You may be fond of strutting around your sales department proclaiming, “Nothing happens until somebody sells something!” As it turns out, you can quote that tired adage in your accounting department, too. Whether you sell products or services, the first sale to a new customer can initiate a flurry of activity, including creating a new customer in QuickBooks, assigning a job for the work, and the ultimate goal of all this effort—invoicing your customer (sending a bill for your services and products that states how much the customer owes) to collect some income.

The people who buy what you sell have plenty of nicknames: customers, clients, consumers, patrons, patients, purchasers, donors, members, shoppers, and so on. QuickBooks throws out the thesaurus and applies one term to every person or organization that buys from you: customer. In QuickBooks, a customer is a record of information about your real-life customer. The program takes the data you enter about customers and fills in invoices and other sales forms with your customers’ names, addresses, payment terms, and other info.

Real-world customers are essential to your success, but do you need customers in QuickBooks? Even if you run a primarily cash business, creating customers in QuickBooks could still be a good idea. For example, setting up QuickBooks records for the repeat customers at your store saves you time by automatically filling in their information on each new sales receipt.

If, on the other hand, your business revolves around projects, you can create a job in QuickBooks for each project you do for a customer. To QuickBooks, a job is a record of a real-life project that you agreed (or perhaps begged) to perform for a customer—remodeling a kitchen, designing an ad campaign, or whatever. Suppose you’re a plumber and you regularly do work for a general contractor. You could create several jobs, one for each place you plumb: Smith house, Jones house, and Winfrey house. In QuickBooks, you can then track income and expenses by job and gauge each one’s profitability. However, if your company doesn’t take on jobs, you don’t have to create them in QuickBooks. For example, retail stores sell products, not projects. If you don’t need jobs, you can simply create your customers in QuickBooks and then move on to invoicing them or creating sales receipts for their purchases.

In addition to customers, you’re going to do business with vendors and pay them for their services and products. The telephone company, your accountant, and the subcontractor who installs Venetian plaster in your spec houses are all vendors. The information you fill in for vendors isn’t all that different from what you specify for customers.

This chapter guides you through creating customers, jobs, and vendors in QuickBooks. It also helps you decide how to apply the program’s customer, job, and vendor fields to your business. And you’ll learn how to manage the customer, job, and vendor records you create in QuickBooks.

Alas, you first have to persuade customers to work with your company. But once you’ve cleared that hurdle, creating those customers in QuickBooks is easy. The box on Making Customers Easy to Identify provides some hints on keeping customers straight in QuickBooks. The program offers several methods for creating customer records:

QuickBooks Setup. When you’re getting started with the program, you can use the QuickBooks Setup window to quickly import piles of customer information (as well as vendor and employee info) from your email program or by copying and pasting data from Excel, as described on Beginning to Use QuickBooks. You can return to the QuickBooks Setup window at any time (Reopening the QuickBooks Setup Dialog Box) to add more records.

One at a time. The New Customer window lets you create one customer at a time, although you can create several records in a row without closing the window. The section Creating a New Customer on page 66 describes how to create customers with this window and explains what each customer field represents.

Copying data. You can also create customers in batches. With the Add/Edit Multiple List Entries feature (Adding and Editing Multiple Records), you can paste data from Microsoft Excel or copy values from customer to customer.

Tip

QuickBooks doesn’t care if you create customers and jobs without any forethought, but it pays to take the time to set them up properly. For example, you can create customers and jobs without classifying them in any way, but you might want to categorize them so you can send customized communications to each type or determine which types are the most profitable. If you want to categorize customers from the get-go, turn to Categorizing Customers and Jobs to learn how to set up customer and job types and different ways to use them.

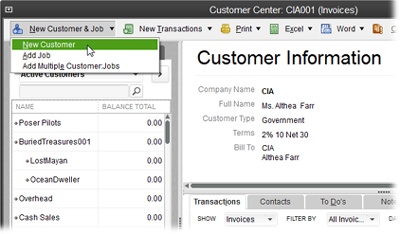

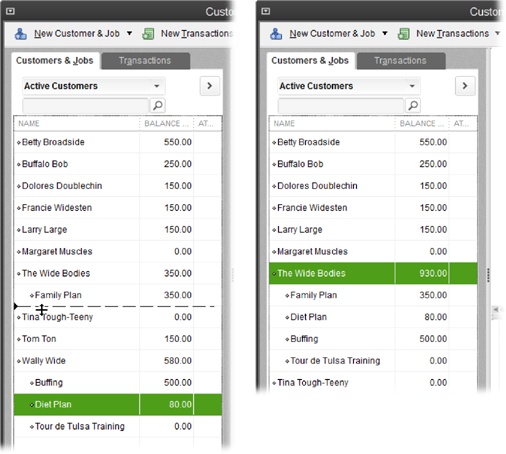

The Customer Center (Figure 4-1) is a one-stop shop for customers and jobs: creating, modifying, and viewing their records, and creating transactions for them. QuickBooks gives you four easy ways to open the Customer Center window:

From anywhere in the program, press Ctrl+J.

At the top of the Customers panel on the QuickBooks Home page, click Customers.

On the icon bar, click Customers. (If you don’t see a Customers item on the icon bar, flip to Adding and Removing Icons to learn how to add it.)

On the QuickBooks menu bar, choose Customers→Customer Center.

Figure 4-1. To create a new customer in the Customer Center, click New Customer & Job and then choose New Customer. To view a customer’s details and transactions, click the customer’s name in the Customers & Jobs list on the left side of this window. If the Transactions tab is selected instead of the Customers & Jobs tab, you’ll see the New Customer feature on the Customer Center menu bar; clicking it opens the New Customer window immediately.

Here’s the short and sweet method of creating a customer in QuickBooks:

In the Customer Center toolbar, click New Customer & Job→New Customer or press Ctrl+N.

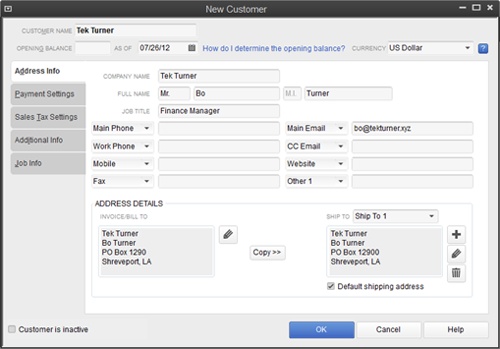

The New Customer window opens (Figure 4-2).

Figure 4-2. Although the Opening Balance box beckons from below the Customer Name field in the New Customer window, it’s better to leave it blank. The box on page 58 explains the best way to define a customer’s opening balance, and the following sections explain what’s on each of this window’s tabs (Address Info, Payment Settings, and so on).

In the Customer Name field, type a unique name or code for this customer, following the naming convention you’ve chosen (see the box on Making Customers Easy to Identify).

The Customer Name field is the only field you have to fill in—the rest are optional.

To save that customer’s record and close the New Customer window, click OK.

To discard what you entered and close the window, click Cancel instead.

Tip

To create a job for a customer, you have to close the New Customer window and open the New Job window. So it’s a lot faster to create all your customers first and then add the jobs for each one.

The box on Making Customers Easy to Identify tells you how to prevent your QuickBooks Customer List from growing out of control.

If you’ve turned on QuickBooks’ multiple currency option (General), a Currency box appears in the New Customer window in the row below the Customer Name box, as shown in Figure 4-2. QuickBooks automatically fills in this box with your home currency, so you usually don’t have to change this value. But if the customer pays in a foreign currency, choose it in the Currency drop-down list. QuickBooks creates a separate Accounts Receivable account (Creating an Account) for each currency you use.

Note

In QuickBooks 2013, the organization of tabs and fields in the New Customer (and Edit Customer) windows is much improved. The contact and address info is all on the first tab, Address Info. All the fields related to payments are now on the Payment Settings tab. The Sales Tax Settings tab contains fields for sales tax, so you can skip it entirely if you don’t sell taxable goods. The Additional Info tab, which used to be a jumble of different types of fields, now holds a few miscellaneous fields like customer type, sales rep, and custom fields you’ve created. You’ll learn about the Job Info tab on Creating a New Job.

If you plan to bill your customers, ship them products, or call them to make them feel appreciated, address and contact information is important. You record this info on the New Customer window’s Address Info tab. Here’s a guide to what you enter on this tab:

Company Name. Unlike Customer Name, which acts as an identifier, the Company Name field is the customer’s name as you want it to appear on invoices and other forms you create. QuickBooks automatically copies what you type here into the Invoice/Bill To box below.

Contact. To address invoices, letters, and other company communications, enter the primary contact’s salutation or title, first name, middle initial, and last name in the appropriate fields. QuickBooks automatically copies the information you type in these fields into the Invoice/Bill To fields. You can also fill in the Job Title box with the contact’s title.

