Chapter 15

JOB ORDER COSTING

CHAPTER LEARNING OBJECTIVES

After studying this chapter, you should be able to:

- Explain the characteristics and purposes of cost accounting.

- Describe the flow of costs in a job order cost system.

- Explain the nature and importance of a job cost sheet.

- Indicate how the predetermined overhead rate is determined and used.

- Prepare entries for jobs completed and sold.

- Distinguish between under- and overapplied manufacturing overhead.

PREVIEW OF CHAPTER 15

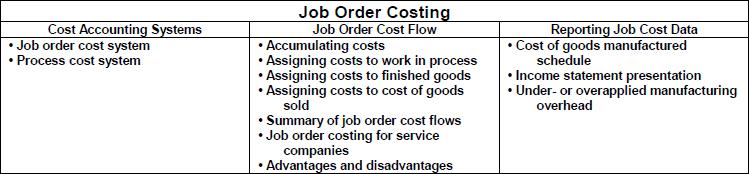

This chapter illustrates how manufacturing costs are assigned to specific jobs. We begin the discussion in this chapter with an overview of the flow of costs in a job order cost accounting system. We then use a case study to explain and illustrate the documents, entries, and accounts in this type of cost accounting system. The content and organization of this chapter are as follows:

CHAPTER REVIEW

Cost Accounting Systems

- (L.O. 1) Cost accounting involves measuring, recording, and reporting product costs. Companies determine both the total cost and unit cost of each product.

- A cost accounting system consists of accounts for the various manufacturing costs. These accounts are fully integrated into the general ledger of a company. An important feature of a cost accounting system is the use of a perpetual inventory system. Such a system provides information immediately on the cost of a product. The two basic ...

Get Study Guide Vol 2 t/a Accounting: Tools for Business Decision Makers, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.