2.18 EXEMPTION FOR PAST BUSINESS COMBINATIONS

2.18.1 Exemption Explained

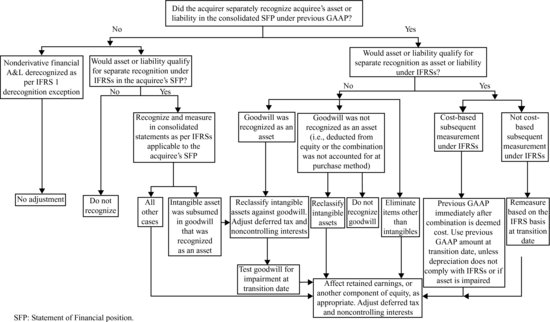

A past business combination is one that occurred before the transition date. An IFRS first-time adopter may restate all past business combinations under the version of IFRS 3 in force at the first IFRS reporting date, do so for only all that occurred after any earlier date, or avail itself of a special exemption for all past business combination. Whenever it uses IFRS 3 it must also use IAS 27, as appropriate.501 The rules of the last option are complex, and Exhibit 2-15 illustrates them for easier comprehension.

Exhibit 2-15 Exemption for Past Business Combinations

Get The Handbook to IFRS Transition and to IFRS U.S. GAAP Dual Reporting now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.