Introduction

Thousands of small companies and nonprofit organizations turn to QuickBooks to keep company finances on track. And over the years, Intuit has introduced editions of QuickBooks to satisfy the needs of different types of companies. Back when milk was simply milk, you either used QuickBooks or you didn’t. Now that milk comes from soy beans as well as cows, and sports five different amounts of fat, it’s no surprise that you can choose from QuickBooks Simple Start, Pro, Premier, Online, and Enterprise editions, as well as six industry-specific editions. From the smallest of sole proprietorships to thriving enterprises that aren’t small at all, one of the QuickBooks editions is likely to meet your organization’s needs and budget.

QuickBooks isn’t hard to learn. Many of the techniques that you’re familiar with from other programs work just as well in QuickBooks—windows, dialog boxes, drop-down lists, and keyboard shortcuts to name a few. With each new version, Intuit adds enhancements and new features to make your work flow more smoothly and finish much faster. The challenge that remains is knowing what to do according to accounting rules, as well as how to do so in QuickBooks.

What’s New in QuickBooks 2006

Despite the malleable size of the tax code each year, accounting and bookkeeping practices don’t change all that much. Many changes in QuickBooks 2006 are small tweaks and subtle improvements. But a few additions might make you sit up and take notice:

The QuickBooks Home page is a slick new launch pad for your accounting tasks. For easy navigation, this window consolidates the many navigators and centers from previous versions into a single diagram (Section 6.4.4). Whether you’re a beginner or a QuickBooks veteran, you can quickly get an overview of your accounting system and then trace the workflow diagram to find the specific task you want to perform. Along with accounting tasks, the Home page gives you quick access to your Chart of Accounts, online banking, and more.

The Customer Center, Vendor Center, Employee Center, and Report Center windows organize your QuickBooks information into compact dashboards. For example, the Customer Center displays your Customer List, as well as the contact information and transactions for the customer whose name you select. The same window lets you add or edit customer records and create any kind of customer transaction. (You can open the Centers by clicking their names on the left side of the Home page or in the navigation bar.)

Streamlined QuickBooks menus remove the duplicate entries for some commands. For example, you now find Make General Journal Entries only on the Company menu, instead of both Company and Banking (as in QuickBooks 2005). Add-on services, which used to pop up on several QuickBooks menus, now congregate neatly in one place. Click Add Services in the Home page to find all the add-ons that Intuit offers.

The Payroll Setup wizard has been totally revamped in QuickBooks 2006. As you step through the screens, selecting payroll items and setting up employees, the wizard creates the payroll items, accounts, and employee records you need.

Audit trail tracking is always on in QuickBooks 2006, so you can always tell who’s done what in your books.

In QuickBooks 2006, the Report Center does the same things as QuickBooks 2005’s nifty Report Navigator, but like the other Center windows, it’s more easily accessible. By clicking Report Center in the navigation bar, you can read what each report does, view an example of one, and click a link to run the report. (See Chapter 19.)

Synchronizing contact information with Microsoft Outlook is now a one-step process with the new—and free—download, QuickBooks Contact Sync for Outlook (Section 21.2).

Behind the scenes, QuickBooks now uses an industry-standard SQL database, which can handle accounting for larger operations and more concurrent users, while dramatically improving performance.

Getting to Know QuickBooks

When you run a business (or a nonprofit), you track company finances for two reasons: to keep your business running smoothly and to generate the reports required by the IRS, the SEC, and any other stakeholders to whom you are responsible. QuickBooks helps you perform your basic financial tasks, track your financial situation, and manage your business to make it even better. Before you read any further, here are a few things you shouldn’t try to do with QuickBooks:

Work with more than 14,500 unique inventory items or 14,500 contact names. QuickBooks Pro and Premier company files can contain up to 14,500 inventory items and a combined total of up to 14,500 Company:Job, Vendor, Employee, and Other names. The Enterprise Edition increases these limits to 29,000.

Track personal finances. Even if you are a company of one, keeping your personal finances separate from your business finances is a good move, particularly when it comes to tax reporting. In addition to opening a separate checking account for your business, track your personal finances somewhere else. If that somewhere else is QuickBooks, at least create a separate company file for your personal financial information.