Note

After you create a customer, you can add additional contacts for that customer in the Customer Center. Adding More Customer Contacts tells you how.

Tip

The Address Info tab has more fields for contact information, including four phone numbers, two email addresses, the company’s website, and a field labeled “Other 1.” If you look closely, you’ll notice that the labels for these eight fields have down arrows on them, so you can set these fields to any of 16 contact-related fields, such as LinkedIn, Facebook, and Skype ID.

Invoice/Bill To. QuickBooks uses the address you enter in this box on invoices. To edit the address at any time, click the Edit button (its icon looks like a pencil). Then, in the Edit Address Information dialog box, fill in the street address, city, state, country, and postal code, or paste that info from another program. QuickBooks automatically turns on the “Show this window again when address is incomplete or unclear” checkbox, which tells the program to notify you when you forget a field like the city or when the address is ambiguous. For example, if the address of your biggest toy customer is Santa Claus, North Pole, then QuickBooks opens the Edit Address Information dialog box so you can flesh out the address with a street, city, and arctic postal code.

Tip

You can quickly enter addresses and contact info for all your customers by importing data from another program (Importing Data from Other Programs or by using QuickBooks’ Add/Edit Multiple List Entries feature (Adding and Editing Multiple Records).

Ship To If you don’t ship products to this customer, you can skip the Ship To field altogether. If the billing and shipping addresses are the same, click “Copy>>” to replicate the contents of the Invoice/Bill To field in the Ship To field. (The greater-than symbols on the button indicate the direction that QuickBooks copies the address—left to right.) Otherwise, type the shipping address in the Ship To box.

Tip

You can define more than one ship-to address for a single customer, which is perfect if that customer has multiple locations. To add another ship-to address, click the + button to the field’s right and fill in the Add Shipping Address Information dialog box. Once you’ve added shipping addresses, you can choose the one you want in the Ship To drop-down list. When the shipping address you use most often is visible, turn on the “Default shipping address” checkbox below the Ship To field to tell QuickBooks to pick that address automatically. Click the Edit button (the pencil icon) or Delete button (the trash can icon) to modify or remove a shipping address, respectively.

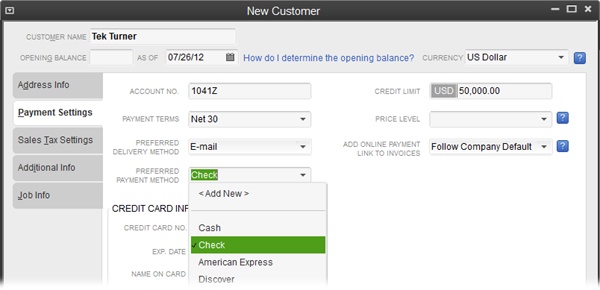

The Payment Settings tab, shown in Figure 4-3, is the place to indicate how the customer pays and how much credit you’re willing to extend.

Figure 4-3. Several of the fields on the Payment Settings tab use QuickBooks’ lists. To jump directly to the entry you want in long lists, in any text box with a drop-down list, type the first few characters of that entry. QuickBooks selects the first entry that matches the characters you’ve typed and continues to reselect the best match as you continue typing. You can also scroll to the entry in the list and click to select it. If the entry you want doesn’t exist, click <Add New> to create it.

You can use the following fields to specify the customer’s payment info:

Account No. Account numbers are optional in QuickBooks. Large accounting programs often assign unique account numbers to customers, which greatly reduces the time it takes to locate a customer’s record. In QuickBooks, the Customer Name field works like an identifier, so you’re best off reserving the Account No. field for an account number generated by one of your other business systems.

Payment Terms. What you select here represents the payment terms the customer has agreed to. The entries you see in this drop-down list come from the Terms List (Terms List), which QuickBooks uses for both payment terms for your customers and the ones you accept from your vendors. This list includes several of the most common payment terms, such as “Due on receipt” and Net 30, but you can choose <Add New> at the top of the drop-down list to define additional payment terms in the Terms List. If you leave this field blank in a customer’s record, you have to choose the payment terms every time you create an invoice for that customer.

Preferred Delivery Method. Choose E-mail, Mail, or None to identify the method that your customer prefers for receiving information. If you choose E-mail, QuickBooks automatically turns on the E-mail checkbox when you create forms (such as invoices) for this customer. The Mail method uses an add-on QuickBooks service to mail invoices (additional fees apply). Choose None if you typically print documents and mail them the old-fashioned way. You can’t add a new entry to the Preferred Delivery Method list, so if you use carrier pigeons to correspond with your incarcerated customers, you’ll just have to choose None and remember that preference.

Preferred Payment Method. Choose the form of payment that the customer uses most frequently. This drop-down list includes several common ones such as Cash, Check, and Visa, but you can add others by choosing <Add New>. The payment method you specify appears automatically in the Receive Payments window (Receiving Payments for Invoiced Income) when you choose this customer. If a regular customer pays with a method different than the one you chose here, you can simply select that method in the Receive Payments window.

Credit card information. For credit card payments (see Emailing One Form to learn about QuickBooks’ credit card processing service), you can specify the customer’s card number, the name on the card, the billing address, the Zip/postal code, and the expiration date. (You can enter only one credit card number for each customer.)

Note

If you store customer credit card numbers in QuickBooks, turn on the Customer Credit Card Protection feature (choose Company→Customer Credit Card Protection and then click Enable Protection). That way, the program helps you comply with credit card industry security requirements (Complying with Credit Card Security Regulations). For example, any user who views complete credit card information must create a complex password. In addition, QuickBooks doesn’t let you store the card’s security code (the three-digit code on the back of the card) because doing so violates your merchant account agreement and PCI (Payment Card Industry) standards.

Credit Limit. You can specify the amount of credit that you’re willing to extend to the customer. If you do, QuickBooks warns you when an order or invoice exceeds this customer’s credit limit, but that’s as far as it goes—it’s up to you to reject the order or ship your products COD. If you don’t plan to enforce the credit limits you assign, don’t bother entering a value in this field.

Price Level. More often than not, customers pay different prices for the same product. Just think about the labyrinth of pricing options for seats on airplanes, for instance. In QuickBooks, price levels represent discounts or markups that you apply to transactions. For example, you might have one price level called Top20, which applies a 20 percent discount for your best customers, and another price level called AuntMabel that extends a 50 percent discount to your Aunt Mabel because she fronted you the money to start your business. Price Levels explains how to define price levels. Once you create a price level, you can apply it to every transaction for a customer by choosing that price level in this box.

Add Online Payment Link to Invoices. Online payment links on invoices allow your customers to pay you through the Intuit PaymentNetwork either by making a payment directly from their bank accounts into yours or by credit card. (The fees you pay vary based on how the customers pay). However, setting up this feature requires a couple of steps. First, be sure to sign up for the Intuit PaymentNetwork service. If you don’t sign up and your customers click an online payment link, they’ll see a message telling them that you haven’t signed up for the service yet. Choose Customers→Intuit PaymentNetwork→About Payment-Network to learn about the service and how to enroll. Adding a Message to the Customer describes how online payment links work.)

On the Payment Settings tab, you can use this field to tell QuickBooks which online payment option to use for this customer. “Follow Company Default” applies the setting that you selected in QuickBooks preferences (Payroll & Employees). Choosing “Always ON (bank only)” means the customer can only pay through their bank account regardless of your company preference. With “Always ON (bank or credit card),” the customer can pay by bank account or credit card. “Always OFF for this customer” means QuickBooks doesn’t display the online payment link on this customer’s invoices.

The Sales Tax Settings tab appears whether or not you turn on QuickBooks’ Sales Tax preference (Sales Tax). However, if sales tax isn’t turned on, the fields on this tab are grayed out. If the customer pays sales tax, choose “Tax” in the Tax Code drop-down list. Then, in the Tax Item drop-down list, choose the tax item that specifies the tax rate the customer pays. (See Setting Up Sales Tax for instructions on setting up sales tax items and Inserting and Deleting Line Items for the full scoop on charging sales tax.)

Customers who buy products for resale usually don’t pay sales tax because that would tax the products twice. (Who says tax authorities don’t have hearts?) To bypass sales tax for a customer, choose Non (for “nontaxable sales”) in the Tax Code drop-down list, and then type the customer’s resale number in the Resale Number field. That way, if tax auditors pay you a visit, the resale number tells them where the sales-tax burden should fall.

