REAL ESTATE INVESTMENT TRUSTS

Real estate investment trusts, or REITS, were developed in the early 1970s as a liquid alternative to direct ownership of real estate. REITS own, and in most cases operate, income-producing real estate such as apartments, shopping centers, offices, hotels, and warehouses. REITS are corporations that invest in real estate but are set up to pay little or no corporate income tax.3 To qualify for tax exemption, the REITS must distribute 90 percent of their income each year to investors. REITS may be publicly or privately held just like other corporations. Publicly traded REITS typically trade on stock exchanges such as the NYSE and NASDAQ.

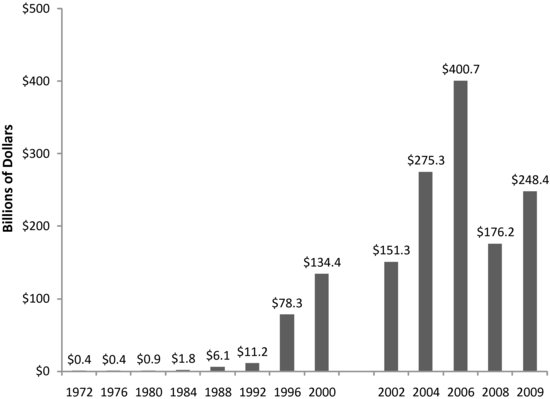

Prior to the 1990s, the total capitalization of the REIT sector was less than $10 billion. But in the early 1990s, long-established real estate operating companies began to package properties they owned into REITS. This led to an IPO boom that sharply increased the REIT sector. Figure 11.3 tracks the growth of the REIT market from 1972 to 2009 using data from the National Association of Real Estate Investment Trusts (NAREIT).4 In 1992, REITS totaled only $11.2 billion, but that total rose to $78.3 billion four years later and to $400.7 billion in 2006.

Since REITS are stocks, it’s also interesting to compare them with the stock market itself. As of 2004, REITS ...

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.