Track the performance of stocks and bonds. QuickBooks isn’t meant to keep track of the capital gains and dividends you earn from investments such as stocks and bonds. But companies have investments, of course. A machine that costs hundreds of thousands of dollars is an investment that you hope will generate lots of income and you should track it in QuickBooks. However, in QuickBooks, these types of investments show up as assets of the company (Section 5.6).

Manage customer relationships. Lots of information goes into keeping customers happy. With QuickBooks, you can stay on top of customer activities with features like To Do items, Reminders, and Memorized Transactions. But for tracking details like membership, items sold on consignment, project progress, and scheduled events, another program would be a better solution.

Tip

Intuit sells an add-on product called Customer Manager (Section 21.7). Also, some third-party customer management products integrate with QuickBooks (Section 21.3).

Choosing the Right QuickBooks Product

QuickBooks comes in a gamut of editions, offering options for organizations at both ends of the small-business spectrum. QuickBooks Simple Start and Online Edition cover the basic needs of very small operations. Enterprise Solutions are the most robust and powerful editions of QuickBooks, boasting enhanced features and speed for the biggest of small businesses.

This book focuses on QuickBooks Pro because its balance of features and price make it the most popular edition. Throughout this book, you’ll also find notes about features offered in the Premier edition, which is one step up from Pro. Whether you’re willing to pay for these advanced features is up to you. Here’s an overview of what each edition does:

QuickBooks Simple Start is the new, low-cost option for small businesses with simple accounting needs. It’s easy to set up and easy to use, but it doesn’t handle features like payroll, inventory, accounts payable, or even purchase orders. (If you outgrow this edition, you can always move your data to QuickBooks Pro or Premier.)

QuickBooks Online Edition offers most of the features of QuickBooks Pro, but you access it via the Web instead of running it on your PC. Since it lets you use QuickBooks anywhere, on any computer, this edition is ideal for the consultant who’s always on the go.

QuickBooks Pro is the workhorse edition. It lets more than one user work in a company file at a time. (You can purchase licenses in single-or five-user packs.) QuickBooks Pro includes features such as job costing; creating estimates; saving and distributing reports and forms as email attachments; creating budgets automatically; projecting cash flow; tracking mileage; customizing forms; customizing prices with price levels; printing shipping labels for FedEx and UPS; and integrating with Word, Excel, and hundreds of other programs. All QuickBooks Pro lists—customers, vendors, employees, and so on—can include up to a combined total of 14,500 entries.

QuickBooks Premier is another multiuser edition. For business owners, its big claim to fame is handling inventory items assembled from other items and components. In addition, Premier edition can generate purchase orders from sales orders or estimates, and it can apply price levels to individual items. You can also track employee information and access data remotely. This edition includes a few extra features typically of more interest to accountants, like reversing general journal entries. Premier edition comes in different flavors targeted to several specific industries (see the section, “The QuickBooks Premier Choices”). Like the Pro edition, Premier can handle a combined total of up to 14,500 list entries.

Enterprise Solutions is the edition for larger operations. It’s faster, bigger, and more robust. Up to 15 people can access a company file at the same time, and this simultaneous access is at least twice as fast as in the Pro or Premier edition. The database can handle twice as many names in its customer, vendor, employee, and other names lists. You can have multiple company files, work in several locations, and produce combined reports for those companies and locations. With more people in your company file, this edition offers features such as an enhanced audit trail, more options for assigning or limiting user permissions, and the ability to delegate administrative functions to other users.

The QuickBooks Premier Choices

If you work in one of the industries covered by QuickBooks’ industry editions, you can get additional features unique to your industry—for only a few hundred dollars more than QuickBooks Pro. Some people swear that these customizations are worth every extra penny. Others say the extra features don’t warrant the Premier price. On the QuickBooks Web site (http://quickbooks.intuit.com), you can tour the Premier editions to decide for yourself.

Accountant Edition is designed to help professional accountants deliver services to their clients. In addition to being compatible with all other editions of QuickBooks, it lets you design financial statements and other documents, process payroll for clients, reconcile client bank accounts, and prepare client tax returns. This edition comes with a one-year subscription to WebEx, an online conferencing service that makes it easy to work with your clients.

Contractor Edition includes special features near and dear to construction contractors’ hearts: job cost reports, different billing rates by employee, managing change orders, and other contractor-specific reports.

Manufacturing & Wholesale Edition is targeted to companies that manufacture products. It includes a Chart of Accounts and menus customized for manufacturing and wholesale operations. You can manage inventory assembled from components and track customer return materials authorizations (RMAs) and damaged goods.