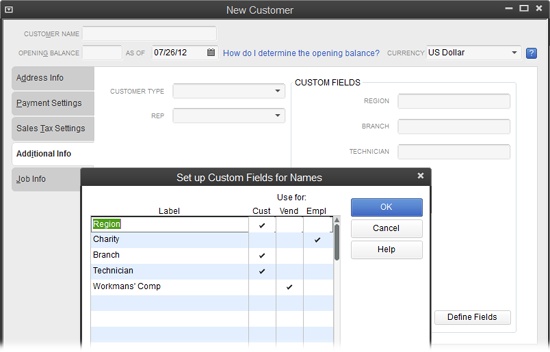

The New Customer window’s Additional Info tab serves up a few fields that categorize your customers. Here are the fields you can fill in and some ways to use them:

Customer Type. Categorize this customer (see Categorizing Customers and Jobs) by choosing from this drop-down list, which displays the entries from your Customer Type List, such as government, health insurance, or private pay, if you run a healthcare company.

Rep. Choosing a name in this field links a customer to a sales representative, which is helpful if you want to track sales reps’ results. But reps don’t have to be sales representatives: One of the best ways to provide good customer service is to assign a customer service rep to a customer. When you choose <Add New> here to create a new Rep entry (Sales Rep List), you can select existing names from the Employee List, Vendor List, and the Other Names List, or even add a new name to one of those lists to use as a rep.

Custom Fields. QuickBooks offers 15 custom fields, which you can use to store important info that QuickBooks doesn’t include fields for out of the box. Because custom fields don’t use drop-down lists, you have to type your entries and take care to enter values consistently. The box below has more about custom fields.

Figure 4-4. The “Set up Custom Fields for Names” dialog box (which opens when you click Define Fields in a New or Edit window for customers, vendors, or employees) lets you create up to 15 custom fields. To associate a custom field with a customer, vendor, or employee, click the corresponding cell in the field’s row in the table. You can associate a custom field with one or more types of names; for example, with both customers and employees.

Note

The New Customer window also includes a Job Info tab, which (not surprisingly) has fields for jobrelated information. If you don’t track jobs, you could use this tab’s Job Status field to store the overall status of your work for the customer, although a contact-management or project-management program is probably more useful. And if a customer hires you to do more than one job, skip the Job Info tab, since you’ll create separate jobs to track the info, as described on Creating Jobs in QuickBooks.

When you create a customer, you can specify information about a contact on the Address Info tab of the New Customer window (Entering Contact Information). However, you can then add more contacts to a customer’s record. For example, you might add contacts for the person who handles day-to-day billing questions, the employee who resolves shipping issues, as well as the owner in case you need to escalate a problem. You can also edit or delete contacts as the people you deal with change offices or transfer to new jobs.

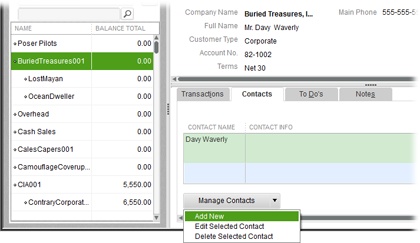

When you select a customer in the Customer Center’s Customers & Jobs list, you see contact info for that customer on the right side of the window. To add more contacts to the customer’s record, click the Contacts tab in the Center’s lower-right pane (Figure 4-5). The Contacts tab doesn’t list the contact you specified in the Address Info tab of the New Customer or Edit Customer window.

Figure 4-5. Any time you want to see information about one of the additional contacts you’ve created, select the contact in the Contacts tab shown here, click Manage Contacts, and then choose Edit Selected Contact from the drop-down menu. To delete the contact, select the contact, click Manage Contacts, and then choose Delete Selected Contact. Or choose Add New to add another contact.

To add a new contact, click Manage Contacts at the bottom of the pane (if you don’t see this button, drag a corner of the Customer Center window to make it taller), and then choose Add New to open the Contacts window. Then, start filling in the boxes, such as Job Title, First Name, Last Name, and so on.

In the Contacts dialog box, you can select any contact for that customer if, for example, you want to edit or delete the contact. Click the down arrow to the right of the Contact box to see a drop-down list that includes all the contacts for that customer sorted by first and last name.

The fields in the Contacts dialog box are a subset of those on the Address Info tab in the New Customer window. They include Job Title and name fields, as well as five other fields that are initially set to Work Phone, Work Fax, Mobile, Main Email, and Additional Email, respectively. However, if you contact the person via Skype or LinkedIn, click the down arrow on the right end of a field label and then choose the appropriate type of contact info from the drop-down list. Click “Save and New” to add another contact or “Save and Close” to close the window.

Project-based work means that your current effort for a customer has a beginning and an end (even if it sometimes feels like the project will last forever). Whether you build custom computer programs or rustic cabins, you can use QuickBooks’ job-tracking features to analyze financial performance by project. Suppose you want to know whether you’re making more money on the mansion you’re building or on the bungalow remodel, and the percentage of profit you made on each project. As long as you create jobs for each project you want to track, QuickBooks can calculate these financial measures.

Note

If you sell products and don’t give a hoot about job tracking, you can simply invoice customers for the products you sell without ever creating a job in QuickBooks.

In QuickBooks, jobs cling to customers like baby possums to their mothers. A QuickBooks job always belongs to a customer. In fact, if you try to choose the Add Job feature before you create a customer, you’ll see a message box telling you to create a customer first. Both the New Customer and Edit Customer windows include tabs for customer info and job info. So when you create a customer, in effect, you create one job automatically, but you can add as many as you need. This section explains how.

Because jobs belong to customers, you have to create a customer (Creating a New Customer) before you can create any of that customer’s jobs. Once the customer exists, follow these steps to add a job to the customer’s record:

In the Customer Center’s Customers & Jobs tab, right-click the customer you want to create a job for, and then choose Add Job from the shortcut menu.

You can also select the customer in the Customers & Jobs tab, and then, in the Customer Center toolbar, choose New Customer & Job→Add Job. Either way, the New Job window appears.

In the Job Name box, type a name for the job.

This name will appear on invoices and other customer documents. You can type up to 41 characters in the box. The best names are short but easily recognizable by both you and the customer.

QuickBooks fills in most of the remaining job fields with the information you entered for the customer associated with this job. The only time you have to edit the fields on the Address Info, Payment Settings, and Additional Info tabs is when the information on these tabs is different for this job. For example, if materials for the job go to a different shipping address than the customer’s, type the address in the fields on the Address Info tab.

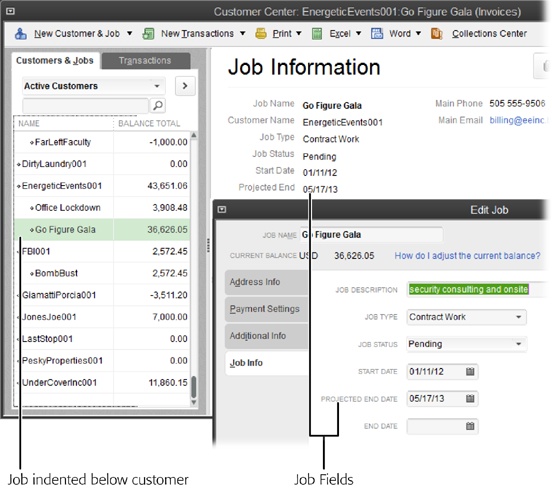

If you want to add info about the job type, dates, or status, click the Job Info tab and enter values in the appropriate fields.

If you add job types (Vendor Type List), you can analyze jobs with similar characteristics, no matter which customer hired you to do the work. Filling in the Job Status field lets you see what’s going on by scanning the Customer Center, as shown in Figure 4-6. If you want to see whether you’re going to finish the work on schedule, you can document your estimated and actual dates for the job in the Date fields (the box on Specifying Job Information has more about these fields).

Note

To change the values you can choose in the Job Status field, modify the status text in QuickBooks’ preferences (see Jobs & Estimates).

After you’ve filled in the job fields, click OK to save the job and close the New Job window.

Figure 4-6. When you select a job in the Customer Center (jobs are indented below their customers), the Job Information section of the window displays Job Status, Start Date, Projected End, and End Date. If you want to edit info you’ve entered for a job, double-click the job’s name in Customers & Jobs tab to open the Edit Job dialog box.

You can edit a customer’s record at any time to add more data or change what’s already there. Similarly, you can create a job with only the job name and then come back later to edit it or add details.

QuickBooks gives you a few ways to open the Edit Customer or Edit Job window when the Customer Center window is open. On the Customers & Jobs tab:

Double-click the customer or job you want to tweak.

Select the customer or job you want to edit and then press Ctrl+E or, on the right side of the Customer Center, click the Edit button (its icon looks like a pencil).

Right-click the customer or job and then choose Edit Customer:Job from the shortcut menu.

Note

You can also modify multiple customer and job records at once, as described on Adding and Editing Multiple Records.

In the Edit Customer window, you can make changes to all the fields except Current Balance. QuickBooks calculates the customer’s balance from the opening balance (if you provide one) and any unpaid invoices for that customer. Once a customer exists, you modify the customer’s balance by creating invoices (Creating an Invoice), credit memos (Creating Credit Memos), journal entries (Recording Purchases Made with Petty Cash), or payment discounts (Discounting for Early Payment).

