CORRECTIVE 5-3-5 PATTERNS

The A5-B3-C5 patterns consist of zigzags.

Zigzags

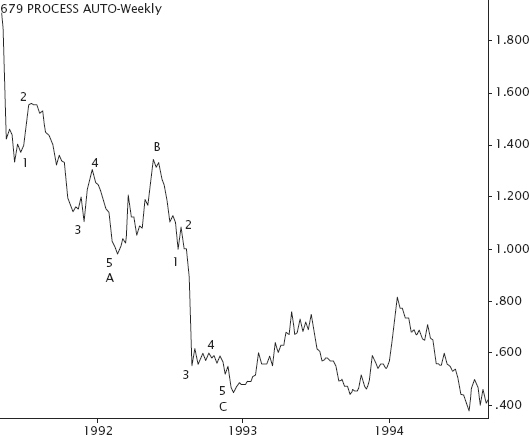

A zigzag pattern (shown in Figure 4.15) consists of three prime movements: a steep decline of Wave A comprising five waves, a Wave B rally, and a continuation of the declining trend by Wave C. Wave C is always made up of five waves. Frequently, Wave C will either be equal to Wave A or 1.618 of Wave A. Zigzags are corrective waves and have the same characteristics as those of five-wave structures. Zigzags can also be extended.

FIGURE 4.15 An example of a zigzag pattern.

Complex Corrections

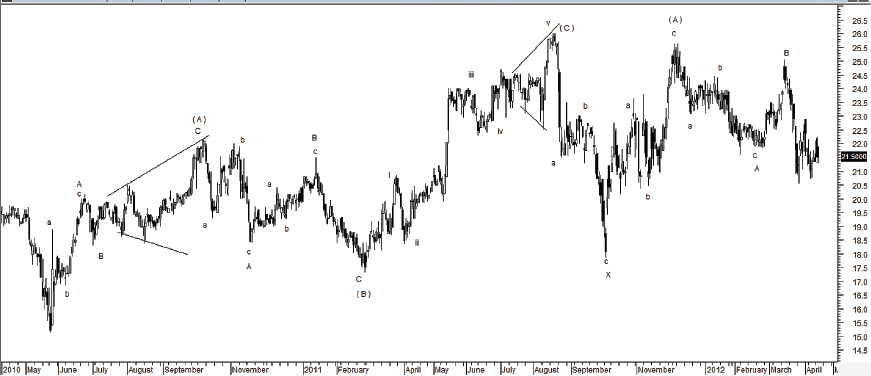

Complex corrections are formations composed of random combinations of corrective patterns such as flats, zigzags, triple flats, and triangles. They are the most difficult patterns to interpret in the wave principle.

Sometimes an A-B-C correction is called an X-wave. X-waves are used to discern sets of corrective patterns and are marked between corrective patterns in a complex formation. They can be composed of any corrective structure formation. The Rule of Alternation also applies to X-waves. When the first X-wave is a zigzag, the following X-wave will not be a zigzag; it will either be a triangle or a flat.

Figures 4.16 to 4.20 are examples of complex corrections.

FIGURE 4.16 An example of a complex correction.

Get Timing Solutions for Swing Traders: A Novel Approach to Successful Trading Using Technical Analysis and Financial Astrology now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.