If you run a nonprofit organization, you know that several things work differently in the nonprofit world. Nonprofit Edition includes features such as a Chart of Accounts customized for nonprofits, forms and letters targeted to donors and pledges, help about using QuickBooks for a nonprofit, and the ability to generate the Statement of Functional Expenses 990 form.

Note

You may be tempted to save some money by using QuickBooks Pro for your nonprofit organization, but be prepared to live with some limitations. As long as funding comes primarily from unrestricted sources, the Pro edition fits reasonably well. Your biggest annoyance is using the term “customer” when you mean donor or member, or the term “job” for grants you receive. Throughout this book, you’ll find notes and tips about tracking nonprofit finances with QuickBooks Pro.

However, if you receive restricted funds or track funds by program, you must manually post them to equity accounts and allocate funds to accounts in your Chart of Accounts: QuickBooks Pro doesn’t automatically perform these staples of nonprofit accounting. Likewise, the program doesn’t generate all the reports you need to satisfy your grant providers or the government, though you can export reports (Section 21.5.1.2) and then modify them as necessary in a spreadsheet program.

Professional Services Edition (not to be confused with QuickBooks Pro) is designed for the company that delivers services to its clients. Features unique to this edition include project costing reports, templates for proposals and invoices, billing rates that you can customize by client, billing rate by employee, and professional service-specific reports and help.

Retail Edition customizes much of QuickBooks to work for retail operations. It includes a specialized Chart of Accounts, menus, reports, forms, and help. Intuit offers companion products that you can integrate with this edition to support all aspects of your retail operation. For example, QuickBooks’ Point of Sale tracks sales, customers, and inventory as you ring up sales, and it shoots the information over to your QuickBooks company file. Similarly, Merchant Services (Section 20.1) and Virtual Terminal Plus let you take credit cards as payment, often far more cheaply than the deal you can get at your bank.

Accounting Basics—The Important Stuff

Intuit claims that you don’t need to understand most accounting concepts to use QuickBooks. However, the accuracy of your books and your productivity will benefit if you understand the following concepts and terms:

Double-entry accounting is the standard method for tracking where your money comes from and where it goes. Following the old saw that money doesn’t grow on trees, with double-entry accounting, money always comes from somewhere. For example, as demonstrated in Table I-1, when you sell something to a customer, the money on your invoice comes in as income and goes into your Accounts Receivable account. Then, when you deposit the payment, the money comes out of the Accounts Receivable account and goes into your checking account.

Tip

Each side of a double-entry transaction has a name: debit or credit. As you can see in Table I-1, when you sell products or services, you credit your income account (you increase your income when you sell something), but debit the Accounts Receivable account (selling something also increases how much customers owe you). You’ll see examples throughout the book of how transactions equate to account debits and credits.

Table 1. Following the money through accountsTransaction

Account

Debit

Credit

Sell products or services

Accounts Receivable

$1,000

Sell products or services

Service Income

$1,000

Receive payment

Checking Account

$1,000

Receive payment

Accounts Receivable

$1,000

Pay for expense

Office Supplies

$500

Pay for expense

Checking Account

$500

Chart of Accounts. In bookkeeping, an account is a place to store money, just like your checking account is a place to store your ready cash. The difference is that you need an account for each kind of income, expense, asset, and liability you have. The Chart of Accounts is simply a list of all the accounts you use to keep track of money in your company. (See Chapter 4 to learn about all the different types of accounts you might use.)

Cash vs. Accrual Accounting. Cash and accrual are the two different approaches companies can take to document how much they make and spend. Cash accounting is the choice of many small companies because it’s easy. You don’t show income until you’ve received a payment, regardless of when that might occur. And, you don’t show expenses until you’ve paid your bills.

The accrual method follows something known as the matching principal, which matches revenue with the corresponding expenses. This approach keeps income and expenses linked to the period in which they occurred, no matter when cash comes in or goes out. With accrual accounting, you recognize income as soon as you record an invoice, even if you’ll receive payment during the next fiscal year. If you pay employees in January for work they did in December, those wages are part of the previous fiscal year. The advantage of the accrual method is that it provides a better picture of profitability because income and its corresponding expenses appear in the same period.

