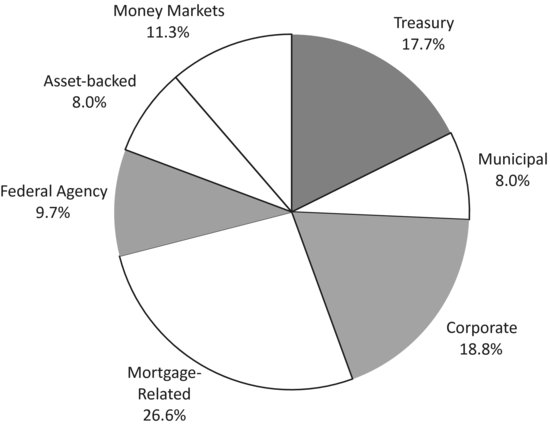

THE WIDER U.S. BOND MARKET

At the end of 2008, the U.S. bond market encompassed securities with a total market value of $33.5 trillion (or $33,500 billion) according to the Securities Industry and Financial Markets Association.4 Figure 7.5 shows the breakdown of fixed income securities as of the end of 2008. U.S. Treasury securities represent only 17.7 percent of the U.S. market. Municipal bonds (issued by local as well as state governments) represent 8.0 percent of the market, while corporate debt represents another 18.8 percent. Mortgage-related securities, 26.6 percent of the market, include those issued by the government agencies Fannie Mae and Freddie Mac as well as collateralized mortgage obligations (CMOs). Federal agency securities, 9.7 percent of the market, are non-mortgage obligations of agencies like the Federal Farm Loan Mortgage Corporation and the Student Loan Marketing Association. Money market securities and asset-backed bonds round out the rest.

FIGURE 7.5 U.S. Bond Market in 2008

Source: Securities Industry and Financial Markets Association, 2009.

The relative importance of Treasury bonds has declined over time because other bond markets have grown more rapidly. Part of this growth is due to financial innovation that has led to the securitization of assets that were previously held in bank balance sheets such as mortgages and commercial loans. Figure 7.6 shows ...

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.