Chapter 3. Don't Shoot the Messenger

How the Story Ends

One has to be very careful with the "E" in the P/E equation. There are usually no qualms about the "P"—it is what it is. The S&P 500 is trading at 1,122.8 as I am typing this in August 2010; that is the "P." But the "E" is a whole different animal.

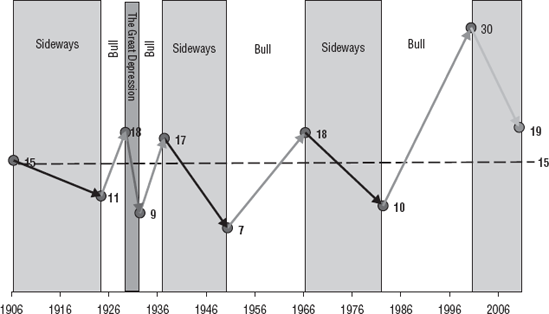

"E" often requires normalization, as earnings are impacted tremendously by where we are in the economic cycle at a given time. Blindly using "E" without normalization will lead you to the wrong conclusions when you analyze the stock market and individual stocks. In Exhibit 3.1, P/Es for past market cycles are computed based on 12-month trailing earnings; however, I used 2010 estimated earnings to demonstrate current market valuation. Here is the rub: Estimates for 2010 reported and operating earnings for the S&P 500 are $75 and $45, respectively. A significant difference between two numbers is the "one-time" charges that never end up being one-time. I arrived at my "E" of $60 by averaging these two numbers.

Figure 3.1. Starting and Ending P/Es Based on 1-Year Trailing (Reported) Earnings of S&P 500

However, a better way to deal with the volatility of "E" in the P/E equation, when we attempt to value the market is to use 10-year trailing earnings. We use the current "P" but then average earnings over the preceding 10-year period. Don't worry, I won't ask you to compute the average (free ...

Get The Little Book of Sideways Markets: How to Make Money in Markets that Go Nowhere now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.