Similarly, all the fields in the Edit Job window are editable except for Current Balance. Remember that the changes you make to fields on the Address Info, Additional Info, Payment Info, and Job Info tabs apply only to that job, not to the customer.

You can’t change the currency assigned to a customer if you’ve recorded a transaction for that customer. So if the customer moves from Florida to France and starts using euros, you’ll need to close that customer’s current balance (by receiving payments for outstanding invoices). Then you can create a new customer in QuickBooks and assign the new currency to it. After the customer’s new record is ready to go, you can make the old record inactive (Hiding and Deleting Customers).

Warning

Unless you’ve revamped your naming standard for customers (Creating a New Customer), don’t edit the value in a customer’s Customer Name field. Why? Because doing so can mess up things like customized reports you’ve created that are filtered by a specific customer name. Such reports aren’t smart enough to automatically use the new customer name. So if you do modify a Customer Name field, make sure to modify any customizations to use the new name.

If you want to report and analyze your financial performance to see where your business comes from and which type is most profitable, categorizing your QuickBooks customers and jobs is the way to go. For example, customer and job types can help you produce a report of kitchen remodel jobs that you’re working on for residential customers. With that report, you can order catered dinners to treat those clients to customer service they’ll brag about to their friends. If you run a construction company, knowing that your commercial customers cause fewer headaches and that doing work for them is more profitable than residential jobs is a strong motivator to focus future marketing efforts on commercial work. The box on Categorizing with Classes explains how you can analyze your business in other ways.

If you take the time to plan your QuickBooks customers and jobs in advance, you’ll save yourself hours of effort later, when you need information about your business. You can add customer and job types (as well as customers and jobs) anytime. If you don’t have time to add types now, come back to this section when you’re ready to learn how.

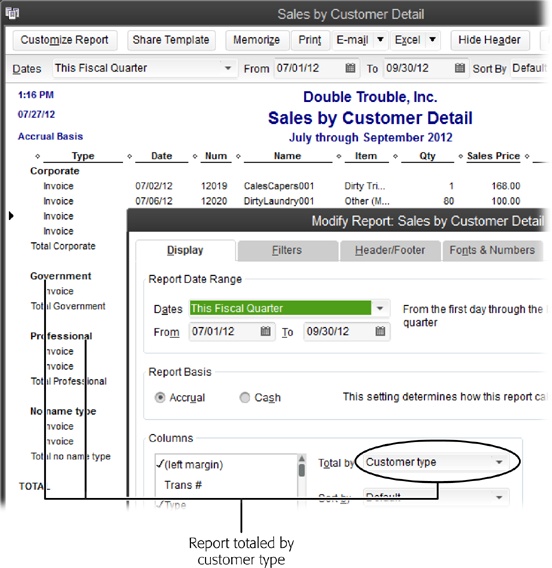

Business owners often like to look at the performance of different segments of their businesses. Say your building-supply company has expanded over the years to include sales to homeowners, and you want to know how much you sell to homeowners versus professional contractors. In that case, you can use customer types to designate each customer as a homeowner or a contractor to make this comparison, and then total sales by Customer Type, as shown in Figure 4-7. As you’ll learn on Specifying Additional Customer Information, categorizing a customer is as easy as choosing from the Customer Types list.

Customer types are yours to mold into whatever categories help you analyze your business. A healthcare provider might classify customers by their insurance, because reimbursement levels depend on whether a patient has Medicare, uses major medical insurance, or pays privately. A clothing maker might classify customers as custom, retail, or wholesale, because the markup percentages are different for each. And a training company could categorize customers by how they learned about the company’s services.

Note

As you’ll see throughout this book, QuickBooks’ lists make it easy to fill in information in most QuickBooks dialog boxes by choosing from a list instead of typing.

Figure 4-7. The Sales by Customer Detail report initially totals income by customer. To subtotal income by customer type (in this example, corporate, government, professional, and so on), click Customize Report in the report window’s button bar. On the Display tab of the dialog box that appears, choose “Customer type” in the “Total by” drop-down list (circled), and then click OK.

If you create a company file by using an industry-specific edition of QuickBooks or you select an industry when creating your company file (Company Information), QuickBooks fills in the Customer Type List with a few kinds of customers that are typical for your industry. If your business sense is eccentric, you can delete QuickBooks’ suggestions and replace them with your own entries. If you’re a landscaper, you might include customer types such as Green Thumb, Means Well, or Lethal, so you can decide whether orchids, cacti, or Astroturf are most appropriate.

Tip

A common mistake is creating customer types that don’t relate to customer characteristics. For example, if you provide several kinds of services—like financial forecasting, investment advice, and reading fortunes—your customers might hire you to perform any or all of those services. So if you classify your customers by the services you offer, you’ll wonder which customer type to choose when someone hires you for two different services. Instead, go with customer types that describe the customer in some way, like Economics, Investments, and Gambler.

Here are some suggestions for using customer types and other QuickBooks features to analyze your business in different ways:

Customer business type. Use customer types to classify your customers by their business sector, such as Corporate, Government, and Small Business.

Nonprofit “customers.” For nonprofit organizations, customer types such as Member, Individual, Corporation, Foundation, and Government Agency can help you target fundraising efforts.

Location or region. Customer types or classes can help track business performance if your company spans multiple regions, offices, or business units.

Services. To track how much business you do for each type of service you offer, set up separate income accounts or subaccounts in your chart of accounts, as outlined on Planning the Chart of Accounts.

Products. To track product sales, create one or more income accounts or sub-accounts in your chart of accounts.

Tip

Create income accounts for broad categories of income, such as services and products. Don’t create separate accounts for each service or product you sell; you can use items to track sales for each service and product instead, as described in Chapter 5.

Marketing. To identify the income you earned based on how customers learned about your services, create classes such as Referral, Web, Newspaper, and Blimp, or enter this info in a custom field (Specifying Additional Customer Information). That way, you can create a report that shows the revenue you’ve earned from different marketing efforts—and figure out whether each one is worth the money.

You can create customer types when you set up your QuickBooks company file or at any time after setup. If you want, you can even set up a customer type as a subtype of another type. To see the list of customer types, choose Lists→Customer & Vendor Profile Lists→Customer Type List. See Customer Type List to learn how to create customer types and subtypes.

Jobs are optional in QuickBooks, so job types matter only if you track your work by the job. If your sole source of income is selling organic chicken-fat ripple ice cream, jobs and job types don’t matter—your relationship with your customers is one long run of selling and delivering products. But for project-based businesses, job types add another level of filtering to the reports you produce. If you’re a writer, then you can use job types to track the kinds of documents you produce (Manual, White Paper, and Marketing Propaganda, for instance) and filter the Job Profitability Report by job type to see which forms of writing are the most lucrative. (Filtering Reports describes how to filter reports.)

Creating a job type is similar to creating a customer type (Customer Type List): Choose Lists→Customer & Vendor Profile Lists→Job Type List. When the Job Type List window opens, press Ctrl+N to open the New Job Type window, and then enter a name for the job type. If you want to create a subtype, turn on the “Subtype of” checkbox and choose the job type this subtype belongs to.

Attention to detail. Follow-through. These are a couple of the things that keep customers coming back for more. Following up on promises or calling to check that an issue was resolved successfully is good business. But sending reorder brochures after customers have made purchases can just make them mad. If you use another program for managing customer relationships, you can track these types of details there. But if you prefer to use as few programs as possible, QuickBooks’ notes feature can help you stay in customers’ good graces by tracking what’s been going on, and the to-do items that still need to be done.

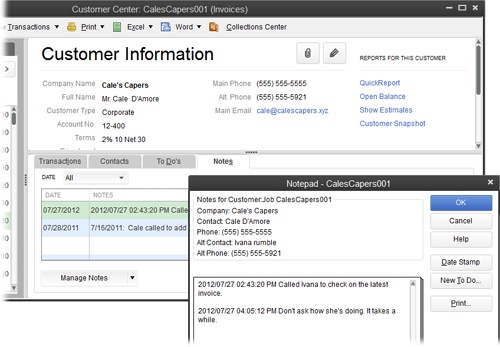

In earlier versions of QuickBooks, there was only one note box for all the notes you added to a customer’s or job’s record. But in QuickBooks 2013, you can add as many separate notes as you want. To view them, simply open the Customer Center, select a customer or job in the Customers & Jobs tab, and then click the Notes tab on the right side of the window. All the notes for the selected customer or job appear, as shown in Figure 4-8 (background). On the Notes tab, you can add, edit, and delete notes in the same way you work with contacts (Adding More Customer Contacts):

Add a note. With a customer or job selected, click Manage Notes→Add New. The Notepad dialog box opens with the customer’s contact information filled in as shown in Figure 4-8 (foreground).

