It’s Not Your Fault—Blame Evolution

One of the first things we learn about finance is: “Buy low, sell high.” In the movie Trading Places, when Eddie Murphy and Dan Aykroyd prepare to corner the orange juice market (illegally and implausibly but comically), you can tell the scriptwriter was casting about for something finance-sounding to say. So Dan tells Eddie, “Buy low, sell high.” What more advice do you need, really?

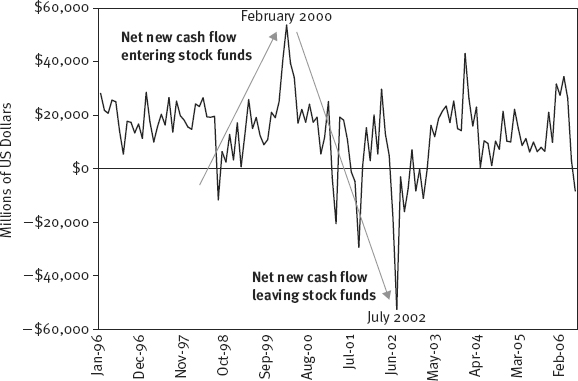

We all know the goal, but more often than not, we end up doing the opposite. How hard can this be? Buy when stuff is priced low; sell when it’s priced high. It’s not rocket science. And yet this problem is ageless and endless. Investors routinely buy and sell precisely backward. For evidence, look at Figure 3.1 showing fund flows—the amount of money going into and out of equity mutual funds each month—in the period just before and after the 2000 Tech peak.

Inflows for stock mutual funds were highest during February 20001—a good time to get out of stocks—at the peak of an ensuing three-year bear market. Fast forward to 2002, and the reverse is true. Huge numbers of folks bailed from funds in July2—a fantastic time for stocks—just before a new bull market. Here is evidence of investors buying high and selling low en masse. These weren’t a few deranged outliers; this shows widespread ...

Get The Only Three Questions That Still Count: Investing By Knowing What Others Don't, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.