Financial Reports. You need a triumvirate of reports to evaluate the health of your company (described in detail in Chapter 14). The income statement, which QuickBooks calls a Profit & Loss report, shows how much income you’ve brought in and how much you’ve spent over a period of time. The QuickBooks report gets its name from the difference between the income and expenses, which results in your profit (or loss) for that period.

The balance sheet is a snapshot of how much you own and how much you owe. Assets are things you own and that have value such as buildings, equipment, and brand names. Liabilities are the money you owe to others (perhaps money you borrowed to buy one of your assets). The difference between assets and liabilities is the equity in the company—like the equity you have in your house when the house is worth more than you owe on the mortgage.

The Statement of Cash Flows tells you how much hard cash you have. You might think that the Profit & Loss report would tell you that, but noncash transactions, such as depreciation, prevent it from doing so. The statement of cash flow removes all noncash transactions and shows the money generated or spent operating the company, investing in the company, or financing.

About This Book

Despite the many improvements in QuickBooks over the years, one feature has remained mostly stagnant: Intuit documentation. For a topic as complicated as accounting software, all you get with QuickBooks is a small Fundamentals manual, which is little more than a guide to tasks QuickBooks performs, with a reference to the Help topic for each. Any detail to be found is in the program’s online help.

Even if you have no problem reading instructions in one window as you work in another, you’ll quickly discover that QuickBooks help is often unworthy of the screen space it consumes. Topics are terse, offer little in the way of technical background or troubleshooting tips, and lack useful examples. In many cases, you get nothing more helpful than “Choose the command you want and follow the onscreen instructions.” Well, duh. The help system rarely tells you what you really need to know, like when and why to use a certain feature. And marking your place, underlining key points, jotting notes in the margins, or reading about QuickBooks while sitting in the sun are all out of the question.

The purpose of this book, then, is to serve as the manual that should have accompanied QuickBooks 2006. It focuses on the Windows version of QuickBooks, though many features work similarly on a Mac.

Tip

Although each version of QuickBooks introduces new features and enhancements, you can still use this book if you’re keeping your company books with earlier versions of QuickBooks. Of course, the older your version of the program, the more discrepancies you’ll run across.

In this book’s pages, you’ll find step-by-step instructions for using every QuickBooks Pro feature, including those you might not have quite understood, let alone mastered: progress invoicing (Section 8.9), making general journal entries (Section 13.3), customizing templates (Section 22.3), writing off losses (Section 12.3), and so on. As mentioned earlier in this introduction, you’ll learn about some of the extra bells and whistles in the QuickBooks Premier edition as well. (All of the features in QuickBooks Pro—and in this book—are also in Premier.) To keep you productive, the book includes evaluations of features that help you figure out which ones are useful and when to use them.

QuickBooks 2006: The Missing Manual is designed to accommodate readers at every technical level. The primary discussions are written for advanced-beginner or intermediate QuickBooks users. But if you’re a first-time QuickBooks user, special boxes with the title “Up To Speed” provide the introductory information you need to understand the topic at hand. On the other hand, advanced users should watch for similar boxes called “Power Users’ Clinic.” These sidebars offer more technical tips, tricks, and shortcuts for the experienced QuickBooks fan.

About the Outline

QuickBooks 2006: The Missing Manual is divided into five parts, each containing several chapters:

Part 1, Getting Started , covers everything you must do to set up QuickBooks based on your organization’s needs. These chapters explain how to create and manage a company file; create accounts, customers, jobs, invoice items, and other lists; and configure preferences.

Part 2, Accounting with QuickBooks , follows the money from the moment you add charges to a customer’s invoice to the tasks you must perform at the end of the year to satisfy the IRS and other interested parties. These chapters describe how to bill customers, manage the money that your customers owe you, pay for expenses, run payroll, manage your bank accounts, and perform other bookkeeping tasks.

Part 3, Managing Your Business , delves into the features that help you make your business a success—or even more successful than it was before. These chapters explain how to keep your inventory at just the right level, how to keep track of time and mileage, how to build budgets and plan for the future, and how to use QuickBooks reports to evaluate every aspect of your enterprise.

Part 4, QuickBooks Power , helps you take your copy of QuickBooks to the next level. Save time and prevent errors by downloading transactions electronically. Boost your productivity by integrating QuickBooks with other programs. Customize QuickBooks components to the way you like to work. And, most important, set up QuickBooks so your financial data is secure.

