Time Horizon and Benchmark

Why the heck is time horizon so important? Very generally, the longer the time horizon, the more a bigger allocation of equities likely becomes appropriate in your benchmark.

This isn’t to say time horizon is the only deciding factor. No! That would be akin to saying age is the only factor. But it is key. It must be considered alongside and in concert with return expectations, cash flow needs and other factors. But a longer time horizon means investors have more time to grow beyond near-term equity volatility.

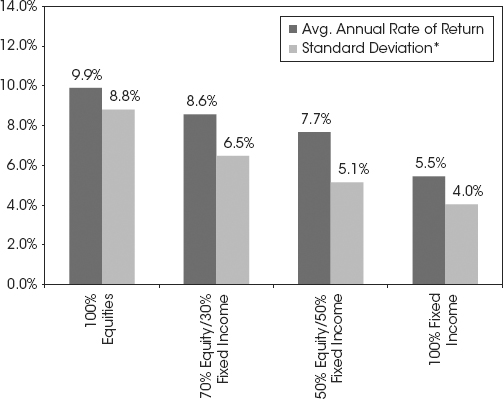

A fact that shocks no readers: Over short time periods, equities are generally more volatile than bonds. Figure 4.2 shows standard deviation (a common measure for volatility) and average annual rates of return over five-year rolling periods for a 100% equity allocation, a 70% equity/30% fixed income, a 50/50 and a 100% fixed-income allocation.

Figure 4.2 Five-Year Time Horizon—Volatility

Source: Global Financial Data, Inc., as of 06/22/2012. US 10-Year Government Bond Index, S&P 500 total return, average rate of return from 1926 through 12/31/11.2

* Standard deviation represents the degree of fluctuations in historical returns. This risk measure is applied to five-year annualized rolling returns in the chart.

Get Plan Your Prosperity: The Only Retirement Guide You'll Ever Need, Starting Now--Whether You're 22, 52 or 82 now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.