Edit a note. Select the note you want to edit, and then click Manage Notes→Edit Selected Note.

Delete a note. Select the note you want to delete, and then click Manage Notes→Delete Selected Note.

The Notes tab displays all the notes you’ve added for the selected customer or job. To limit the notes to a date range, click the down arrow to the right of the Date box and choose the time period you want, such as This Month-to-date. To keep track of when conversations happen, click Date Stamp before you start typing. If you’re adding a note about something that happened on a day other than today, you have to type in the date.

Suppose you attend a tradeshow and return to your office with a stack of leads. If you want to turn those leads into new sales, you usually have a host of to-dos, like following up on the questions that prospects asked, sending out more info about your products and services, or simply taking the next step in your sales process. The information you collect about leads is similar to that for customers, but leads aren’t customers—yet. If your lead-tracking needs are simple, the Lead Center can help you track prospects while you’re trying to turn them into customers. Then, if your persuasion pays off, you can transform leads into customers in QuickBooks.

To work with leads, open the Lead Center by choosing Customers→Lead Center. The Lead Center looks a lot like the Customer Center with a few exceptions. The Leads list on the left shows the lead’s name and status. And because leads don’t have transactions, the tabs at the bottom of the Lead Center focus on to-dos, contacts, locations, and notes you can use to try to convert the leads into customers.

Note

The Lead Center’s features aren’t as powerful as the ones you find in market-leading customer relationship management (CRM) programs. For example, you can’t send an email to a lead from the Lead Center or create an estimate for a lead. But if your leads are scribbled in a notebook or listed in a spreadsheet, the Lead Center can help you organize them—and because it’s built into QuickBooks, it doesn’t cost extra. If you need more sophisticated tracking tools, skip the Lead Center and check out CRM programs that integrate with QuickBooks. You can find a few dozen listed at the Intuit marketplace (http://tinyurl.com/7xntgpe). QuickBooks also integrates with Salesforce, a major CRM provider. You can learn about this program in the Lead Center window by clicking the “Learn about Salesforce” button to the right of the Lead Information heading.

Here are some of the actions you can perform with leads:

Create a new lead. In the Lead Center toolbar, click New Lead. In the Add Lead dialog box, name the lead. The Status field lets you classify leads as Hot, Warm, or Cold, so you know which ones to focus on first. The Company tab contains fields for info such as company name, telephone number, email address, website, and main address. (You can add other addresses if the company has several locations.) The Contacts tab lets you add contact information for people in the company. The first contact you enter is designated the Primary Contact, but you can add other contacts by clicking the Add Another Contacts button.

View leads. Like the Customer Center, the Lead Center lists your leads on the left side of the window. The list shows the lead’s name and status. You can filter the list by choosing an entry in the View drop-down list. For example, choose Active Leads to see all the leads you’re working on, or choose Hot to filter the list for all your most promising leads.

Search leads. If your sales team is prolific, your lead list could be quite long. You can search for specific leads by typing part of the lead’s name in the Find box on the left side of the Lead Center and then clicking the magnifying glass icon. QuickBooks filters the list to show all the leads that contain the text you typed.

Edit a lead. After you create a lead, you can view its information and edit it. Simply double-click the lead in the Leads list on the left side of the Lead Center.

Create a to-do. To add a to-do for a lead, select the lead in the Leads list. Next, click the To Do’s tab at the bottom of the Lead Center, click To Do at the bottom of the tab, and then choose New To Do. (See Tracking To-Dos to learn how to create different types of to-dos.) The To Do’s tab shows info about that lead’s to-dos, including the type of to-do, its priority, when it’s due, and whether it’s complete.

Add notes. To add notes about a lead, first select the lead in the Leads list. Next, click the Notes tab at the bottom of the Lead Center, and then click Add Notes. In the “Note For <customer>” dialog box, type the information you want to record. For example, you might specify the particular services or products that lead is interested in or her budget. When you add a note, QuickBooks automatically records the date you wrote it. To filter the notes by date, choose a time period in the Notes tab’s Date drop-down list.

Convert a lead to a customer. Leads are stored in a separate list from your customers. When you turn a lead into a customer in real life, you can easily do the same in QuickBooks. Right-click the lead in the Leads list and choose “Convert to a Customer” in the shortcut menu. (Or click the “Convert this Lead to a Customer” button in the Lead Center’s upper right.) QuickBooks asks you to confirm this action, because you can’t undo it. When you click OK, the lead disappears from the Active Leads list. You can see the leads you’ve converted to customers by choosing Converted Leads in the View drop-down list. Although you can still view these converted leads in the Lead Center, you can no longer edit them there. They appear as customers in the Customer Center, and you can edit them there as you do other customers (Modifying Customer and Job Information).

Import leads. To import information about several leads, in the Lead Center toolbar, click Import Multiple Leads. The Import Leads dialog box that appears lets you type values into a table, but you can also copy and paste information from an Excel spreadsheet like you do in the Add/Edit Multiple List Entries window (Adding and Editing Multiple Records).

Suppose you remodeled buildings for two companies run by brothers: Morey’s City Diner and Les’s Exercise Studio. Morey and Les conclude that their businesses have a lot of synergy—people are either eating or trying to lose weight, and usually doing both. To smooth out their cash flow, they decide to merge their companies into More or Less Body Building and All You Can Eat Buffet. Your challenge: to create one customer in QuickBooks from the two businesses, while retaining the jobs, invoices, and other transactions that you created when the companies were separate. The solution: QuickBooks’ merge feature.

Tip

Here’s another instance when merging can come in handy: If you don’t use a standard naming convention as recommended on Creating a New Customer, you could end up with multiple customer records representing one real-life customer, such as “Les’s Exercise Studio” and “LesEx.” You can merge these doppelgangers into one customer just as you can merge two truly separate companies into one.

When you merge customer records in QuickBooks, one customer retains the entire transaction history for the two original customers. In other words, you don’t so much merge two customers as turn one customer’s records into those of another. QuickBooks doesn’t have a Merge Customer button. If you want to merge two customers’ records into one, the secret is to rename one customer to the same name as another. Sounds simple, right? But there’s a catch: The customer you rename can’t have any jobs associated with it. So if the customer you want to rename has jobs associated with it, you have to move all those jobs to the customer you intend to keep before you start the merge. Your best bet: Subsume the customer with fewer jobs so you don’t have to move very many. (If you don’t use jobs, then subsume whichever customer you want.)

Note

If you work in multiuser mode, you have to switch to single-user mode for the duration of the merging operation. See Switching Between Multi- and Single-User Mode to learn how to switch to single-user mode and back again after the merge is complete.

To merge customers with a minimum of frustrated outbursts, follow these steps:

Open the Customer Center.

In QuickBooks’ icon bar, click Customers, or in the Customers panel of the Home page, click Customers.

If the customer you’re going to subsume has jobs associated with it, on the Customers & Jobs tab, position your cursor over the diamond to the left of the job you want to reassign.

Jobs are indented beneath the customer to which they belong.

When the cursor changes to a four-headed arrow, drag the job under the customer you plan to keep, as shown in Figure 4-9, left.

Repeat steps 2 and 3 for each job that belongs to the customer you’re going to subsume.

If you have hundreds of jobs for the customer, moving them is tedious at best—but move them you must.

On the Customers & Jobs tab, right-click the name of the customer you want to subsume and, from the shortcut menu, choose Edit Customer:Job.

You can also edit the customer by selecting its name on the Customer & Jobs tab and then, when the customer’s info appears on the right side of the Customer Center, clicking the Edit button (the pencil icon). Either way, the Edit Customer dialog box opens.

In the Edit Customer dialog box, edit the Customer Name field to match the name of the customer you intend to keep, and then click OK.

QuickBooks displays a message letting you know that the name is in use and asking if you want to merge the customers.

Click Yes to complete the merge.

In the Customer Center, the customer you renamed disappears and any balances it had now belong to the remaining customer, as shown in Figure 4-9, right.

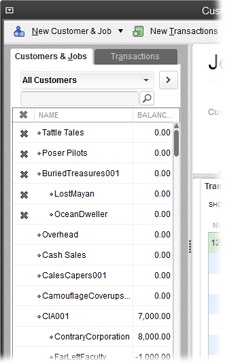

Figure 4-9. Left: When your cursor changes to a four-headed arrow, drag within the Customers & Jobs tab to move the job. As you drag, a horizontal line between the two arrowheads shows you where the job will go when you release the mouse button. Right: After reassigning all the jobs to the customer you intend to keep, you can merge the now-jobless customer into the other. When the merge is complete, you see only the customer you kept.

Hiding customers isn’t about barricading them in a conference room when the competition shows up to talk to you. Because QuickBooks lets you delete customers only in very limited circumstances, hiding customers helps keep your list of customers manageable and your financial history intact. This section explains your options.