Part 5, Appendixes , provides a guide to installing and upgrading QuickBooks, a reference to help resources for QuickBooks, and a quick review of the most helpful keyboard shortcuts.

The Very Basics

To use this book, and indeed to use QuickBooks, you need to know a few basics. This book assumes that you’re familiar with a few terms and concepts:

Clicking. This book gives you three kinds of instructions that require you to use your computer’s mouse or track pad. To click means to point the arrow pointer at something on the screen and then—without moving the pointer at all—press and release the left button on the mouse (or laptop track pad). To double-click, of course, means to click twice in rapid succession, again without moving the pointer at all. And to drag means to move the pointer while holding down the button the entire time.

When you’re told to Shift+click something, you click while pressing the Shift key. Related procedures, such as Ctrl+clicking, work the same way—just click while pressing the corresponding key.

Menus. The menus are the words at the top of your screen: File, Edit, and so on. Click one to make a list of commands appear, as though they’re written on a window shade you’ve just pulled down. Some people click to open a menu and then release the mouse button; after reading the menu command choices, they click the command they want. Other people like to press the mouse button continuously as they click the menu title and drag down the list to the desired command; only then do they release the mouse button. Either method works, so choose the one you prefer.

Keyboard shortcuts. Nothing is faster than keeping your fingers on your keyboard to enter data, choose names, and trigger commands. You’ll save time by not needing to grab the mouse, carefully position it, and then choose a command or list entry. That’s why many experienced QuickBooks fans prefer to trigger commands by pressing combinations of keys on the keyboard. For example, in most word processors, you can press Ctrl+B to produce a boldface word. When you read an instruction like “Press Ctrl+A to open the Chart of Accounts window,” start by pressing the Ctrl key; while it’s down, type the letter A, and then release both keys.

About → These → Arrows

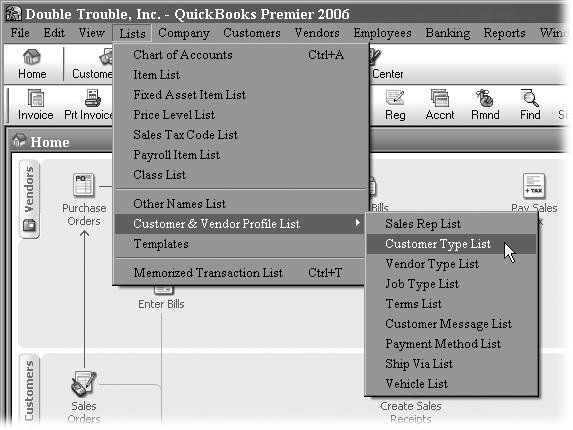

Throughout this book, and throughout the Missing Manual series, you’ll find sentences like this one: “Choose Lists → Customer & Vendor Profile Lists → Customer Type List.” That’s shorthand for a much longer instruction that directs you to navigate three nested menus in sequence, like this: “Choose Lists. On the Lists menu, point to the Customer & Vendor Profile Lists menu entry. On the submenu that appears, choose Customer Type List.” Figure I-1 shows the menus this sequence opens.

Similarly, this arrow shorthand also simplifies the instructions for opening nested folders, such as Program Files → QuickBooks → Export Files.

About MissingManuals.com

At www.missingmanuals.com, you’ll find news, articles, and updates to the books in this series.

But the Web site also offers corrections and updates to this book (to see them, click the book’s title, and then click Errata). In fact, you’re invited and encouraged to submit such corrections and updates yourself. In an effort to keep the book as up-to-date and accurate as possible, each time we print more copies of this book, we’ll make any confirmed corrections you’ve suggested. We’ll also note such changes on the Web site, so that you can mark important corrections into your own copy of the book, if you like.

In the meantime, we’d love to hear your suggestions for new books in the Missing Manual line. There’s a place for that on the Web site, too, as well as a place to sign up for free email notification of new titles in the series.

Safari® Enabled

When you see a Safari® Enabled icon on the cover of your favorite technology book, that means the book is available online through the O’Reilly Network Safari Bookshef.

Safari offers a solution that’s better than e-books. It’s a virtual library that lets you easily search thousands of top tech books, cut and paste code samples, download chapters, and find quick answers when you need the most accurate, current information. Try it for free at http://safari.oreilly.com.

Get QuickBooks 2006: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.