3.4 REGULAR PROCESSING

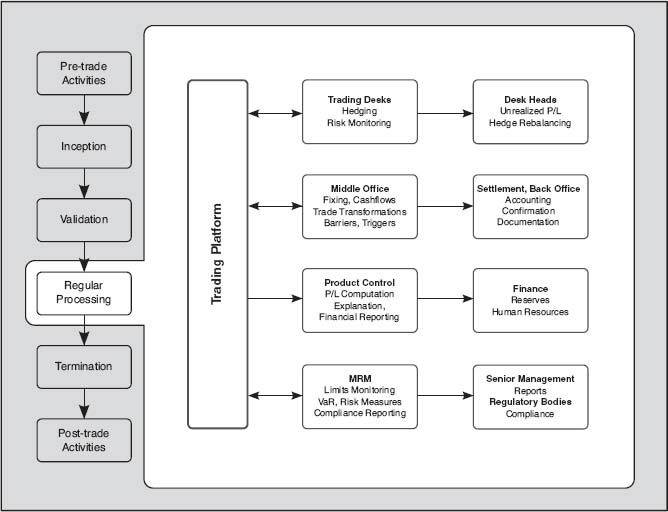

The next destination in the trade workflow is again the middle office, specifically the market risk management and product control professionals (see Figure 3.4). They handle a large number of processes on a regular basis after the trade is booked in the system. They monitor the trades at a per-trade level basis as well as at the portfolio level.

Product control worries about the trade valuations every day. They worry about the daily profit and loss movements both at the trade and portfolio levels. They also modulate the profit claims by the front office through a reserving mechanism and come up with the so-called unrealized P/L. The unrealized P/L has a direct impact on the compensation and incentive structure of the front office in the short run, which may explain the perennial tussle over the reserve levels.

Figure 3.4 Regular processing during the life of a trade. The FO trading desks monitor their trades for performance and hedging. The MO life-cycle management team keeps track of rate fixings and cash flows, and monitors triggers, barrier breaches and termination events. The product control unit studies the P/L in conjunction with finance. They pass on reserve and unrealized profit to finance and human resources for compensation incentives. The market risk management deals with VaR and limit monitoring on a daily basis, and may handle regulatory and ...

Get Principles of Quantitative Development now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.