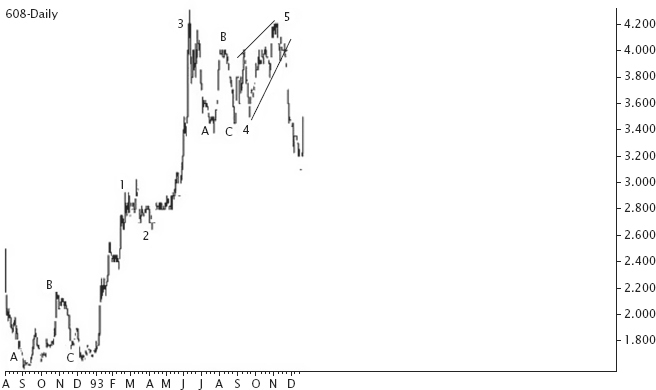

WAVE 5

Wave 5 is the last impulse wave of the five-wave structure. At Wave 5, it is most common to find divergence between directional movement of price and the momentum oscillator. The target of Wave 5 is normally about 0.618 of the distance covered by Wave 1 and Wave 3, plotted from the low of Wave 4.

If Wave 5 extends, then the probable target is about 1.618 of the distance covered by Wave 1 and Wave 3. When Wave 5 does not extend, it could be retraced entirely by Wave A of the corrective A-B-C pattern.

A fifth wave’s failure means that Wave 5 fails to move above the end of Wave 3. A failure in Wave 5 could occur when Wave 3 is the extended wave. In such an instance, Wave 5 will relate to Wave 1 in price by 38.2 percent to 61.8 percent. Wave 5’s failure usually happens when it is the fifth wave of a larger impulse Wave 5 pattern. Wave 5 could also develop into a diagonal triangle. A diagonal pattern development at Wave 5 usually signals the termination of the trend. (See Figure 4.5.)

FIGURE 4.5 A fifth-wave failure, ending in a diagonal triangle pattern, signals the termination of the uptrend.

Get Timing Solutions for Swing Traders: A Novel Approach to Successful Trading Using Technical Analysis and Financial Astrology now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.