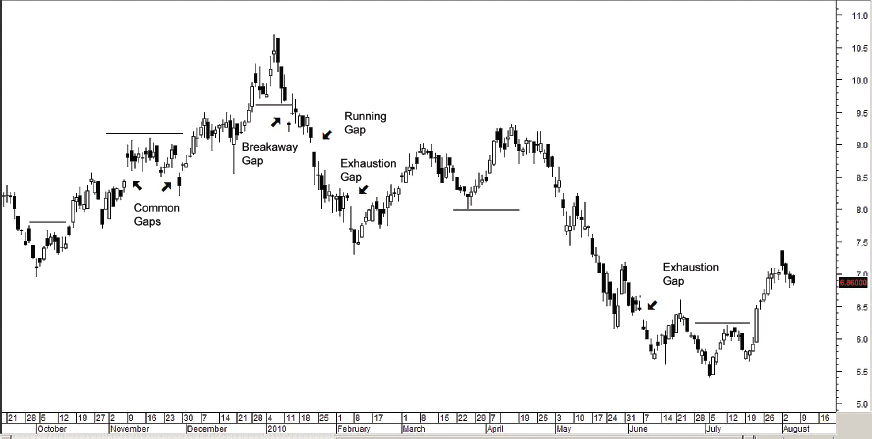

GAPS

A gap is an opening outside the previous day’s range, creating an area where there are no trades. In an uptrend, a gap occurs when the price opens above the previous day’s high and the space (the area between today’s low and yesterday’s high) is not filled during the day. In a downtrend, the day high gaps down below the previous day’s low.

Generally, most gaps are eventually filled, some on the next trading bar, while others may take a much longer time and some may never get filled. It depends on the types of gaps—breakaway, common, runaway, or exhaustion. Breakaway gaps are not filled quickly and occur when the market is in the early stage as prices break out of a trading range or consolidation area. Breakaway gaps move prices into new territory and do not often retreat to fill the gap in subsequent trading.

Breakaway gaps are found mostly in impulse waves (Wave 1) or corrective waves (Wave A or Wave C). Breakaway gaps can be reliable trading signals, particularly when they occur during high volume.

Common gaps (see Figure 3.33) develop within a trend and reaffirm the conviction and strength of the trend’s direction. They are probably caused by going ex-dividend and the gaps get filled quickly. They appear most often in Wave 2 and Wave 4, or Wave B.

FIGURE 3.33 Chart showing various types of gaps in a short rally and a corrective A-B-C wave.

Runaway gaps are series of gaps ...

Get Timing Solutions for Swing Traders: A Novel Approach to Successful Trading Using Technical Analysis and Financial Astrology now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.