“M” AND “W” PATTERNS

“M” and “W” patterns (see Figure 3.18) are also known as double tops and double bottoms, respectively. A double top is a pattern for two successive peaks, which may or may not be of the same price levels. The pattern looks like an M. A double top pattern occurs when the stock fails to continue the uptrend in its second attempt as it meets resistance pressure from sellers at its highs. In a market rally, sellers suddenly take control and push the price downward. Price begins to retreat to a level that is considered attractive for buyers. The buyers enter the market and push the price up to make a second top where it finds new selling pressure, which pushes the price down past its last trough. When the price declines below the low point established between the two tops, a double top pattern has been activated.

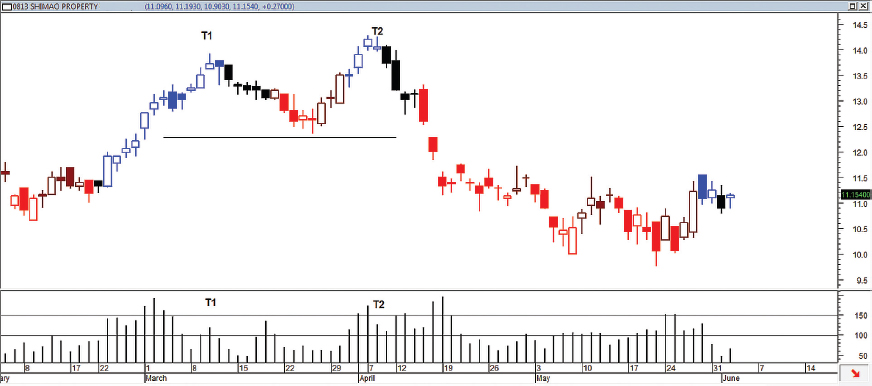

FIGURE 3.18 The chart shows a typical double top pattern. At T1, selling pressure pushes prices down to a trough, where prices regain buying support and rally to a new top. At T2, prices encounter further selling pressure and retrace below the horizontal trend line to confirm a double top reversal pattern.

A double bottom is the inverse pattern of a double top and has two successive troughs, which may or may not be at the same price levels. It looks like a W. In a double bottom, prices must close above the high point between the two bottoms before a trading ...

Get Timing Solutions for Swing Traders: A Novel Approach to Successful Trading Using Technical Analysis and Financial Astrology now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.