6.3 EXAMPLE ARCHITECTURE

We have looked at the various components that make up a trading platform. In fact, we looked at these components as business processes at first, focusing on their role in the trade life cycle. Later, we looked at the way in which various business units viewed these processes. Finally, in this chapter, we looked at them again as program modules, exploring various implementation strategies, still staying at a level high enough to ensure generality.

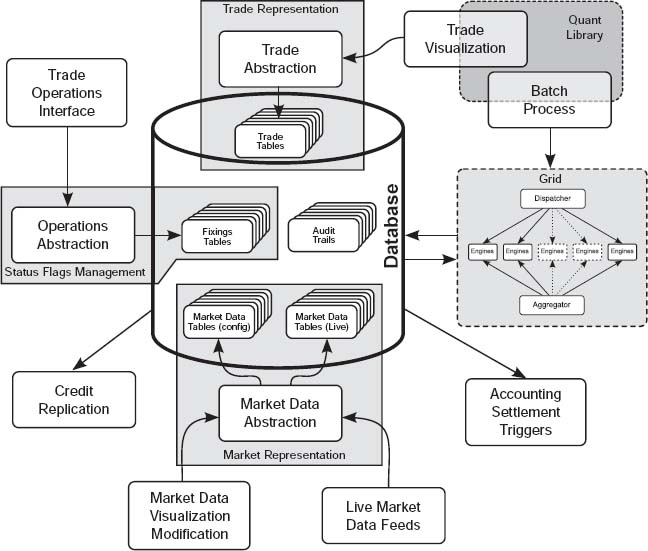

Figure 6.4 An example architecture of a trading platform. This example puts together all the facets of a basic trading platform that we have explored so far

We are now ready to put these modules together and look at the overall architecture of a typical trading platform, as in Figure 6.4. At first glance, this architecture may look dauntingly complex, but a closer inspection will reveal that every component in the architecture is, in fact, familiar. The top right corner, for instance, depicts the quant library, which forms the backdrop of the batch processing (computing mark to market values, value at risk, sensitivities, etc.) and the trade visualization (the interface that traders use to input trade parameters and inspect them). Indeed, it is the rapid deployment of the mathematical intelligence in the quant library that is the basic raison d'être of the in-house trading platform.

What may be surprising about ...

Get Principles of Quantitative Development now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.