EXPANDING THE PORTFOLIO TO INCLUDE FOREIGN STOCKS

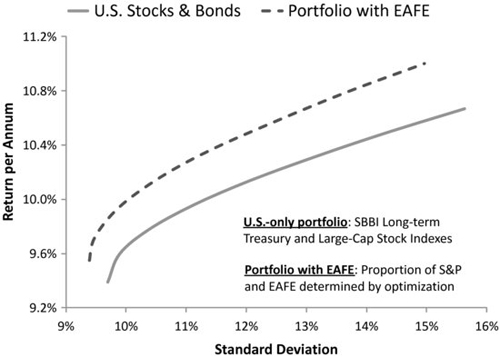

How does the efficient frontier shift if foreign equities are added to the portfolio? Figure 8.4 adds the MSCI EAFE index to the original mix of Treasury bonds and the SBBI Large Company index. The EAFE index begins only in January 1970, so the portfolio optimization is done only over the period since then. Figure 8.4 shows two alternative sets of portfolios. One is defined for the U.S. stocks and bonds alone. The second is defined for a mix that includes the EAFE index.

FIGURE 8.4 Addition of Foreign Stocks to U.S. Portfolio, 1970–2009

Data Sources: ©Morningstar, MSCI, and S&P.

The results are encouraging. Expanding the menu of assets to include foreign stocks lowers risk at any given level of return. That’s because the correlation between EAFE and the large-cap U.S. stock index is relatively low at 0.60 over this sample period.4 Consider the portfolios on these two frontiers consisting of 70 percent in stocks and 30 percent in bonds. For the 70/30 portfolio on the original frontier, the return is equal to 10.1 percent with a standard deviation of 12.1 percent. For the 70/30 portfolio on the enhanced frontier, the return rises to 10.4 percent with a standard deviation 0.7 percent lower at 11.4 percent. The Sharpe ratio of the 70/30 portfolio that includes EAFE is 0.42 compared with a Sharpe ratio for the U.S.-only portfolio (on ...

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.