3.6 TERMINATION AND SETTLEMENT

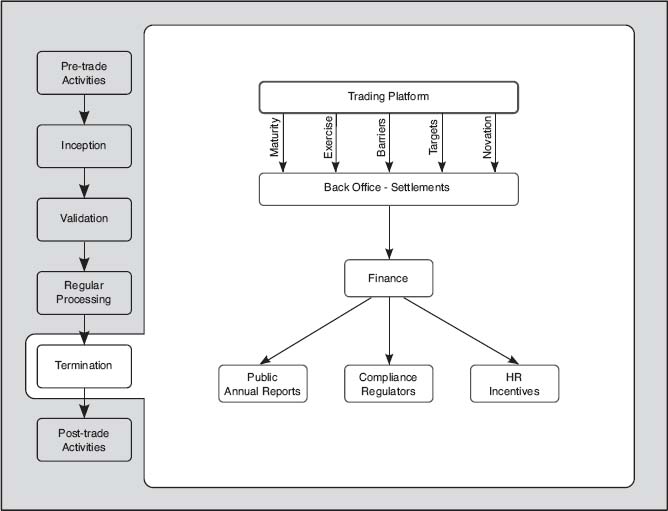

Settlements (cash and/or asset exchanges between counterparties) can take place during the life of a trade or at its termination (see Figure 3.5). In swap kinds of trades (interest rate swaps, for instance), there are net cash flows at regular intervals as specified in the contract. These cash flows are computed in the trading platform and settled by the relevant back-office team. The settlement takes place after a delay, as specified in the contract or term sheet. The settlement delay is usually two business days for most asset classes, but it can be longer for some commodity trades, for instance.

Figure 3.5 Trade termination events and settlement processes and activities

A trade may terminate in a variety of ways:

- Normal termination at maturity. In the case of noncancellable, noncallable swaps, the trade lasts till its maturity. In addition to any periodic cash flows, the trade may have a final settlement as well. For an option, the termination at maturity does not involve settlement if it matures out of the money.

- Exercises. When an option is exercised, it generates a settlement trigger. Depending on the nature of the option, the exercise may or may not coincide with the maturity of the trade. A European option, if in the money, is exercised only at maturity. If it is out of the money, it matures worthless. American options, on the other hand, ...

Get Principles of Quantitative Development now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.