Although your work with a customer might be over, you still have to keep records about your past relationship. But old customers can clutter up the Customer Center, making it difficult to select active customers. The solution is to hide old customers, which also removes those customers’ names from all the lists that appear in transaction windows so you can’t select them by mistake. Hiding old customers is a better solution than deleting them, because QuickBooks retains the historical transactions for those customers so you can reactivate them if they decide to work with you again.

To hide a customer, in the Customer Center’s Customers & Jobs tab, right-click the customer and then, from the shortcut menu, choose Make Customer:Job Inactive. The customer and any associated jobs disappear from the list. Figure 4-10 shows you how to unhide (reactivate) customers.

Figure 4-10. To make hidden customers visible again and reactivate their records, set the drop-down list at the top of the Customers & Jobs tab to All Customers as shown here. QuickBooks displays an X to the left of every inactive customer in the list. Simply click that X to restore the customer to active duty.

You can delete a customer only if there’s no activity for that customer in your QuickBooks file. If you try to delete a customer that has even one transaction, QuickBooks tells you that you can’t delete that record.

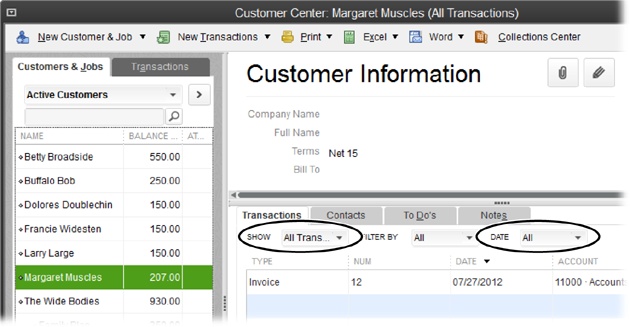

If you create a customer by mistake, you can remove it, as long as you first remove any associated transactions—which are likely to be mistakes as well. But QuickBooks doesn’t tell you which transactions are preventing you from deleting this customer. To find and delete transactions that prevent you from deleting a customer, follow these steps:

View all the transactions for the customer by selecting that customer in the Customer Center’s Customers & Jobs tab, and then, in the Transactions pane, setting the Show box to All Transactions and the Date box to All, as shown in Figure 4-11.

You can also view transactions by running the “Transaction List by Customer” report (Reports→Customers & Receivables→Transaction List by Customer).

In the Customer Center or the report, open the transaction you want to delete by double-clicking it.

The Create Invoices window (or the corresponding transaction window) opens to the transaction you double-clicked.

Right-click the Create Invoices window and choose Delete Invoice from the shortcut menu (or choose Edit→Delete Invoice, Edit→Delete Check, or the corresponding delete command).

In the message box that appears, click OK to confirm that you want to delete the transaction.

Repeat steps 2 and 3 for every transaction for that customer.

Back on the Customers & Jobs tab, select the customer you want to delete, and then press Ctrl+D or choose Edit→Delete Customer:Job.

If the customer has no transactions, QuickBooks asks you to confirm that you want to delete the customer; click OK. If you see a message stating that you can’t delete the customer, go back to steps 2 and 3 to delete any remaining transactions.

Creating and editing vendors is similar to creating and editing customers: You can add them one at a time or create them all at once. The New Vendor window lets you create one vendor at a time. The next section describes how to use that window and explains the fields that are unique to vendors.

Tip

You can create a vendor record when you create that vendor’s first bill (Entering Bills). Simply choose <Add New> in the Enter Bills window’s Vendor drop-down list.

You can use the QuickBooks Setup window to import vendor information from your email program or copy and paste data from Microsoft Excel, as described on Beginning to Use QuickBooks. And the Add/Edit Multiple List Entries feature lets you paste data from Excel or copy values from vendor to vendor; you can read how to use it on Adding and Editing Multiple Records.

Importing vendor information into QuickBooks is another fast way to create oodles of vendor records. After you create a map between QuickBooks’ fields and fields in another program, you can transfer all your vendor info, as described on Importing Data from Other Programs.

The Vendor Center makes creating, editing, and reviewing vendors in QuickBooks a breeze. Like the Customer Center (Customers), the Vendor Center lists the details of your vendors and their transactions in one easy-to-use dashboard. To open the Vendor Center window, use any of the following methods:

Choose Vendors→Vendor Center.

In the Vendors panel of the QuickBooks Home page, click Vendors.

In the icon bar, click Vendors.

You create a new vendor from the Vendor Center window by pressing Ctrl+N or, in the Vendor Center menu bar, by clicking New Vendor→New Vendor. Either way, the New Vendor window opens.

Many of the fields you see should be familiar from creating customers in QuickBooks. For example, the Vendor Name field corresponds to the Customer Name field, which you might remember is actually more of a code than a name (Creating a New Customer). Use the same sort of naming convention for vendors that you use for customers (see the box on Making Customers Easy to Identify). As with customer records, you’re better off leaving the Opening Balance field blank and building your current vendor balance by entering the invoices or bills they send.

The following sections explain how to fill out the rest of the fields in a vendor record.

If you print checks and envelopes to pay your bills, you’ll need address and contact information for your vendors. The Address Info tab in the New Vendor window has fields for the vendor’s address and contact info, which are almost identical to customer address and contact fields, so see Entering Contact Information if you need help filling them in.

In QuickBooks 2013, the fields related to payments reside on the Payment Settings tab. Here are the fields and how you fill them in:

Account No. When you create customers, you can assign account numbers to them; when it’s your turn to be a customer, your vendors return the favor and assign an account number to your company. If you fill in this box with the account number that the vendor gave you, QuickBooks prints it in the memo field of checks you print. Even if you don’t print checks, keeping your account number in QuickBooks is handy if a question arises about one of your payments.

Payment Terms. Choose the payment terms that the vendor extended to your company. The entries in this drop-down list (Entering Payment Information) are the same as for customers.

Print Name On Check As. QuickBooks automatically fills in this box with whatever you enter in the vendor’s Company Name field on the Address Info tab. When you print checks, QuickBooks fills in the payee with the contents of this field, so to print a different name, simply edit what’s in this box.

Credit Limit. If the vendor has set a credit limit for your company (like $30,000 from a building supply store), type that value in this box. That way, QuickBooks warns you when you create a purchase order that pushes your credit balance above this limit.

Billing Rate Level. If you use the Contractor, Professional Services, or Accountant edition of QuickBooks, this is another list that lets you set up custom billing rates for employees and vendors. Billing rates let you price the services you sell the same way a Price Level helps you adjust the prices of products you sell. Say you have three carpenters: a newbie, an old-timer, and a finish carpenter. You can set up a Billing Rate Level for each one based on experience. Then, when you create an invoice for your carpenters’ billable time, QuickBooks automatically applies the correct rate to each carpenter’s hours.

QuickBooks 2013 keeps the two sales tax–related fields on the Sales Tax Settings tab. Here’s what they do:

Vendor ID. You have to put the vendor’s Employer Identification Number (EIN) or Social Security number in this field only if you plan to create a 1099 for this vendor.

Vendor eligible for 1099. Turn on this checkbox if you’re going to create a 1099 for this vendor (1099s).

Note

When you hire subcontractors to do work for you, you have them fill out a W-9 form, which tells you the subcontractor’s taxpayer identification number. Then, at the end of the year, you fill out a 1099 tax form that indicates how much you paid them, which they use to prepare their tax returns. See 1099s to learn how QuickBooks can help with 1099s.

When you write checks, record credit card charges, or enter bills for a vendor, you have to indicate the expense account to which you want to assign the payment. The Account Settings tab in the New Vendor or Edit Vendor window lets you tell QuickBooks which accounts you typically use. However, the easiest approach to filling in expense accounts is to tell QuickBooks to automatically recall your previous transactions. That way, when you record a bill, check, or credit card charge for a vendor, the program creates a new bill using the total amount and the accounts you chose on the previous transaction. Tuning QuickBooks to Your Liking explains how to set the “Automatically recall last transaction for this name” preference.

With all the New Vendor window’s new tabs in QuickBooks 2013, the Additional Info tab is rather sparse, which is probably why it’s the last tab in the list. Here are its fields and what you can do with them:

Vendor Type. If you want to classify vendors or generate reports based on their types, choose an entry in this drop-down list or create a new type in the Vendor Type List (Vendor Type List) by choosing <Add New>. For example, if you assign a Tax type to all the tax agencies you remit taxes to, you can easily prepare a report of your tax liabilities and payments.

Custom Fields. If you want to track vendor information that isn’t handled by the fields that QuickBooks provides, you can add several custom fields (see the box on Defining Custom Fields for Lists). Say your subcontractors are supposed to have current certificates for workers’ comp insurance, and you could be in big trouble if you hire one whose certificate has expired. If you create a custom field to hold the expiration date for each subcontractor’s certificate, you can generate a report of these dates.

