BOND MARKETS OUTSIDE THE UNITED STATES

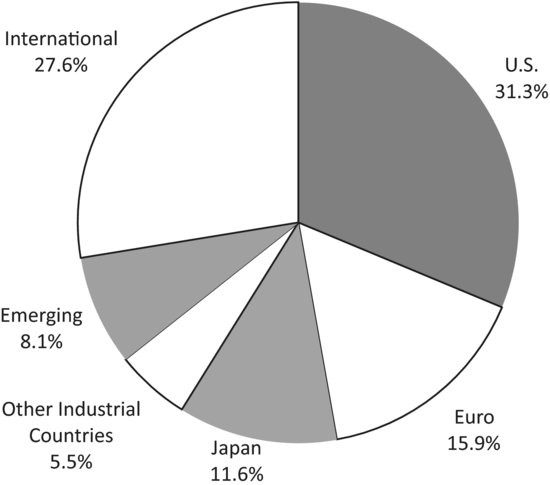

The world’s bond markets have grown enormously in the last few decades. According to the Bank for International Settlements, the total value of all bonds outstanding as of September 2008 was $82.5 trillion.10 This compares with a market capitalization of $54.2 trillion for the world’s stock markets (at the end of 2007). The relative size of the world bond markets is shown in Figure 7.9. The U.S. bond market represents 31.3 percent of this total capitalization. But there are also major bond markets in the Euro area, Japan, and other industrial countries. All together, these national bond markets represent another 33.0 percent of the world market. The bond markets of the developing (or emerging market) countries add another 8.1 percent to the world’s total. The remaining 27.6 percent are international bonds.

FIGURE 7.9 World Bond Markets, 2008 (Total Size of the World Bond Market in 2008 = $82.5 trillion)

Source: Bank for International Settlements, 2009.

In addition to traditional national bond markets, there are parallel bond markets called international bond markets where most investors are offshore investors, but where borrowers can be from any country including the United States. Take the example of a U.S. dollar international bond issued in London by an American company with American and foreign underwriters and investors who are predominantly ...

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.