Chapter 4. THE SAVAGE ANSWER: MONTE CARLO MODELING

No, I'm not suggesting gambling. You want the answer to that key question: How much money will you need in order to retire?

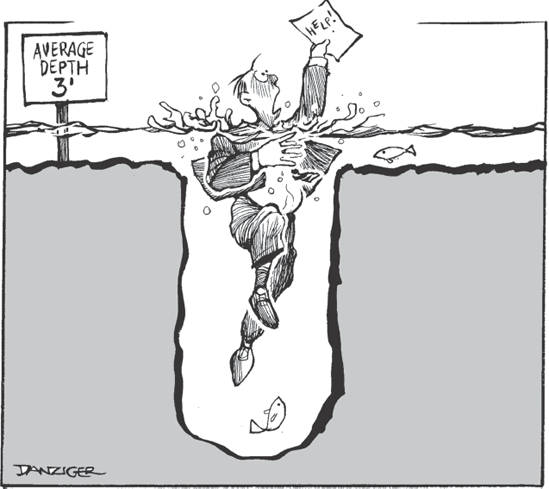

The answer is simple. All you have to do is factor in your current assets, your future savings rate, how much those assets will grow in value based on your investment decisions, over your uncertain life expectancy, and how much they will be devalued by inflation. Then decide how much annual income you'll need to withdraw to maintain your lifestyle in retirement!

The complexity of this task, with all its uncertainties, is over-whelming—whether you're just starting to accumulate money or you're contemplating retirement. But there is a sophisticated computer you're modeling process that is designed to deal with all these variables. It is called Monte Carlo modeling.

Monte Carlo Modeling: How It Works

Despite the name, Monte Carlo modeling has nothing to do with gambling. It's simply the statistical science of modeling multiple alternatives to come up with a likely range of probable results. Monte Carlo was a code name for a technique employed during the Manhattan Project to create the atomic bomb. Now it is being used to describe this simulation process, which has been made easier, faster, and more accessible by today's computers.

Stanford University professor and noted Monte Carlo modeling expert Dr. Sam Savage (no ...

Get The New Savage Number: How Much Money Do You Really Need to Retire? now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.