If you frequently add or edit more than one customer or vendor a time, filling in the New Customer or New Vendor window isn’t only tedious, it also takes up time you should spend on more important tasks, like selling, managing cash flow, or finding out who has the incriminating pictures from the last company party.

When you set up your company file, the QuickBooks Setup window helps you bring information in from an email program or Excel (Beginning to Use QuickBooks), and you can use that same window anytime you want to add more customers or vendors. Another option is the Add/Edit Multiple List Entries feature. When you’re creating customers, vendors, or items, you can use the Add/Edit Multiple List Entries window to paste data from Excel into QuickBooks. Or, to edit existing records, you can filter or search the list in that window to show just the customers (or vendors, or items) you want to update and then paste Excel data, type in values, or copy values between records.

Then again, you might store info about customers and vendors in other programs such as a database or word-processing program where you create mailing labels. If your other programs can create Excel-compatible files or delimited text files, you can avoid data-entry grunt work by transferring data to or from QuickBooks. (Delimited text files are nothing more than files that separate each piece of data with a comma, space, tab, or other character.) In both types of files, the same kind of info appears in the same position in each line or row, so QuickBooks (as well as other programs) can pull the information into the right places. When you want to transfer a ton of customer information between QuickBooks and other programs, importing and exporting is the way to go. By mapping QuickBooks fields to the fields in the other program, you can quickly transfer hundreds or even thousands of records.

This section covers it all: working with multiple entries, importing, and exporting.

The Add/Edit Multiple List Entries feature is a great tool for adding or updating values in the Customer, Vendor, and Item Lists. If you have data in an Excel spreadsheet, you can paste it directly into a table in the Add/Edit Multiple List Entries window. Features for copying or duplicating values between records come in handy with changes like updating the billing address for a customer who sends you job after job. (Typing values into cells works, too, if you notice a typo in one of the records in the list.) And you can customize the window’s table to show only the customers, vendors, or items you want to edit and the fields you want to modify.

This feature goes by different names depending on where you find it in QuickBooks. Choose it in any of these locations to open the Add/Edit Multiple List Entries window:

In the Lists menu, choose Add/Edit Multiple List Entries. When you go this route, QuickBooks sets the window’s List box to Customers.

In the Customer Center toolbar, click New Customer & Job→Add Multiple Customer:Jobs or Excel→Paste from Excel. QuickBooks sets the List box to Customers.

In the Vendor Center toolbar, click New Vendor→Add Multiple Vendors or Excel→Paste from Excel. QuickBooks sets the List box to Vendors.

At the bottom of the Item List window (Subitems), click Excel→Paste from Excel. QuickBooks sets the List box to Service Items.

As mentioned above, if you open the Add/Edit Multiple List Entries window from the Customer Center, Vendor Center, or Item List window, it automatically selects the appropriate list in the List drop-down menu. You can switch lists by choosing Customers, Vendors, Service Items, Inventory Parts, or Non-Inventory Parts from this drop-down menu.

Tip

If you set up jobs for customers, the Add/Edit Multiple List Entries window’s table includes rows for both customers and jobs. The Name column contains the customer’s name for a customer row and the job’s name for a job row. Usually, you can spot job rows by looking at the Company Name field, since all jobs for that customer will have the same value listed here.

To make it easier to edit existing list entries, you can display only the ones you want to change. Here are some ways to control what you see in the table:

Filter the entries. The View drop-down list includes several choices for filtering the list. Choose Active Customers if you want to make changes to only active customers in your company file. Choosing Inactive Customers displays only customers that you’ve set to inactive status (Hiding and Deleting Customers). You can filter for active or inactive vendors and items, too.

Because QuickBooks doesn’t save the changes you make in the Add/Edit Multiple List Entries window until you click Save Changes, you can filter by Unsaved Customers (or Unsaved Vendors or Unsaved Items) to see all the entries you’ve edited but haven’t yet saved. Choosing the entry that ends in “with errors” displays only entries that contain invalid values, like a vendor type or tax code that doesn’t exist in your company file. In fact, if you click Save Changes when there are records with errors, the window automatically filters the list to the “with errors” view so you can see what you need to correct before you can save your changes. Saving Changes explains how to spot and fix errors.

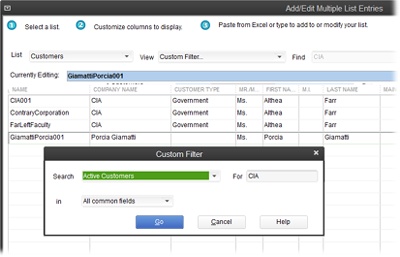

To filter the list to your exact specifications, choose Custom Filter and then fill in the dialog box shown in Figure 4-12. For example, if you want to divide your government customers into local, state, and federal groups, you can filter the list to show only records with “Government” in their customer fields. Note that QuickBooks displays only list entries that exactly match what you filter for, so if you type (555) to look for the 555 area code, records that don’t have parentheses around the area code won’t show up.

Find entries. Typing a word, value, or phrase in the Find box is similar to applying a custom filter to the list, except that QuickBooks searches all fields. For example, if you type 555 in the Find box and then click the Search button (which looks like a magnifying glass), QuickBooks will display records that contain 555 anywhere, whether it’s in the company name, telephone number, address, or account number field.

Tip

To clear a custom filter or the search criteria you typed in the Find box, simply click the button to the right of the Find box (which has a red X on it when you’ve applied a filter or find criteria to the list).

Figure 4-12. In the Custom Filter dialog box, you can type a word, value, or phrase to look for, and specify the fields you want QuickBooks to search. For example, type cia in the For field and set the “in” drop-down list to “All common fields” to find customers with “cia” in fields like name, company name, and so on.

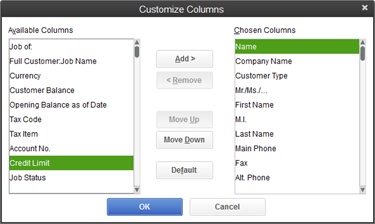

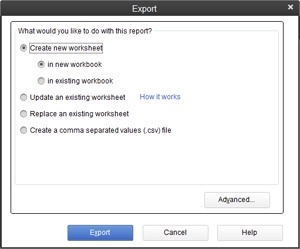

Customize the columns that appear in the table. To paste data from Excel in a jiffy, you can customize the table’s columns to match your Excel spreadsheet. (If you’re an Excel whiz, you may prefer to rearrange the columns in your spreadsheet before pasting data.) Click Customize Columns to open the Customize Columns dialog box. The tools for customizing columns are straightforward, as Figure 4-13 illustrates. To add a column, select the field you want in the Available Columns list and then click Add. To remove a column, select it in the Chosen Columns list and then click Remove.

Sort the list entries. To sort the entries in the table, click the column heading for the field you want to sort by, and QuickBooks sorts the records in ascending order (from A to Z or from low to high numbers). Click again to sort in descending order.

Whether you want to add new entries or edit existing ones, you can paste data from Excel, type in values, or use features like Copy Down to copy values between records. (When you want to add a new record, you have to click the first empty row at the bottom of the list before you can enter any data.) Here are the various ways to enter values in records:

Type values in cells. This method is straightforward: Click a cell and make your changes.

Copy and paste values from Excel. If you’re a fan of copying and pasting (and who isn’t?), you can copy data from an Excel spreadsheet (a single cell, a range of cells, one or more rows, or one or more columns) and paste it into the table. The only requirement is that the rows and columns in the table and in the spreadsheet have to contain the same information in the same order. You can rearrange the rows and columns either in the Add/Edit Multiple List Entries window or in the spreadsheet, whichever you prefer.

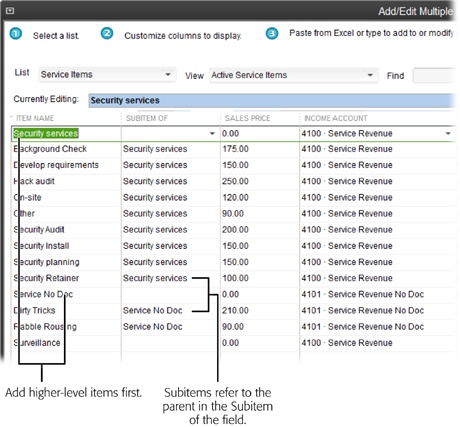

If you want to copy and paste customers and jobs (or items with subitems), you first have to create the top-level entries, as shown in Figure 4-14. That’s because jobs or subitems you paste include the name of the customer in the Company Name field (a parent item’s name appears in the “Subitem of” field). Once the parent entries exist, you can use the Add/Edit Multiple List Entries window again to paste jobs or subitems.

