That Predictable Market

Presume at every turn, the market is actually out to get you. I’m not being paranoid—it’s true. I don’t call the market The Great Humiliator (TGH) for nothing. Think of it as a dangerous predatory, living, instinctual beast doing anything and everything to abjectly humiliate you out of every last penny possible. Just knowing and accepting that is the first step to getting the whip hand of TGH. Your goal is to engage TGH without ending up too humiliated. In the next chapter, we talk about how to create a strategy to increase the odds you reach your long-term goals, but first, let’s talk about exactly how to use the Questions to see clearly how the market operates so you can cease being humiliated.

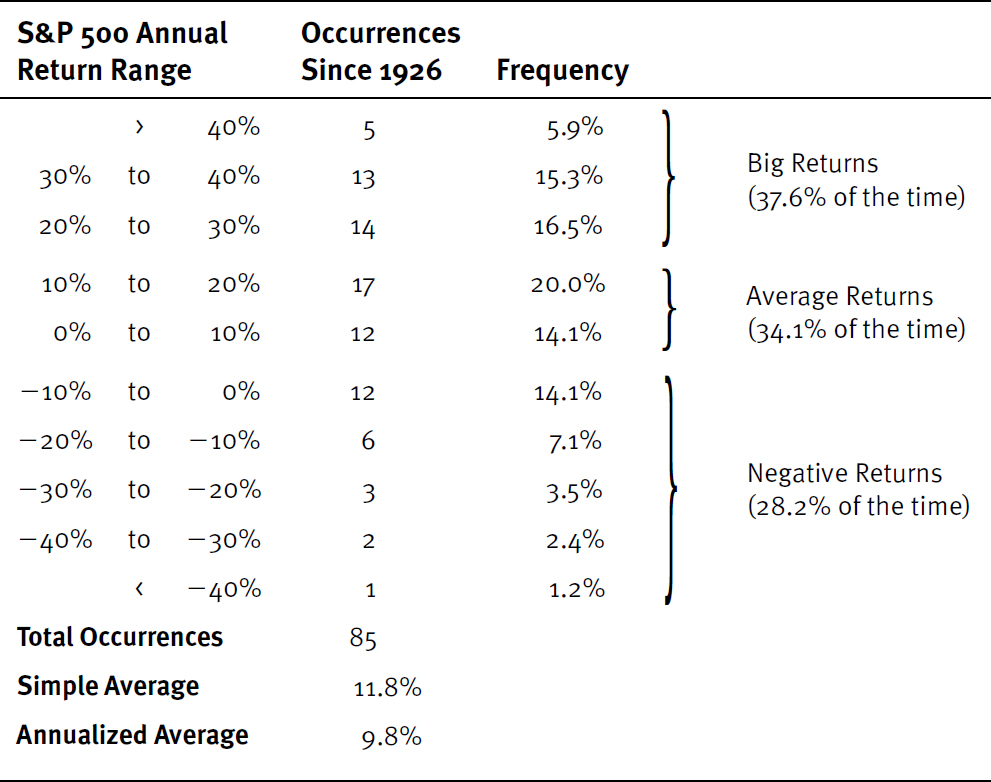

TGH headfakes you by moving in disorderly patterns. We know the market historically has averaged about 10% yearly over long time periods.1 So is it reasonable to expect about 10% absolute returns each and every year? No way. Since 1926, there have been relatively few years the stock market has actually returned something close to the long-term average. Normal market years are anything but average. This is an easy Question One truth shown in Table 8.1.

Table 8.1 Average Returns Aren’t Normal. Normal Returns Are Extreme—US

Source: Global Financial Data, Inc., S&P 500 total returns from 12/31/1925 to 12/31/2010.

Not only are returns wildly variable, but it’s a global ...

Get The Only Three Questions That Still Count: Investing By Knowing What Others Don't, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.