. I plan to retire at 65. That means I have a 10-year time horizon.” In my view, this is harmful thinking that potentially cuts you off at the knees.

Rather, your time horizon is how long you need your assets to work toward your objectives. For most investors, this is their entire lives. If you don’t want to risk the ire of your spouse and prefer he/she remembers you fondly (and not with crass epithets), include his/her lifetime, too—particularly if your spouse is younger and/or healthier.

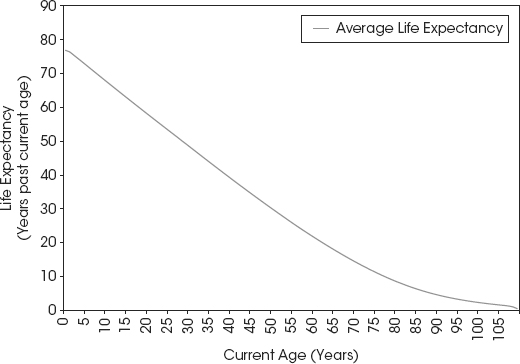

Figure 4.1 is a good start in thinking about time horizon. It’s basic US life expectancy, produced by IRS actuaries. The x-axis shows current age, and the y-axis shows average life expectancy. So if you’re 30, average life expectancy is another approximately 48 years (i.e., 78 years old). If you’re 70, average life expectancy is another approximately 14 years (i.e., 84).

Figure 4.1 Life Expectancy—Keeps Getting Longer

Source: Internal Revenue Service, Publication 1457 (Rev. 5-2009), Table 2000CM.

And keep in mind, this ...

Get Plan Your Prosperity: The Only Retirement Guide You'll Ever Need, Starting Now--Whether You're 22, 52 or 82 now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.