Figure 4-14. Create customers before you create jobs, and create parent items before creating subitems. That way, the company name you paste in the Company Name field (or the parent item name you paste in the “Subitem of” field) will exist in your company file. If you don’t create the parent items first, the jobs or subitems you paste will produce errors.

Note

To prevent errors when you copy and paste data, make sure the values you reference, such as accounts, tax codes, and so on, already exist in your company file.

When you paste Excel data into existing records in the Add/Edit Multiple List Entries window, QuickBooks overwrites the existing values in the cells. To paste Excel data into new records, be sure to select the first empty row in the window before pasting the data.

Copy and paste data within the table. You can also copy and paste data from one cell in the table to another. For example, if a customer with several jobs has relocated its main office, you can copy values from Bill To cells and paste them into the cells for the customer’s jobs. When you copy and paste data within the table, you can copy only one cell at a time.

Duplicate a row. To create a new record that has many of the same values as an existing record, right-click a cell in the row you want to duplicate and then choose Duplicate Row from the shortcut menu. The new record appears in the row below the original and contains all the same values as the original record, except that the value in the first field begins with “DUP” to differentiate it from the original. Edit the cells in the row that have different values. Then edit the Name cell to reflect the new name.

Copy values down a column. You can quickly fill in several cells in a column by using the Copy Down feature. Because this feature copies data into all cells below the one you select, it’s important to filter the list (Selecting a List to Work with) to show only the records you want to change. Then right-click the cell you want to copy down the column and choose Copy Down from the shortcut menu. QuickBooks copies the value in the selected cell to all the cells below it in the column, overwriting any existing data. For example, if you want to change the contact name for all the jobs for a particular customer, filter the list to show just the records for that customer (in the Find box, type the customer’s name, and then click the magnifying glass icon). Next, type the new contact into the first Contact cell. Then, right-click the cell and choose Copy Down.

Insert a row. If you want to insert a blank line in the table (to create a new job for a customer, for example), right-click the row that’s currently where you want the blank line, and then choose Insert Line from the shortcut menu (or press Ctrl+Insert).

Delete a row. If you created a record by mistake, you can get rid of it by right-clicking anywhere in its row and then choosing Delete Line. (This entry is grayed out if the entry is used in a transaction or other record, because you can’t delete a record if it’s referenced somewhere else in your company file.)

Clear a column. To clear all the values in a column, right-click in the column and then choose Clear Column from the shortcut menu; QuickBooks immediately removes all the values in the column. If you chose this feature by mistake, you can undo the deletion by clicking Close, and then, in the Unsaved Customer message box, click No.

After you’ve completed the additions and modifications you want in the Add/Edit Multiple List Entries window, click Save Changes to save your work. QuickBooks saves all the entries that have no errors and tells you how many records it saved.

If you try to save changes and QuickBooks finds any errors, like a value that doesn’t exist in the Terms list, it displays those entries in the Add/Edit Multiple List Entries window’s table and changes the incorrect values to red text. Point your cursor at a cell to see a hint about the error. For example, if you typed a letter in a price field, QuickBooks tells you that the field contains an invalid character. If the problem is a list entry that doesn’t exist, the “<list name> Not Found” dialog box opens (where “<list name>” is a list like Terms) and tells you the value isn’t in the list. Click Set Up to add the entry to the list. Fix the errors and then click Save Changes again.

If you have hundreds of customer or vendor records to stuff into QuickBooks, even copying and pasting can be tedious. If you can produce a delimited text file or a spreadsheet of customer or vendor info in the program where you currently store it (Importing a Delimited File), then you can match up your source data with QuickBooks’ fields and import all your records in one fell swoop.

Delimited files and spreadsheets compartmentalize data by separating each piece of info with a comma or a tab, or by cubbyholing them into columns and rows in a spreadsheet file. An exported delimited file isn’t necessarily ready to import into QuickBooks, though. Headings in the delimited file or spreadsheet might identify the field names in the program that originally held the information, but QuickBooks has no way of knowing the correlation between those fields and its own.

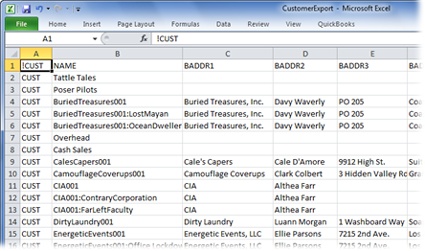

But don’t worry: You can help QuickBooks understand the data you’re importing. QuickBooks looks for keywords in the file you’re importing to figure out what to do, as shown in Figure 4-15. So you’ll need to rename some headings to transform the file produced by the other program into an import file that QuickBooks can read. QuickBooks’ customer keywords and the fields they represent are listed in Table 4-1, and vendor keywords and fields are listed in Table 4-2. Fortunately, it’s easy to edit headings in Excel and other spreadsheet programs. When your exported file looks something like the one in Figure 4-15, save it in Excel 2010 by clicking that program’s File tab and then choosing Save (if you’re using Excel 2007, click the Office button and then choose Save). The box on The Easy Way to View Data describes how to use spreadsheets for other data tasks.

Figure 4-15. A file you import has to use field names that match QuickBooks’. For example, replace a Street_Address heading with BADDR1, which is the keyword for the first address line field in QuickBooks, and a Last_Name heading with LASTNAME. The first column has to include the keywords QuickBooks uses to identify customer (CUST) or vendor (VEND) records. And the first cell in the first row of a customer import file has to contain the text “!CUST,” as shown here. (The first cell in the first row of a vendor import file has to contain “!VEND” instead.)

Tip

To see how QuickBooks wants a delimited file to look, export your current QuickBooks Customer List to an .iif file (Exporting QuickBooks Data) and then open it in Excel and check out the field names it uses.

Table 4-1. Customer keywords and their respective fields in the order that QuickBooks exports them

KEYWORD | FIELD CONTENTS |

|---|---|

NAME | (Required) The Customer Name field, which specifies the name or code you use to identify the customer. |

BADDR1 – BADDR5 | Up to five lines of the customer’s billing address. |

SADDR1 – SADDR5 | Up to five lines of the customer’s shipping address. |

PHONE1 | The number stored in the Phone Number field. |

PHONE2 | The customer’s alternate phone number. |

FAXNUM | The customer’s fax number. |

The customer’s email address. | |

NOTE | Despite its confusing keyword, this field is the name or number of the account stored in the Account No. field. (To set up a customer as an online payee, you have to assign it an account number.) The NOTEPAD keyword explained below, on the other hand, represents the notes you enter about a customer. |

CONT1 | The name of the customer’s primary contact. |

CONT2 | The name of an alternate contact for the customer. |

CTYPE | The customer’s type. If you import a customer type that doesn’t exist in your Customer Type List, QuickBooks adds the new type to the list. |

TERMS | The payment terms by which the customer abides. |

TAXABLE | Y or N in this field indicates whether you charge the customer sales tax. |

SALESTAXCODE | The code that identifies the type of sales tax to charge. |

LIMIT | The dollar amount of the customer’s credit limit with your company. |

RESALENUM | The customer’s resale number. |

REP | The representative who works with the customer. The format for a rep entry is name:list ID:initials, such as “Saul Lafite:2:SEL.” Name represents the rep’s name; list ID equals 1 if the rep’s name belongs to the Vendor List, 2 for the Employee List, or 3 for the Other Names List; and initials are the rep’s initials. |

TAXITEM | The name of the type of tax you charge this customer. What you enter has to correspond to one of the sales tax items in your Item List (on Sales Tax Items). |

NOTEPAD | This field is where you can wax poetic about your customer’s merits or simply document details you want to remember. To see this imported data in QuickBooks, in the Customer Center, select the customer’s name, and then click the Notes tab. |

SALUTATION | The title to include before the contact’s name, such as Mr., Ms., or Dr. |

COMPANYNAME | The name of the customer’s company as you want it to appear on invoices or other documents. |

FIRSTNAME | The primary contact’s first name. |

MIDINIT | The primary contact’s middle initial. |

LASTNAME | The primary contact’s last name. |

CUSTFLD1-CUSTFLD15 | Custom field entries for the customer, if you’ve defined any. (Specifying Additional Customer Information explains how to create custom fields.) |

HIDDEN | This field is set to N if the customer is active in your QuickBooks file, or Y if he’s inactive. |

PRICELEVEL | The customer’s price level (Entering Payment Information). |

Note

QuickBooks also exports the fields for job information into six columns with the keywords JOBDESC, JOBTYPE, JOBSTATUS, JOBSTART, JOBPROJEND, and JOBEND.

Table 4-2. Vendor keywords and their respective fields in the order that QuickBooks exports them

KEYWORD | FIELD CONTENTS |

|---|---|

NAME | (Required) The Vendor Name field, which specifies the name or code that you use to identify the vendor. |